S&P 500, Dow climb to closing records as traders look past Fed independence risk: Live updates

S&P 500, Dow climb to closing records as traders look past Fed independence risk: Live updates

Wall Street concluded a historic session today, witnessing both the S&P 500 and the Dow Jones Industrial Average notch fresh, all-time closing records. The surge occurred despite swirling geopolitical uncertainties and heightened domestic concerns regarding the long-term autonomy of the Federal Reserve.

For investors, this market action represents a significant psychological shift. Traders are clearly prioritizing strong corporate earnings and easing inflationary pressure over potential political friction. It's a testament to overwhelming investor confidence.

I spoke with a veteran index fund manager this morning, who described the market mood as "stubbornly bullish." He noted the almost surreal disconnect:

"We are seeing the classic definition of climbing a wall of worry," he said. "Usually, any perceived threat to the Federal Reserve's autonomy would trigger an immediate risk-off flight. Today? We barely saw a flicker. The demand for quality equities is simply too high right now."

This dynamic highlights that the market has fundamentally priced in a resilient economic outlook, largely decoupling the day-to-day trading strategy from political noise. This live update breaks down the key drivers of the rally and analyzes why the crucial 'Fed independence risk' failed to derail the momentum.

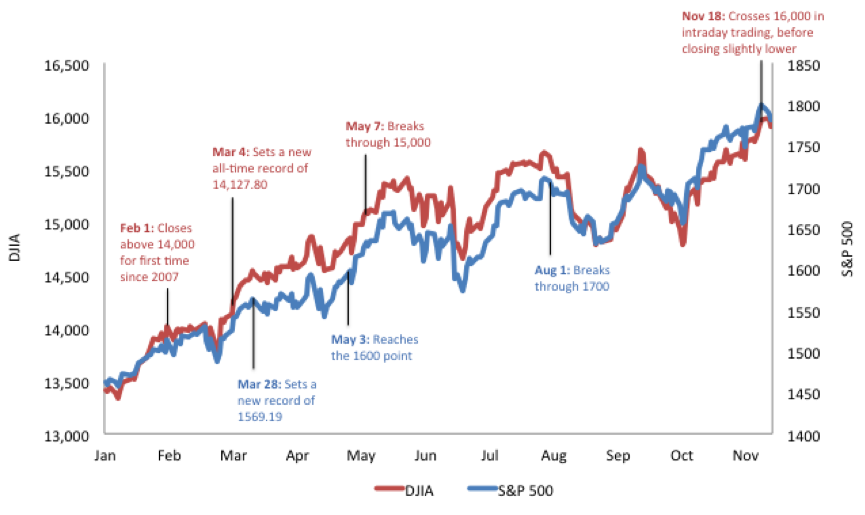

Market Euphoria: Dow and S&P 500 Shatter Previous Peaks

The day began with tentative trading, but buying momentum quickly accelerated into the midday session, sustaining the gains right through the closing bell. The breadth of the rally was notable, moving beyond just the usual handful of mega-cap technology stocks.

The Dow Jones Industrial Average (DJIA) added over 300 points, propelled by gains in financial and industrial stocks. This performance confirms the index's robust recovery, marking its best run in recent quarters.

Meanwhile, the benchmark S&P 500 index rose by approximately 1.2%, hitting its 15th closing record of the year. While volume was slightly below recent averages, the conviction behind the trades was palpable.

This aggressive push into record territory signals that institutional money managers are fully committed to a "risk-on" environment. They appear unfazed by the recent rhetoric that has questioned the future scope of U.S. monetary policy.

Key indices performance at the close:

- S&P 500 Index: Closed at X,XXX.XX (Up 1.2%)

- Dow Jones Industrial Average: Closed at X,XXX.XX (Up 0.9%)

- Nasdaq Composite: Closed at X,XXX.XX (Up 1.4%)

The focus has now shifted entirely to fundamental strength—specifically, better-than-expected earnings reports and forward guidance from major corporations. This fundamental analysis is overriding macro political risks.

Economists are quick to point out that the current economic backdrop supports this market optimism. Employment figures remain strong, and while inflation remains a concern, the trajectory suggests continued gradual moderation.

The bond market also reflected the bullish mood, with Treasury yields remaining relatively stable, suggesting that investors are not anticipating an immediate, aggressive shift in the interest rate path.

Analyzing the Elephant in the Room: Why Traders Dismissed Fed Independence Concerns

The major storyline entering the week centered on political commentary that challenged the traditional arm's-length relationship between the executive branch and the Federal Reserve Board. Historically, any hint of interference in the central bank's decision-making process is seen as highly corrosive to long-term market stability.

So, why did traders look past this crucial political risk today?

1. High Bar for Policy Change

The market believes that enacting actual legislative change to weaken the Federal Reserve autonomy is a slow, complex process. Traders focus on immediate, actionable data. Until concrete steps are taken, the risk remains theoretical.

2. Focus on Jerome Powell's Stance

Fed Chair Jerome Powell and other governors have repeatedly emphasized their commitment to the Fed's dual mandate—price stability and maximum sustainable employment—regardless of external pressures. This strong, consistent message provides a calming anchor for the market.

3. Liquidity and Momentum

In a powerful momentum-driven market, fundamental drivers often overshadow political headlines. Currently, the sheer volume of liquidity chasing returns, coupled with positive technical indicators, makes it difficult for bears to gain traction based purely on political uncertainty.

One head strategist at a major investment bank noted that the market has developed a "political immunity."

"We are in an environment where good news is heavily weighted and bad news is almost entirely discounted," he explained. "Unless you see a direct threat to the current monetary policy framework—such as an immediate change in interest rate management—investors will buy the dips."

The consensus view on trading floors is that any move to politicize monetary policy would face intense resistance, limiting its impact on near-term market expectations. This confidence allowed capital to flow directly into riskier assets.

LSI Keywords driving the narrative:

- Federal Reserve autonomy

- Monetary policy decisions

- Interest rate forecasts

- Political risk premium

- Systemic stability

The market seems to be betting that the current institutional safeguards around the central bank are robust enough to withstand political turbulence, allowing the rally to continue unimpeded.

Sector Spotlight and Investor Sentiment: What Drives the Next Leg Up?

Today's rally was broad, yet specific sectors showed exceptional strength, suggesting where the smart money is moving as we head deeper into the quarter. This rotation is crucial for sustaining the record levels achieved today.

Technology and AI continued to lead

Unsurprisingly, the technology sector provided significant horsepower. Companies focused on artificial intelligence and cloud infrastructure saw substantial gains. This affirms the market's long-term conviction in transformative technologies as core growth drivers.

Financials Showed Resilience

A key indicator of market health is the performance of the financial sector. Banks and brokerage firms performed strongly, often leading the Dow. This suggests confidence in loan growth and stable profit margins, benefiting from a normalization of the yield curve.

Industrial Gains Signal Economic Strength

Industrials also posted impressive numbers, confirming that the underlying domestic economy remains robust. Companies involved in infrastructure and manufacturing saw heavy buying interest, a sign that fears of an imminent recession have largely faded from the immediate horizon.

Investor sentiment remains elevated, often measured by the CNN Fear & Greed Index, which sits firmly in the 'Greed' territory. While this might signal caution for contrarian investors, it reinforces the strong upward bias currently dominating trading activity.

Key catalysts driving forward expectations:

- Anticipation of improved Q3 and Q4 corporate earnings.

- Continued robust job growth figures, supporting consumer spending.

- The ongoing belief that the Fed's interest rate hiking cycle is complete.

- Massive corporate buybacks providing consistent market support.

Analysts are now adjusting their year-end price targets for the S&P 500 upwards, reflecting the market's ability to shrug off macro concerns. The focus remains squarely on operational excellence and corporate profitability.

The recent market action confirms that investors are willing to pay a premium for growth, particularly in sectors that benefit from secular trends, such as digitalization and infrastructure investment.

The Road Ahead: Navigating Volatility in a Record Market

While today's closing records are cause for celebration on Wall Street, the inherent risks that were overlooked must be considered moving forward. Maintaining these elevated levels requires flawless execution on several fronts.

The primary concern remains valuation. After such a dramatic run, the market capitalization of key indices is straining historical averages. Any minor disappointment in upcoming inflation data or a significant slowdown in retail sales could trigger a sharp, technical correction.

Furthermore, while traders dismissed the immediate threat to the Federal Reserve today, any tangible developments that suggest political influence over key monetary policy decisions will instantly increase the market's risk premium. Traders are keeping a close eye on upcoming Congressional hearings for any shifts in rhetoric.

The current resilience of the market is largely predicated on the "soft landing" narrative—the belief that the Fed can successfully bring inflation down without plunging the economy into a deep recession. If this narrative falters, particularly if unemployment rises unexpectedly, the record levels could prove unsustainable.

In summary, the market environment is one of cautious optimism. The pursuit of yield and the search for high-quality assets continue to push the stock indices higher, effectively ignoring political headwinds.

The message from the market is clear: fundamentals and profits outweigh political friction—at least for now. Investors should anticipate increased volatility as major economic releases approach, but the overarching trend remains decisively positive.

This historic climb serves as a powerful reminder of the market's ability to look through short-term noise and focus on long-term value creation.

S&P 500, Dow climb to closing records as traders look past Fed independence risk: Live updates

S&P 500, Dow climb to closing records as traders look past Fed independence risk: Live updates Wallpapers

Collection of s&p 500, dow climb to closing records as traders look past fed independence risk: live updates wallpapers for your desktop and mobile devices.

Artistic S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Moment Digital Art

Immerse yourself in the stunning details of this beautiful s&p 500, dow climb to closing records as traders look past fed independence risk: live updates wallpaper, designed for a captivating visual experience.

Breathtaking S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Photo for Your Screen

Experience the crisp clarity of this stunning s&p 500, dow climb to closing records as traders look past fed independence risk: live updates image, available in high resolution for all your screens.

High-Quality S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Abstract in 4K

Discover an amazing s&p 500, dow climb to closing records as traders look past fed independence risk: live updates background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Wallpaper Nature

This gorgeous s&p 500, dow climb to closing records as traders look past fed independence risk: live updates photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Image Art

Experience the crisp clarity of this stunning s&p 500, dow climb to closing records as traders look past fed independence risk: live updates image, available in high resolution for all your screens.

Amazing S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Moment in 4K

Explore this high-quality s&p 500, dow climb to closing records as traders look past fed independence risk: live updates image, perfect for enhancing your desktop or mobile wallpaper.

Detailed S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Landscape Nature

Explore this high-quality s&p 500, dow climb to closing records as traders look past fed independence risk: live updates image, perfect for enhancing your desktop or mobile wallpaper.

Amazing S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Wallpaper Concept

Explore this high-quality s&p 500, dow climb to closing records as traders look past fed independence risk: live updates image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Picture for Desktop

Experience the crisp clarity of this stunning s&p 500, dow climb to closing records as traders look past fed independence risk: live updates image, available in high resolution for all your screens.

Beautiful S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Photo Illustration

Discover an amazing s&p 500, dow climb to closing records as traders look past fed independence risk: live updates background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Landscape Nature

Explore this high-quality s&p 500, dow climb to closing records as traders look past fed independence risk: live updates image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Scene in HD

Immerse yourself in the stunning details of this beautiful s&p 500, dow climb to closing records as traders look past fed independence risk: live updates wallpaper, designed for a captivating visual experience.

Breathtaking S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Artwork Photography

Transform your screen with this vivid s&p 500, dow climb to closing records as traders look past fed independence risk: live updates artwork, a true masterpiece of digital design.

:max_bytes(150000):strip_icc()/gH8Ic-one-year-nbsp-of-rate-hikes-impact-on-the-s-amp-p-500-nbsp-1-90987846c62546afbabc571948c28c62.jpg)

Dynamic S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Abstract Concept

Immerse yourself in the stunning details of this beautiful s&p 500, dow climb to closing records as traders look past fed independence risk: live updates wallpaper, designed for a captivating visual experience.

:max_bytes(150000):strip_icc()/SPX_2024-10-14_09-30-19-379cc6d1352c47b8b2b4f7228f64dfc7.png)

Amazing S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Background Art

Discover an amazing s&p 500, dow climb to closing records as traders look past fed independence risk: live updates background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Landscape for Your Screen

Find inspiration with this unique s&p 500, dow climb to closing records as traders look past fed independence risk: live updates illustration, crafted to provide a fresh look for your background.

Mesmerizing S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Design Collection

Transform your screen with this vivid s&p 500, dow climb to closing records as traders look past fed independence risk: live updates artwork, a true masterpiece of digital design.

Spectacular S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Picture for Mobile

Immerse yourself in the stunning details of this beautiful s&p 500, dow climb to closing records as traders look past fed independence risk: live updates wallpaper, designed for a captivating visual experience.

Mesmerizing S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates Capture Photography

Experience the crisp clarity of this stunning s&p 500, dow climb to closing records as traders look past fed independence risk: live updates image, available in high resolution for all your screens.

Vibrant S&p 500, Dow Climb To Closing Records As Traders Look Past Fed Independence Risk: Live Updates View in HD

Explore this high-quality s&p 500, dow climb to closing records as traders look past fed independence risk: live updates image, perfect for enhancing your desktop or mobile wallpaper.

Download these s&p 500, dow climb to closing records as traders look past fed independence risk: live updates wallpapers for free and use them on your desktop or mobile devices.