Binance’s Spot Crypto Trading Market Share Falls to Lowest Since Early 2021

Binance's Spot Crypto Trading Market Share Falls to Lowest Since Early 2021

The cryptocurrency exchange landscape is fundamentally shifting. For years, one name stood above all others: Binance. Its market dominance was so pervasive that the phrase "Binance effect" became synonymous with powerful liquidity and retail trading momentum.

I recall vividly the summer of 2021. If you were trading altcoins, virtually every transaction flowed through the centralized exchange (CEX) giant. The platform felt untouchable, holding more than half of all global spot trading activity.

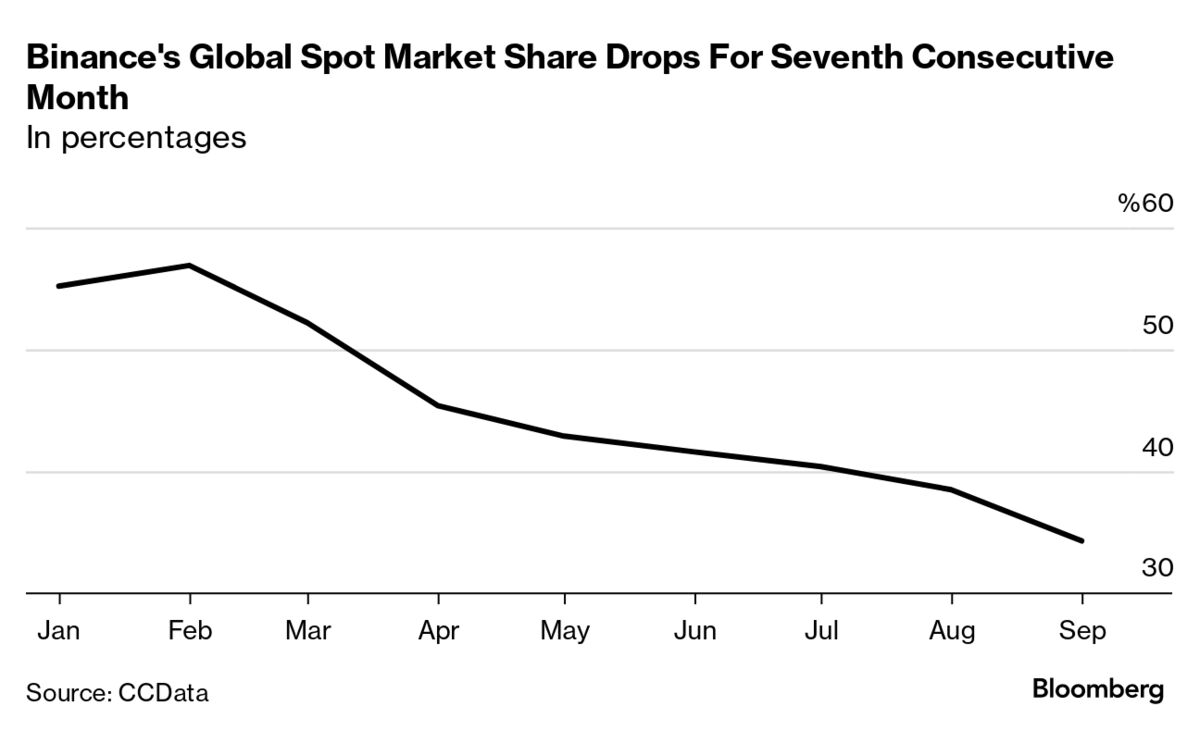

Fast forward to today, and the narrative has changed dramatically. Recent analytical reports confirm a significant retreat: Binance's spot crypto trading market share has plummeted to its lowest level since early 2021. This sharp contraction, measured over recent months, signals a crucial turning point for the industry and for the exchange itself.

The decline is not just a minor fluctuation; it represents a systemic unwinding of the post-2021 dominance enjoyed by the exchange. Regulatory pressures, intensified competition, and major leadership changes have combined to reshape the competitive landscape, creating opportunities for regional and specialized exchanges to capture key segments of the market.

This report delves into the data behind this substantial market share erosion and analyzes the factors pushing traders towards alternative platforms.

The Decline Quantified: Analyzing the Spot Market Shift

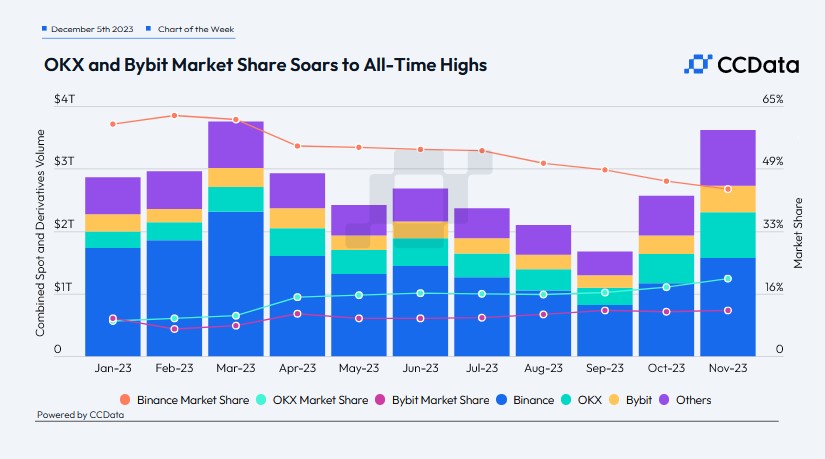

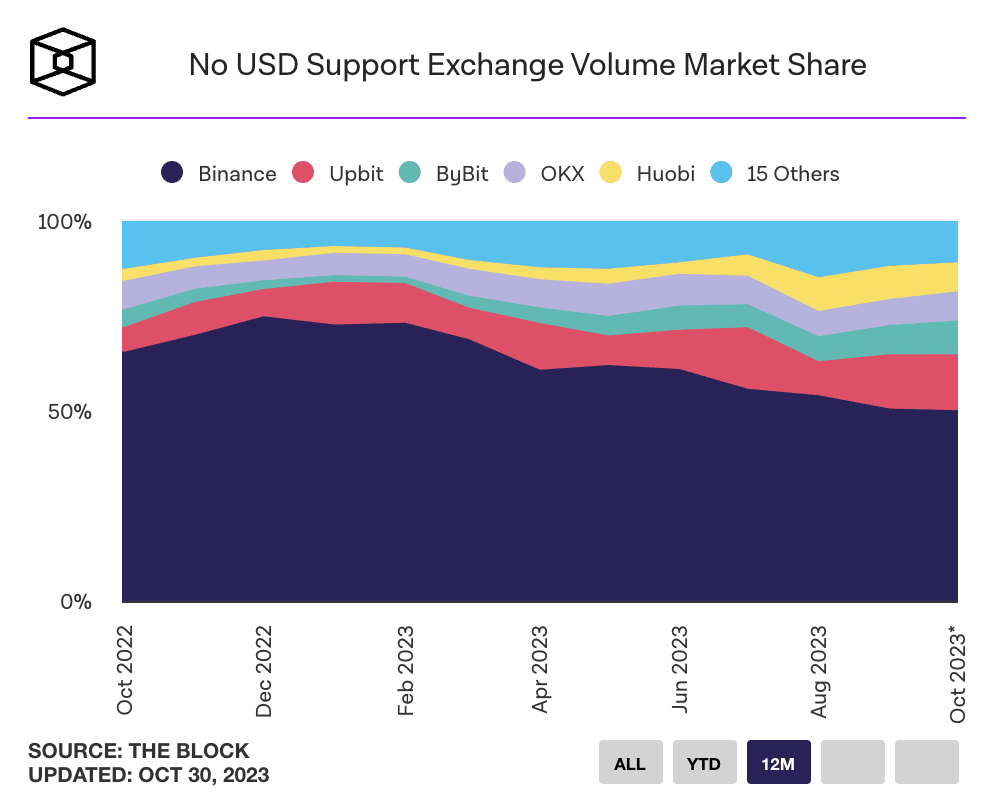

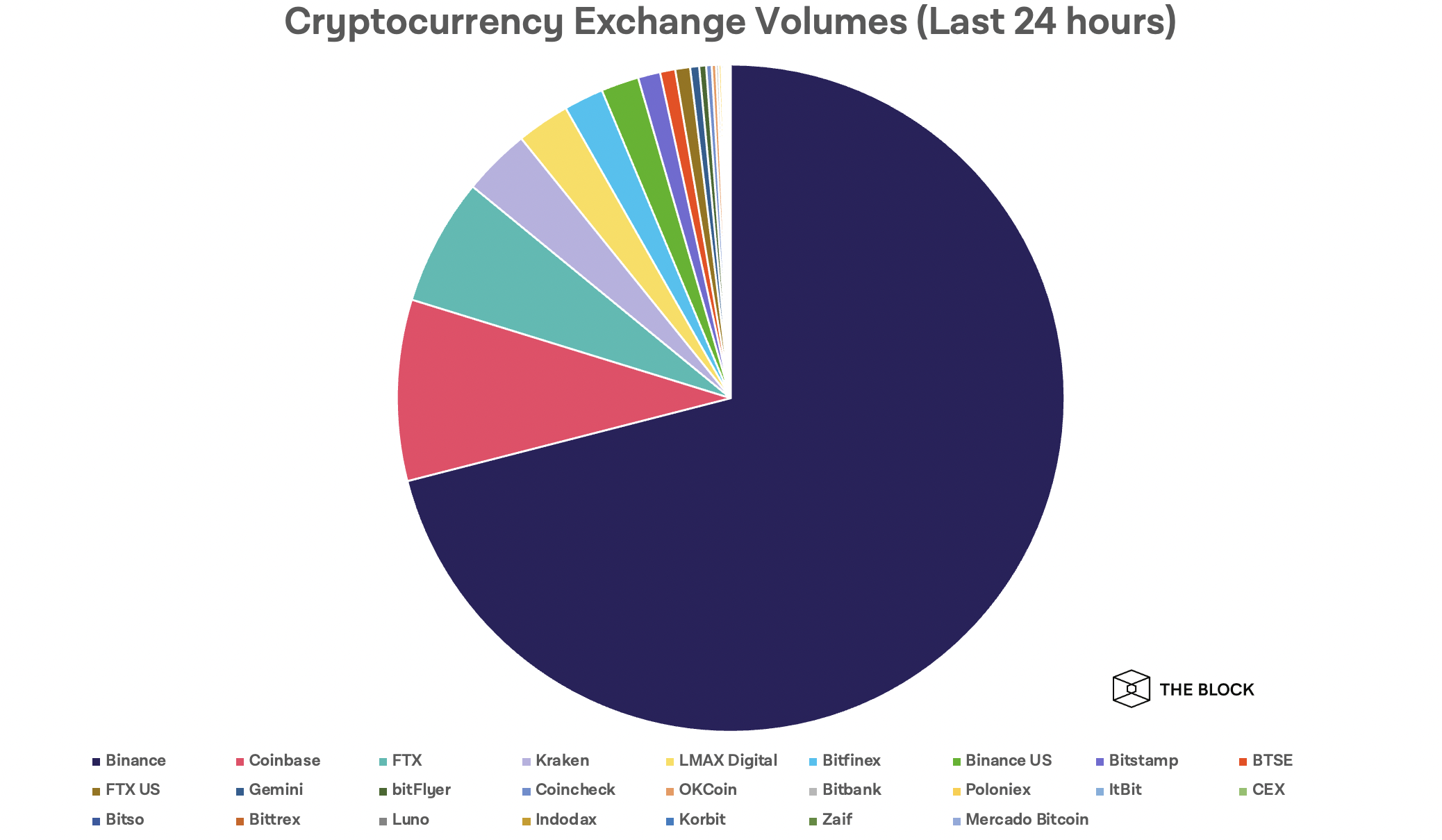

The raw data confirms the structural shift. While Binance remains the largest global exchange by far, its control over the spot trading volume has waned considerably. Data tracking firms indicate that Binance's market share of global centralized exchange spot volume is now hovering near the 40% mark, down significantly from its peak near 55% during the bull run peaks of 2021 and early 2022.

This erosion is particularly noticeable in the highly competitive spot trading pairs involving major altcoins and stablecoins. Where once Binance commanded superior liquidity depth, competitors are closing the gap, offering competitive fee structures and often, localized regulatory clarity.

The peak concentration occurred during periods of intense retail activity. As the market matured and institutional trading protocols evolved, the necessity of relying solely on one mega-exchange diminished.

Analysts point to specific periods where the fall accelerated:

- **Q4 2022:** Initial significant outflow following the collapse of FTX, which, ironically, initially boosted Binance's figures but also kicked off intensified regulatory scrutiny globally.

- **Q3/Q4 2023:** Accelerated decline following high-profile legal settlements and the mandated shift towards highly restrictive Know Your Customer (KYC) and Anti-Money Laundering (AML) policies across its platform.

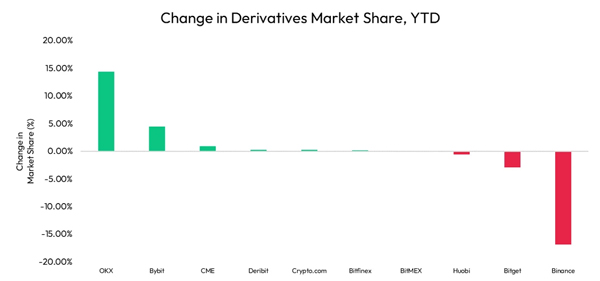

- **Early 2024:** Continued pressure as traders, particularly those focused on futures and derivatives, diversified holdings to exchanges less burdened by compliance costs.

The spot trading market relies heavily on retail investor sentiment and ease of use. If regulatory uncertainty causes friction during the onboarding or withdrawal process, retail investors are quick to seek frictionless alternatives. This behavioral change is proving costly for the global market leader.

Furthermore, the diversification of stablecoin trading is a factor. While BUSD played a critical role in Binance's liquidity, the end of BUSD minting forced traders to migrate to alternatives like USDT and USDC on other platforms, inadvertently spreading liquidity thin across the CEX landscape.

Regulatory Headwinds and Competitive Pressure: Why Binance is Losing Ground

The primary catalyst for Binance's shrinking market share is undoubtedly the aggressive regulatory crackdown witnessed over the past two years, culminating in the massive settlement with the U.S. Department of Justice (DOJ) in late 2023.

The $4.3 billion settlement and the subsequent departure of founder Changpeng "CZ" Zhao, while potentially clearing a path for long-term compliance, created immediate instability and required the exchange to tighten its operational practices globally.

This tightening resulted in several operational friction points. Stricter KYC requirements meant that many international users who valued the exchange's previous accessible structure were forced to fully comply or seek non-compliant platforms. This exodus of users, particularly those seeking high-leverage positions or operating from less regulated regions, directly impacts spot volume.

The Rise of Regional Powerhouses

While Binance dealt with global compliance costs, competitors capitalized on targeted regional strategies.

Exchanges like Bybit and OKX, which aggressively expanded their derivatives and spot market offerings, have successfully chipped away at Binance's former dominance. These exchanges have been nimble, securing licenses in key international jurisdictions and focusing heavily on product innovation, attracting a significant chunk of both institutional and high-volume retail traders.

For instance, in the Asia-Pacific (APAC) region, exchanges focused on local currency trading pairs have gained substantial traction. In South Korea, Upbit continues to dominate the Won-denominated market, proving that localized regulatory approval often outweighs global brand recognition when it comes to user trust.

The competitive landscape has never been fiercer. Competitors aren't just matching Binance's technology; they are excelling in niche areas:

- **Fee Structures:** Offering zero-fee trading for major pairs temporarily to lure high-frequency traders.

- **Product Innovation:** Superior integration of AI trading tools and automated bots.

- **Regulatory Arbitrage:** Focusing on jurisdictions (often outside the direct purview of the US) where regulatory clarity allows for more aggressive product deployment.

Binance's transformation from a nimble, globally ambiguous startup to a highly regulated financial entity is a necessary, yet costly, transition. This transformation inevitably slows down growth and pushes some segments of its customer base toward competitors still operating under a looser regulatory umbrella.

The Broader Implications for Crypto Trading and Future Outlook

What does this reduction in Binance's market dominance mean for the overall health and structure of the cryptocurrency market?

Firstly, it signals a movement away from extreme market centralization. For years, the crypto ecosystem struggled with the single point of failure represented by Binance's vast control. A more distributed CEX landscape reduces systemic risk and encourages greater innovation across multiple platforms.

Increased competition is ultimately healthy for consumers. As exchanges fight for market share, they are forced to improve security, reduce fees, and enhance customer service—areas where Binance faced criticism during its peak dominance.

The focus on stringent compliance is likely to continue defining the future of centralized exchanges. Any exchange hoping to succeed long-term must follow Binance's painful path toward regulatory acceptance, particularly if they aim to capture lucrative institutional money.

For Binance itself, the immediate future involves stabilization and pivot. Under its new leadership, the exchange must now focus on retaining its core compliant user base and demonstrating robust operational standards to regain trust lost during the regulatory battles.

The focus moving forward will likely be on:

- **Institutional Onboarding:** Targeting larger funds that prioritize security and clear compliance pathways over aggressive trading options.

- **Regional Licensing:** Securing specific operational licenses in major markets like Europe (MiCA) and parts of Asia to operate fully legally.

- **Ecosystem Expansion:** Leveraging its BNB Chain and decentralized offerings to maintain influence even if CEX spot trading volumes stabilize at lower levels.

While the market share decline is a significant headline, it does not spell doom for the platform. Binance remains a crypto behemoth, managing colossal trading volumes and maintaining significant influence over liquidity. However, the days of near-absolute market control appear to be over.

The decline to its lowest market share since early 2021 is a clear indicator: the era of the undisputed centralized giant is transitioning into a competitive oligopoly, where regulatory adherence and product specialization will determine the victors.

This evolving landscape presents opportunities for savvy retail investors and institutional traders alike to diversify their exposure across platforms that best suit their regional and compliance needs, ensuring a more resilient and decentralized future for crypto trading.

Binance's Spot Crypto Trading Market Share Falls to Lowest Since Early 2021

Binance's Spot Crypto Trading Market Share Falls to Lowest Since Early 2021 Wallpapers

Collection of binance's spot crypto trading market share falls to lowest since early 2021 wallpapers for your desktop and mobile devices.

Mesmerizing Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Photo Collection

Transform your screen with this vivid binance's spot crypto trading market share falls to lowest since early 2021 artwork, a true masterpiece of digital design.

Exquisite Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Picture for Desktop

A captivating binance's spot crypto trading market share falls to lowest since early 2021 scene that brings tranquility and beauty to any device.

Artistic Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Photo Illustration

Find inspiration with this unique binance's spot crypto trading market share falls to lowest since early 2021 illustration, crafted to provide a fresh look for your background.

Captivating Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Capture for Your Screen

This gorgeous binance's spot crypto trading market share falls to lowest since early 2021 photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Detailed Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Picture Collection

Explore this high-quality binance's spot crypto trading market share falls to lowest since early 2021 image, perfect for enhancing your desktop or mobile wallpaper.

Captivating Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Photo Concept

Immerse yourself in the stunning details of this beautiful binance's spot crypto trading market share falls to lowest since early 2021 wallpaper, designed for a captivating visual experience.

Gorgeous Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 View in 4K

A captivating binance's spot crypto trading market share falls to lowest since early 2021 scene that brings tranquility and beauty to any device.

High-Quality Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Background Nature

Discover an amazing binance's spot crypto trading market share falls to lowest since early 2021 background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Artwork Nature

Discover an amazing binance's spot crypto trading market share falls to lowest since early 2021 background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Captivating Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Design in HD

Find inspiration with this unique binance's spot crypto trading market share falls to lowest since early 2021 illustration, crafted to provide a fresh look for your background.

Serene Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Scene Concept

Transform your screen with this vivid binance's spot crypto trading market share falls to lowest since early 2021 artwork, a true masterpiece of digital design.

Artistic Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Image Art

A captivating binance's spot crypto trading market share falls to lowest since early 2021 scene that brings tranquility and beauty to any device.

Mesmerizing Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Abstract Digital Art

Discover an amazing binance's spot crypto trading market share falls to lowest since early 2021 background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Wallpaper Digital Art

Experience the crisp clarity of this stunning binance's spot crypto trading market share falls to lowest since early 2021 image, available in high resolution for all your screens.

Artistic Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Artwork Art

A captivating binance's spot crypto trading market share falls to lowest since early 2021 scene that brings tranquility and beauty to any device.

Dynamic Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Background Art

A captivating binance's spot crypto trading market share falls to lowest since early 2021 scene that brings tranquility and beauty to any device.

Crisp Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Image Concept

Immerse yourself in the stunning details of this beautiful binance's spot crypto trading market share falls to lowest since early 2021 wallpaper, designed for a captivating visual experience.

Stunning Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Background Art

A captivating binance's spot crypto trading market share falls to lowest since early 2021 scene that brings tranquility and beauty to any device.

Dynamic Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Abstract Nature

This gorgeous binance's spot crypto trading market share falls to lowest since early 2021 photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning Binance's Spot Crypto Trading Market Share Falls To Lowest Since Early 2021 Wallpaper for Your Screen

Find inspiration with this unique binance's spot crypto trading market share falls to lowest since early 2021 illustration, crafted to provide a fresh look for your background.

Download these binance's spot crypto trading market share falls to lowest since early 2021 wallpapers for free and use them on your desktop or mobile devices.