Why I think this ASX tech share sell-off is a great time to invest

Why I Think This ASX Tech Share Sell-Off Is a Great Time to Invest

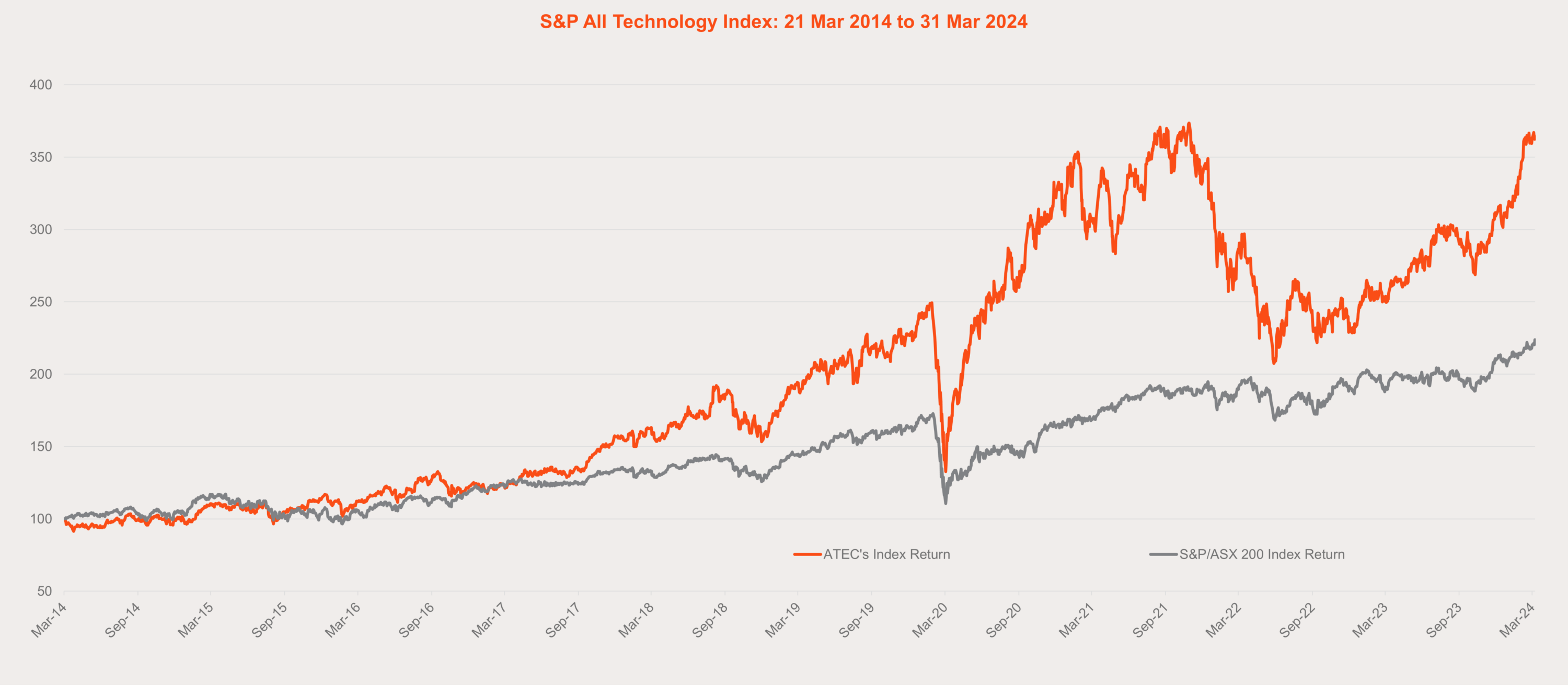

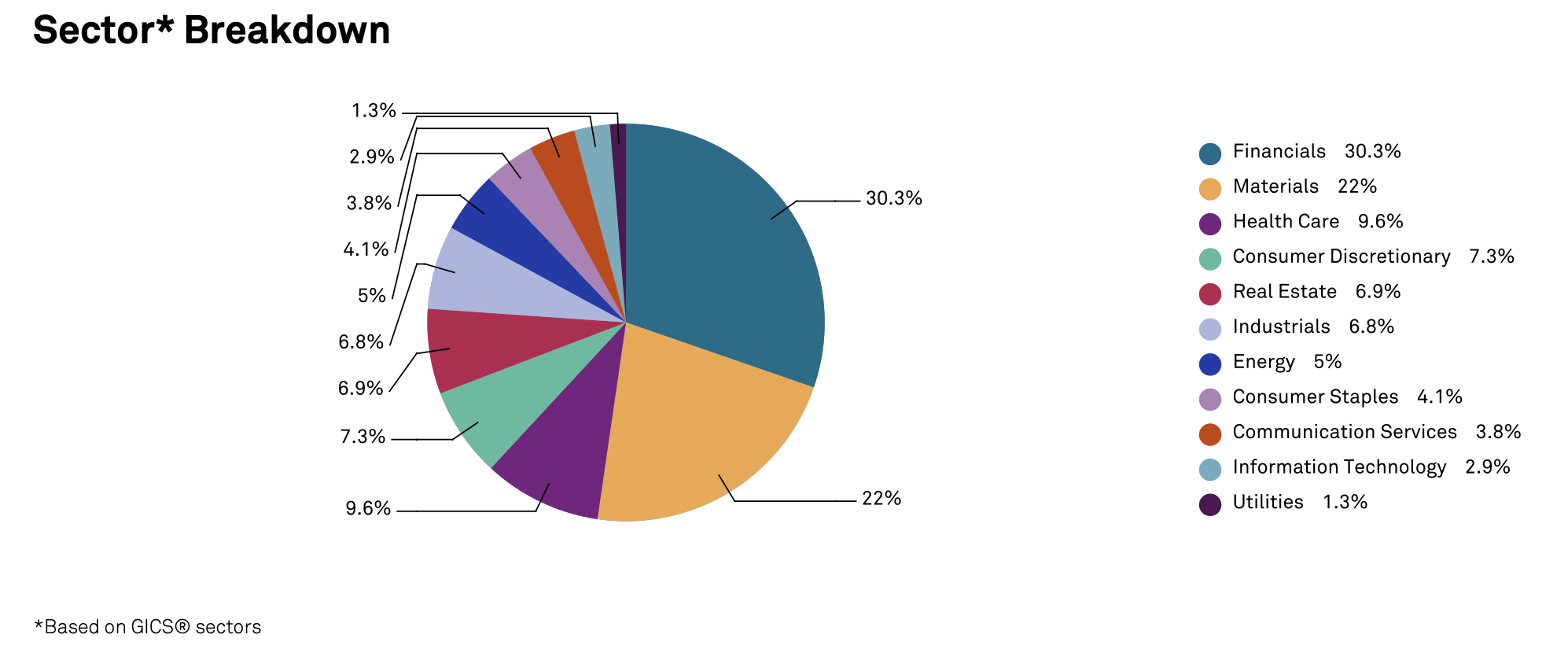

The narrative surrounding the Australian Securities Exchange (ASX) tech sector has been brutal. Headline after headline screams about inflation, rising interest rates, and the subsequent collapse of growth stock valuations. We have seen once-untouchable market darlings shed 50%, 60%, or even 70% of their peak value. For many investors, the sight of their portfolios deep in the red has led to panic selling and a complete loss of confidence in technology investments.

I recall vividly fielding a frantic call just last week from a client concerned about their exposure to ASX SaaS stocks. They asked the classic question: "Should I cut my losses before things get worse?" This moment, filled with fear and extreme market volatility, is precisely why I believe we are witnessing a once-in-a-cycle investment opportunity.

As a seasoned investor and analyst, my conviction is strong: This extreme market correction, particularly within the quality segment of ASX tech shares, is a phenomenal chance to establish positions at a discount. Panic selling by the market provides an inherent advantage for disciplined investors with a long-term investment horizon. This article breaks down why the smart money is moving in now, focusing on the valuation reset and the unwavering secular growth trends that underpin the technology sector.

Understanding the Macroeconomic Drivers Behind the Market Correction

To capitalize on the current situation, we must first correctly diagnose the cause of the downturn. This sell-off is fundamentally different from a company-specific failure or a sudden loss of customer demand. It is a macro-driven repricing event.

The past decade benefited from ultra-low interest rates, a key environment for high-growth companies. Low rates meant that future cash flows, even those projected five or ten years out, were highly valuable in today's dollars. This fueled massive valuations, often resulting in high price-to-sales ratios that seemed detached from reality.

The sudden surge in global inflationary pressure forced central banks, including the Reserve Bank of Australia (RBA), to hike interest rates aggressively. This change in monetary policy acts as a powerful headwind specifically targeting growth stocks for two key reasons:

- The Discount Rate Effect: Higher rates increase the 'discount rate' used in Discounted Cash Flow (DCF) models. Mathematically, this instantly reduces the present value of future earnings, forcing a valuation reset for stocks that rely on profitability far down the track.

- Investor Sentiment Rotation: The market rotates away from speculative 'growth at any cost' toward companies demonstrating immediate profitability and strong free cash flow. This fear index shift has penalized many fantastic companies that are strategically reinvesting for future market dominance.

It is crucial to note that while the share prices have tumbled, the underlying businesses—the quality of their products, their customer retention rates, and the size of their Total Addressable Market (TAM)—remain robust. The pain we are seeing is due to a change in the price of money, not the quality of the asset.

The Valuation Reset: Identifying Quality at a Deep Discount

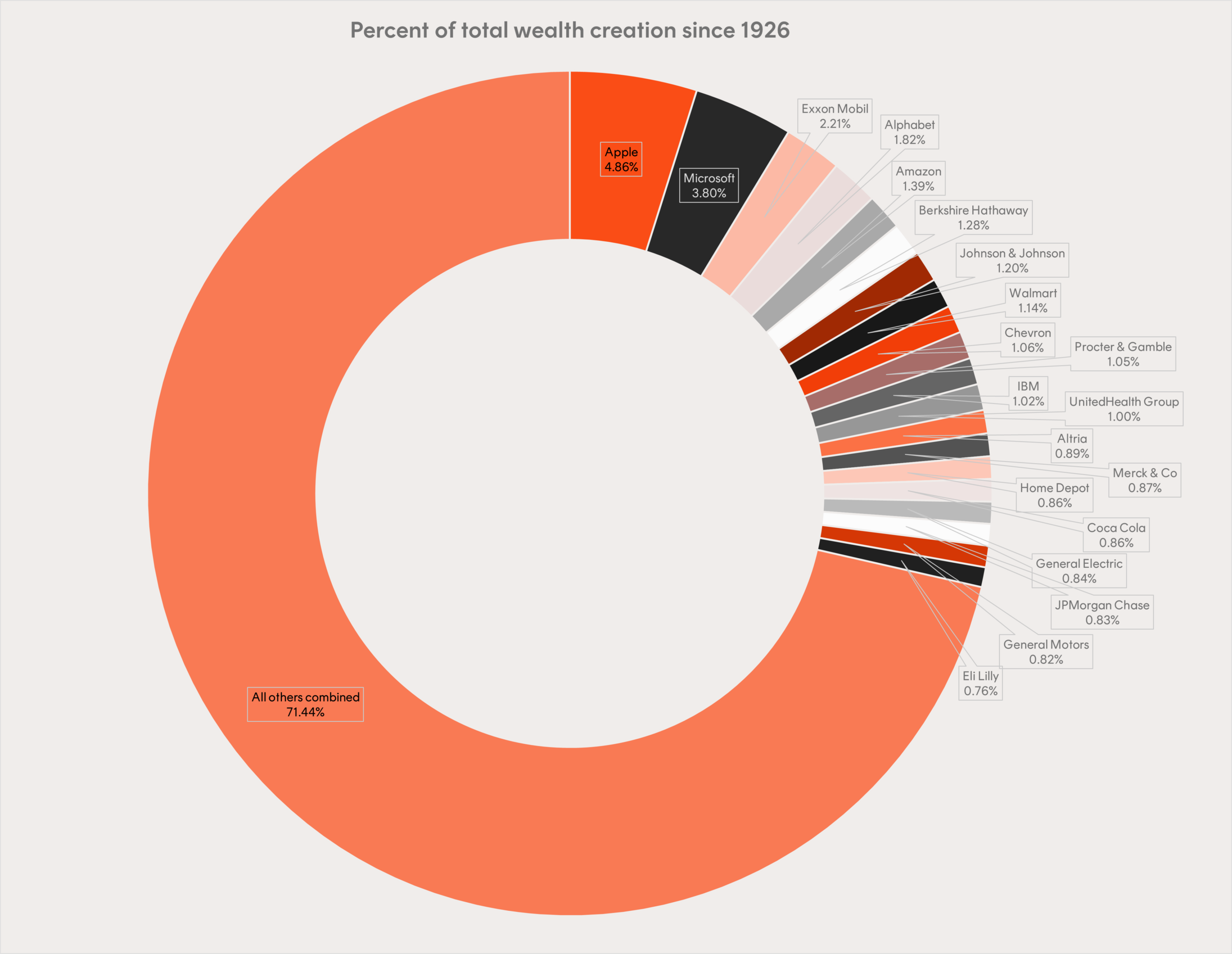

The greatest gift a bear market gives long-term investors is the ability to separate genuine market leaders from mere speculative froth. During the 2021 tech boom, almost every tech stock, regardless of its path to profitability, was bid up relentlessly. Today, that discipline is back in vogue, and we can finally acquire high-quality assets at a sensible price.

We are no longer buying potential at 40x revenue; we are buying proven operating models at fractions of their historical averages. This is the essence of value investing applied to the technology sector.

Smart investors should be highly selective during this period. The focus must be on enduring business models that meet specific criteria:

Focus Areas During the Tech Correction:

The current environment demands rigorous due diligence. Look beyond the daily volatility and focus on these critical fundamentals:

- Recurring Revenue Models: Companies with high-margin, predictable Subscription as a Service (SaaS) revenue are inherently more resilient. Their revenue streams are sticky and less susceptible to short-term economic fluctuations than transactional businesses.

- Strong Balance Sheets and Cash Position: Companies holding significant cash and minimal debt are survivors. They have the flexibility to navigate prolonged downturns without resorting to dilutive capital raises, and they can even capitalize by acquiring smaller, distressed competitors cheaply.

- Defensible Moats and Market Share: Is the company's product deeply embedded in its customers' operations (mission-critical)? High switching costs ensure strong customer retention, even when budgets tighten.

- Cash Flow Positive or Clear Path to Profitability: While growth is necessary, the market now rewards efficiency. Look for evidence that management is prioritizing prudent spending and delivering a viable path toward positive free cash flow.

For example, several established ASX tech platforms with international growth potential, solid gross margins, and large existing customer bases are currently trading at multiples that were considered unimaginable just 18 months ago. These price points represent fantastic opportunities for compounding returns over the next five to seven years.

Long-Term Digital Transformation Outweighs Short-Term Headwinds

A fundamental mistake many fearful investors make is conflating temporary market sentiment with irreversible secular trends. While central bankers can influence interest rates, they cannot halt the global momentum towards digital transformation, cloud computing, or increased automation.

The necessity for businesses to modernize their operations has only accelerated post-pandemic. Every sector—from retail and finance to healthcare and logistics—is reliant on software and technology infrastructure to remain competitive. This digital migration is a multi-decade tailwind that will continue to drive growth for quality tech providers regardless of whether the RBA raises rates another 25 basis points this quarter.

The current dip merely allows us to buy these long-term beneficiaries at a lower price point. Consider the sectors poised for exponential growth:

- Cybersecurity: As businesses move more operations online, the threat landscape expands. Spending on robust cybersecurity solutions is non-negotiable.

- Fintech and Payments: The shift away from legacy banking systems towards integrated, seamless payment processing continues globally.

- Data Analytics and AI: Companies that help businesses derive actionable intelligence from massive datasets will be critical drivers of productivity gains.

These trends are structural. The short-term turbulence is a transient phenomenon caused by the business cycle and monetary policy adjustments. The underlying technological revolution, however, is permanent.

For those adopting a long-term investment horizon, market downturns like the current ASX tech sell-off are not moments of panic, but moments of profound strategic advantage. Legendary investors teach us that the best time to be greedy is when others are fearful. The market has discounted the future, giving patient investors the chance to buy future profits at today's distressed prices.

Do not wait for certainty to return. By the time market sentiment has definitively shifted, and the headlines are positive again, the steepest gains will already have been captured. The time to act, with careful selection and conviction in quality fundamentals, is now.

Why I think this ASX tech share sell-off is a great time to invest-05022026

Why I think this ASX tech share sell-off is a great time to invest Wallpapers

Collection of why i think this asx tech share sell-off is a great time to invest wallpapers for your desktop and mobile devices.

Mesmerizing Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Abstract Photography

Experience the crisp clarity of this stunning why i think this asx tech share sell-off is a great time to invest image, available in high resolution for all your screens.

High-Quality Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Abstract Photography

Explore this high-quality why i think this asx tech share sell-off is a great time to invest image, perfect for enhancing your desktop or mobile wallpaper.

Detailed Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Picture Art

Transform your screen with this vivid why i think this asx tech share sell-off is a great time to invest artwork, a true masterpiece of digital design.

Spectacular Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Image in HD

A captivating why i think this asx tech share sell-off is a great time to invest scene that brings tranquility and beauty to any device.

Captivating Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Photo Collection

Find inspiration with this unique why i think this asx tech share sell-off is a great time to invest illustration, crafted to provide a fresh look for your background.

Captivating Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Scene for Mobile

A captivating why i think this asx tech share sell-off is a great time to invest scene that brings tranquility and beauty to any device.

Artistic Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Image in 4K

This gorgeous why i think this asx tech share sell-off is a great time to invest photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Design for Your Screen

Experience the crisp clarity of this stunning why i think this asx tech share sell-off is a great time to invest image, available in high resolution for all your screens.

Exquisite Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Image Photography

A captivating why i think this asx tech share sell-off is a great time to invest scene that brings tranquility and beauty to any device.

Stunning Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Moment for Desktop

Immerse yourself in the stunning details of this beautiful why i think this asx tech share sell-off is a great time to invest wallpaper, designed for a captivating visual experience.

Crisp Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Landscape Illustration

Find inspiration with this unique why i think this asx tech share sell-off is a great time to invest illustration, crafted to provide a fresh look for your background.

Vibrant Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Capture Photography

Explore this high-quality why i think this asx tech share sell-off is a great time to invest image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Design Art

Transform your screen with this vivid why i think this asx tech share sell-off is a great time to invest artwork, a true masterpiece of digital design.

Crisp Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Design for Desktop

A captivating why i think this asx tech share sell-off is a great time to invest scene that brings tranquility and beauty to any device.

Exquisite Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Artwork for Your Screen

Find inspiration with this unique why i think this asx tech share sell-off is a great time to invest illustration, crafted to provide a fresh look for your background.

Breathtaking Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Wallpaper for Your Screen

Transform your screen with this vivid why i think this asx tech share sell-off is a great time to invest artwork, a true masterpiece of digital design.

Captivating Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Artwork in 4K

Find inspiration with this unique why i think this asx tech share sell-off is a great time to invest illustration, crafted to provide a fresh look for your background.

Artistic Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Capture Illustration

Find inspiration with this unique why i think this asx tech share sell-off is a great time to invest illustration, crafted to provide a fresh look for your background.

Artistic Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Design for Mobile

Immerse yourself in the stunning details of this beautiful why i think this asx tech share sell-off is a great time to invest wallpaper, designed for a captivating visual experience.

Detailed Why I Think This Asx Tech Share Sell-off Is A Great Time To Invest Scene Photography

Discover an amazing why i think this asx tech share sell-off is a great time to invest background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Download these why i think this asx tech share sell-off is a great time to invest wallpapers for free and use them on your desktop or mobile devices.