NASDAQ Index, S&P 500 and Dow Jones Forecasts – US Indices Look Soft in Early Monday Trading

NASDAQ Index, S&P 500 and Dow Jones Forecasts – US Indices Look Soft in Early Monday Trading

The highly anticipated start to the trading week has arrived, and investors are showing clear signs of caution. Specifically, the US markets are indicating a defensive posture as we observe the current environment for the NASDAQ Index, S&P 500 and Dow Jones Forecasts – US Indices Look Soft in Early Monday Trading. Pre-market activity suggests that the strong upward momentum seen late last week might be stalling, forcing traders to reassess risk appetite.

This early softness stems from a mixture of macroeconomic anxiety and specific corporate updates. Traders are currently grappling with persistent inflation worries and geopolitical tensions that refuse to dissipate. Consequently, maintaining vigilance regarding key support levels across all major indices is paramount for navigating the week ahead.

The Tepid Start: Why US Indices Look Soft in Early Monday Trading

The modest downtick we are witnessing in futures is a direct reflection of Friday's tepid close and a cautious response to overnight global market movements. Asian markets demonstrated mixed results, while European indices have also struggled to find substantial direction. This lack of conviction internationally often spills over into the US opening session, especially when a lack of major economic data points leaves a vacuum for speculation.

Furthermore, much of the recent rally has been predicated on strong earnings reports from major tech players. However, the absence of fresh catalysts at the start of the week encourages profit-taking rather than aggressive new entries. We are seeing early resistance testing the resolve of bulls who drove prices higher last month.

Key Drivers: Inflation Fears and Fed Rhetoric

The primary overhang on market sentiment remains the Federal Reserve's future trajectory. Despite hopes for immediate interest rate cuts, sticky CPI and PPI data released recently suggest that inflation is proving more resilient than policymakers initially hoped. This uncertainty fuels volatility across all asset classes.

Several influential Fed officials are scheduled to speak later this week. Traders are positioning defensively now, anticipating potentially hawkish comments that could temper expectations for a dovish pivot. The market dreads the possibility of rates staying higher for longer, directly impacting growth stocks, particularly those dominant in the NASDAQ Index.

The following factors are contributing to the cautious Monday open:

- Uncertainty surrounding upcoming inflation data revisions.

- Anticipation of speeches from key Federal Reserve members.

- Slight geopolitical risk premium impacting oil prices and general sentiment.

- A reduction in trading volumes typical of the start of the week.

Examining Pre-Market Futures for NASDAQ

The NASDAQ 100 futures (NQ) are displaying the most significant weakness among the major US indices. Given the tech index's sensitivity to interest rate expectations, this is not surprising. The technical picture for the NASDAQ suggests critical support rests around the previous swing low established last week.

If the technology sector continues to face selling pressure, particularly in the mega-cap names that heavily weight the index, a deeper correction is possible. Investors must watch for signs of breakdown below key technical moving averages. Volume will be crucial in determining if this early selling is just noise or the start of a trend reversal.

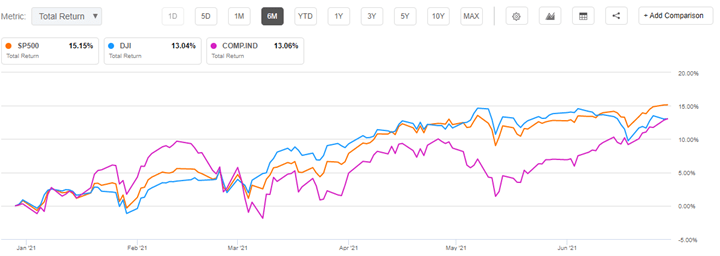

S&P 500 and Dow Jones: Diverging Signals?

While the NASDAQ Index faces immediate pressure, the outlook for the S&P 500 and the Dow Jones Industrial Average presents a slightly more nuanced scenario. The S&P 500 (SPX) is often seen as the barometer of the broader US economy, encompassing sectors that might fare better in a higher interest rate environment, such as energy and financials.

The soft start affects the SPX, but its diversified structure offers some resilience. We are observing slight rotation out of high-growth technology and into value-oriented sectors, which helps prevent a steeper decline in the S&P 500 compared to the tech-heavy NASDAQ.

Sectoral Rotation and the S&P 500 Outlook

Sectoral rotation is the key theme influencing the S&P 500's early movements this week. Defensive sectors like Utilities and Consumer Staples are showing relative strength. This suggests institutional investors are hedging their bets against potential broad market weakness. Conversely, cyclical sectors closely tied to economic expansion, like Materials, are struggling to find footing.

For the S&P 500 to resume its bullish trend, participation needs to broaden beyond the "Magnificent Seven" tech giants. A true sign of enduring health would be positive performance across sectors like Health Care and Industrials, signaling underlying economic confidence. For now, however, caution prevails, contributing to the feeling that US Indices Look Soft in Early Monday Trading.

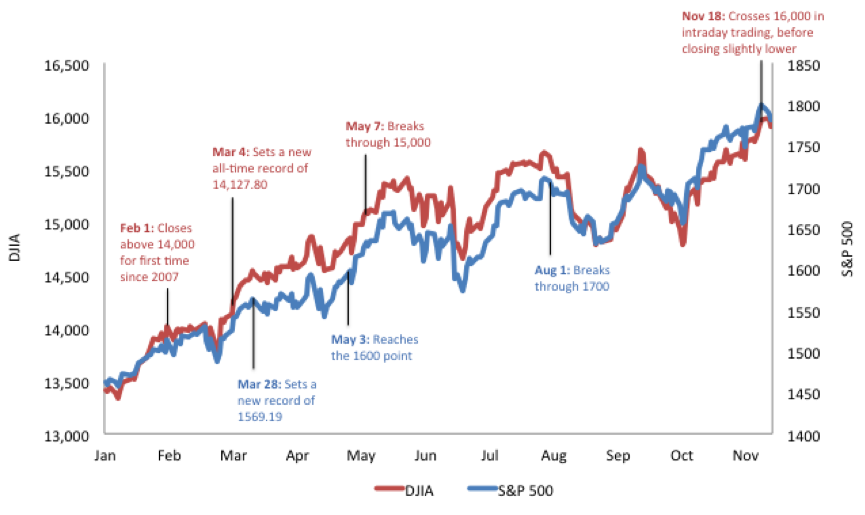

Dow Jones Industrial Average: Watching the Industrials

The Dow Jones Industrial Average (DJIA), comprised mainly of blue-chip industrial and financial companies, typically exhibits lower volatility than the NASDAQ. Its current softness is mainly a spillover effect from the general risk-off sentiment rather than an index-specific fundamental problem. The strength of the US consumer and the industrial complex will be key determinants for the DJIA's performance this week.

Analysts are closely monitoring multinational components of the Dow, whose earnings can be highly sensitive to currency fluctuations and global growth slowdowns. If industrial orders or manufacturing PMI figures improve mid-week, the Dow could quickly rebound, potentially outperforming its tech-heavy counterparts.

Technical Analysis: Crucial Support Levels to Monitor

From a technical standpoint, the current price action demands immediate attention to key support and resistance zones. Breaking these levels could dictate the direction for the rest of the week, validating or invalidating the current soft start.

Here are the key technical levels investors must watch across the NASDAQ Index, S&P 500 and Dow Jones Forecasts:

- NASDAQ Composite (IXIC): The crucial immediate support level is the 50-day Exponential Moving Average (EMA). A firm breach below this point suggests a potential move towards the 200-day EMA, signaling deeper corrective action. Resistance is centered around last week's high.

- S&P 500 (SPX): Support lies strongly near the psychological round number level recently breached. Holding above this range is necessary to keep the short-term bullish structure intact. If buying volume fails to materialize, the next major support target is significant.

- Dow Jones Industrial Average (DJIA): The Dow is currently testing an important pivot point established earlier this quarter. Sustained weakness below this pivot could trigger stop-loss selling, while a bounce here confirms its underlying strength relative to the other indices.

Furthermore, technical indicators like the Relative Strength Index (RSI) are cooling from overbought territory, which many analysts view as a healthy consolidation. However, if the RSI drops rapidly, it could indicate aggressive selling pressure is taking hold, confirming the soft start is turning into a bearish trend.

Upcoming Economic Calendar: What to Watch

While Monday is relatively light on high-impact data releases, the rest of the week holds several key economic indicators that could quickly shift sentiment and trajectory for the NASDAQ Index, S&P 500, and Dow Jones. These reports focus mainly on the health of the labor market and consumer confidence, essential ingredients for sustained index growth.

Key reports include retail sales data and housing starts figures, both of which provide a fresh perspective on consumer resilience in the face of persistent inflation. Any deviation from consensus expectations in these reports will generate significant market reaction, potentially lifting the indices out of their current funk or pushing them further down.

Investors should also pay close attention to Treasury yields. When yields rise, the valuations of future-earning companies (predominantly in the NASDAQ) become less appealing, often leading to a downward revision in stock prices. The relationship between yields and the NASDAQ Index remains a critical driver this week.

Conclusion: Navigating the Early Monday Softness

The consensus regarding NASDAQ Index, S&P 500 and Dow Jones Forecasts – US Indices Look Soft in Early Monday Trading is clear: caution rules the day. Investors are adopting a 'wait and see' approach ahead of key Fed commentary and crucial mid-week economic data. The NASDAQ faces the stiffest headwind due to interest rate sensitivity, while the S&P 500 and Dow Jones show slight resilience through sectoral diversity.

To navigate this period of soft performance, traders should prioritize risk management and maintain tight stop-losses. The current market environment rewards patience and the ability to distinguish between temporary profit-taking and a genuine reversal of the underlying trend. Monitor those crucial technical support levels closely; their breach could signal a sustained move lower.

Frequently Asked Questions (FAQ) Regarding US Indices Forecasts

- What does 'US Indices Look Soft in Early Monday Trading' mean?

- It indicates that pre-market futures and the opening hours show minor declines or sluggish performance across major US stock indices (Dow, S&P 500, and NASDAQ), suggesting a lack of strong buying momentum or early profit-taking.

- Why is the NASDAQ Index typically more volatile than the Dow Jones?

- The NASDAQ is heavily weighted toward technology and growth stocks, which are highly sensitive to changes in interest rates and future earnings expectations. The Dow Jones comprises established, often less volatile blue-chip industrial companies.

- What economic data should investors watch this week?

- The most critical data points include retail sales, housing starts, and any speeches or minutes released by Federal Reserve officials. These will dictate the market's perception of inflation and future interest rate policy.

- Is the softness a signal of a long-term bear market?

- Not necessarily. Early Monday softness often represents short-term profit-taking or positioning ahead of high-impact news. A true bear market signal requires sustained breakdown below major long-term technical support levels and negative shifts in macroeconomic fundamentals.

NASDAQ Index, S&P 500 and Dow Jones Forecasts – US Indices Look Soft in Early Monday Trading

NASDAQ Index, S&P 500 and Dow Jones Forecasts – US Indices Look Soft in Early Monday Trading Wallpapers

Collection of nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading wallpapers for your desktop and mobile devices.

Beautiful Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Photo Illustration

Discover an amazing nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Picture for Desktop

This gorgeous nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Abstract Concept

This gorgeous nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Capture Nature

Transform your screen with this vivid nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading artwork, a true masterpiece of digital design.

Detailed Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Background Collection

Transform your screen with this vivid nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading artwork, a true masterpiece of digital design.

Mesmerizing Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Landscape Illustration

Explore this high-quality nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading image, perfect for enhancing your desktop or mobile wallpaper.

Captivating Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Wallpaper Nature

Immerse yourself in the stunning details of this beautiful nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading wallpaper, designed for a captivating visual experience.

Vivid Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Design Collection

Discover an amazing nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Spectacular Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Artwork Nature

This gorgeous nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Wallpaper Illustration

Experience the crisp clarity of this stunning nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading image, available in high resolution for all your screens.

Breathtaking Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Wallpaper Nature

Discover an amazing nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vibrant Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Background Art

Explore this high-quality nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading image, perfect for enhancing your desktop or mobile wallpaper.

Vivid Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Abstract Concept

Experience the crisp clarity of this stunning nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading image, available in high resolution for all your screens.

Exquisite Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Image Art

This gorgeous nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Image Illustration

Experience the crisp clarity of this stunning nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading image, available in high resolution for all your screens.

Amazing Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Artwork in HD

Explore this high-quality nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading View Nature

Discover an amazing nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vivid Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Abstract Nature

Discover an amazing nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Landscape Nature

Discover an amazing nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading background image, ideal for personalizing your devices with vibrant colors and intricate designs.

High-Quality Nasdaq Index, S&p 500 And Dow Jones Forecasts – Us Indices Look Soft In Early Monday Trading Abstract in 4K

Discover an amazing nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Download these nasdaq index, s&p 500 and dow jones forecasts – us indices look soft in early monday trading wallpapers for free and use them on your desktop or mobile devices.