US 2025 Tax Returns: What is the Deadline to File Taxes? What Happens if You Miss It During the 2026 Tax Filing Season?

US 2025 Tax Returns: What is the Deadline to File Taxes? What Happens if You Miss It During the 2026 Tax Filing Season?

The sound of the IRS ticking clock is often drowned out by the noise of everyday life, but when the calendar flips to the 2026 filing season, the stakes become very real for millions of American taxpayers. We are talking about the income you earned and the deductions you claimed throughout the 2025 calendar year—the *Tax Year 2025* returns.

I remember speaking with a client, let’s call him David, who was traveling internationally in early 2026. He assumed filing his personal tax return was something he could "catch up on" when he returned home late May. His delay resulted in an audit trigger and significant penalties that wiped out his expected refund, all because he confused a tax *extension* with a payment *deferral*. This common, yet costly, mistake highlights why understanding the official IRS deadlines for the 2026 filing season is paramount.

When dealing with federal taxes, the difference between a compliant taxpayer and one facing severe financial consequences often boils down to a single date. Missing the deadline for your US 2025 tax returns doesn't just result in a stern letter; it activates a compounding interest structure and punitive penalties that can snowball rapidly. Let’s break down the critical date and the immediate repercussions of failing to meet your federal tax obligations.

The Critical Date: Pinpointing the 2026 Filing Deadline for Tax Year 2025

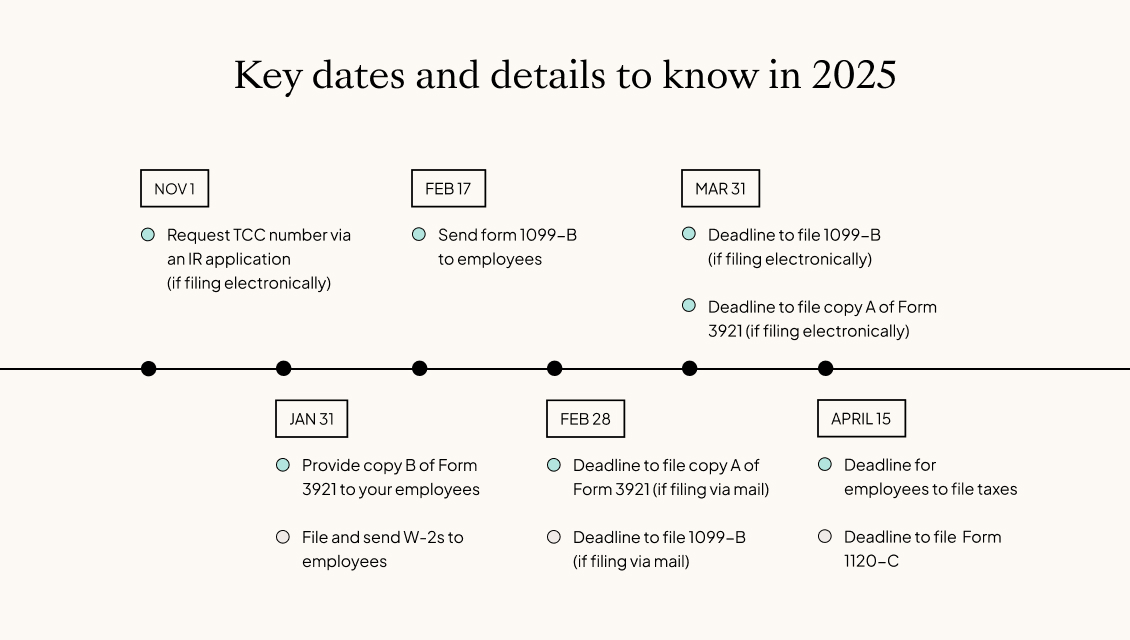

For the majority of individual taxpayers, the deadline to file your Form 1040 for the 2025 Tax Year is universally recognized, though it is subject to minor adjustments based on weekends and federal holidays.

The standard deadline for filing US income tax returns is **April 15th** of the subsequent year. Therefore, for the income earned during the 2025 calendar year, the anticipated deadline will be **Wednesday, April 15, 2026**.

However, the IRS often shifts this date slightly when April 15th falls on a weekend or when certain regional holidays intervene, such as Emancipation Day in D.C. (which affects the entire country's filing deadline) or Patriots' Day in Massachusetts and Maine. While a definitive ruling for 2026 is always announced closer to the date, taxpayers should operate under the assumption of April 15th, 2026, as the immutable deadline.

It is crucial to understand the distinction between the deadline to *file* and the deadline to *pay*. If you cannot finalize your return by April 15, 2026, the IRS allows you to request an automatic six-month extension using **Form 4868**.

Filing Form 4868 grants an extension to file until mid-October 2026 (typically October 15th). This prevents the "Failure to File" penalty. However, it is vital to remember:

- The extension only covers the paperwork filing date.

- It does not extend the deadline for tax payments.

- You must estimate your tax liability and pay any balance due by the April 15th, 2026 deadline to avoid interest and the Failure to Pay penalty.

Taxpayers residing overseas (military or civilian) generally receive an automatic two-month extension to file, moving their deadline to mid-June 2026. However, even these taxpayers are still required to pay interest on any underpayment that persists past the standard April deadline. Proactive tax planning and the use of modern e-filing methods are essential tools to ensure compliance before the clock runs out.

Missing the Mark: Understanding IRS Penalties for Late Filers

When you fail to file your US 2025 tax returns or fail to pay your tax liability by the April 2026 deadline, the Internal Revenue Service (IRS) imposes two primary, separate penalties, which are often mistakenly conflated: the Failure to File (FTF) penalty and the Failure to Pay (FTP) penalty.

The penalties are designed to encourage timely submission, and the FTF penalty is significantly more severe than the FTP penalty.

1. Failure to File (FTF) Penalty

This penalty is triggered if you do not submit your tax return (or file Form 4868 for an extension) by the due date. The FTF penalty is the most damaging for late filers.

The rate is steep:

- 5% of the unpaid tax due for each month or part of a month that a tax return is late.

- This penalty is capped at a maximum of 25% of your unpaid liability.

- If the return is more than 60 days late, the minimum penalty is the lesser of $485 (for returns due in 2026, adjusted for inflation) or 100% of the tax due. This floor penalty ensures that even small liabilities result in a substantial fine if ignored for too long.

2. Failure to Pay (FTP) Penalty

This penalty applies if you filed your return on time (or received an extension) but failed to submit the required payment by the April 15, 2026 deadline.

The rate is comparatively smaller:

- 0.5% of the unpaid taxes for each month or part of a month the taxes remain unpaid.

- This penalty is also capped at 25% of your unpaid liability.

The Severe Combination

If you fail to both file *and* pay (a very common scenario for those who simply ignore the deadline), the IRS applies both penalties simultaneously. However, to prevent excessively punitive fines, the Failure to File penalty is reduced by the Failure to Pay penalty for any month where both apply.

Essentially, the total combined penalty for failure to file and pay generally starts at 4.5% (5% FTF minus 0.5% FTP) of your unpaid taxes per month. This means the interest and penalties combined can quickly push the outstanding balance far beyond the original tax debt. Furthermore, the IRS adds an interest charge (based on the federal short-term rate plus 3 percentage points) on all unpaid balances and associated penalties, compounding daily until the debt is settled. This interest rate adjustment further compounds the financial damage for those delaying payment until mid- or late-2026.

Strategies for Compliance: What to Do If You Can't File or Pay on Time

Realizing you are approaching or have already passed the April 2026 deadline for your 2025 tax returns should trigger immediate, strategic action. Panic is counterproductive; strategic compliance is key to minimizing your overall tax burden and avoiding further escalation from the IRS.

1. File Immediately, Even if You Can't Pay

The number one priority is mitigating the massive Failure to File penalty. Since the FTF penalty (5% per month) is nine times greater than the FTP penalty (0.5% per month), submitting your return or Form 4868 (Extension Request) immediately will stop the clock on the worst of the potential fines. Use the most accurate information you have available to complete your **Form 1040**.

2. Pay What You Can

Do not wait until you have the full amount. Any payment, no matter how small, reduces the principal balance upon which both the FTP penalty and the daily accruing interest are calculated. Partial payments should be made electronically via IRS Direct Pay or through a payment voucher.

3. Explore Relief Options: Abatement and Agreements

If you have a genuine reason for missing the deadline, the IRS offers several avenues for relief, particularly concerning the penalties incurred during the 2026 filing season:

- First Time Penalty Abatement (FTA): If you have a clean compliance history for the past three tax years, you may qualify to have the Failure to File and Failure to Pay penalties waived for a single tax period. This applies widely to individual taxpayers who simply made a mistake.

- Reasonable Cause Exception: If you can demonstrate circumstances beyond your control prevented timely filing or payment (such as severe illness, natural disaster, death in the family, or documented inability to access records), the IRS may grant penalty relief.

- Installment Agreement (Payment Plan): If you owe less than $50,000 in combined tax, penalties, and interest, you can apply for an Online Payment Agreement. This allows you up to 72 months to pay your debt, reducing the Failure to Pay penalty rate to 0.25% per month while the agreement is in force.

4. Address State Taxes Separately

Remember that states have their own independent deadlines and penalty structures. Missing the federal deadline for your US 2025 tax returns usually means you have missed your state income tax deadline as well. You must proactively check and address your state tax obligations, often using the same compliance strategies (filing an extension, making partial payments).

The 2026 filing season for 2025 income demands attention to detail. Ignoring the deadline is not an option. By understanding the critical date, the severe nature of the Failure to File penalty, and the available relief mechanisms, taxpayers can ensure robust **IRS compliance** and protect their financial well-being. Start your planning now—well ahead of April 15, 2026.

US 2025 tax returns: What is the deadline to file taxes? What happens if you miss it during the 2026 tax filing season?

US 2025 tax returns: What is the deadline to file taxes? What happens if you miss it during the 2026 tax filing season? Wallpapers

Collection of us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? wallpapers for your desktop and mobile devices.

Crisp Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Wallpaper Photography

Find inspiration with this unique us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? illustration, crafted to provide a fresh look for your background.

Vibrant Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Background in HD

Experience the crisp clarity of this stunning us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? image, available in high resolution for all your screens.

Captivating Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Capture for Mobile

This gorgeous us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Scene Concept

Immerse yourself in the stunning details of this beautiful us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? wallpaper, designed for a captivating visual experience.

Artistic Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Image Concept

A captivating us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? scene that brings tranquility and beauty to any device.

Detailed Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Artwork Collection

Experience the crisp clarity of this stunning us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? image, available in high resolution for all your screens.

Stunning Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Picture Collection

This gorgeous us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Landscape Nature

Find inspiration with this unique us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? illustration, crafted to provide a fresh look for your background.

Vivid Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Capture Photography

Transform your screen with this vivid us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? artwork, a true masterpiece of digital design.

Exquisite Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Background in 4K

Immerse yourself in the stunning details of this beautiful us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? wallpaper, designed for a captivating visual experience.

Spectacular Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Picture for Your Screen

Immerse yourself in the stunning details of this beautiful us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? wallpaper, designed for a captivating visual experience.

Amazing Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Abstract for Your Screen

Experience the crisp clarity of this stunning us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? image, available in high resolution for all your screens.

Gorgeous Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Capture Illustration

This gorgeous us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Picture in 4K

Discover an amazing us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vivid Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Artwork in 4K

Transform your screen with this vivid us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? artwork, a true masterpiece of digital design.

Stunning Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Picture Concept

A captivating us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? scene that brings tranquility and beauty to any device.

Serene Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Background Nature

Explore this high-quality us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? image, perfect for enhancing your desktop or mobile wallpaper.

Amazing Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Photo Concept

Transform your screen with this vivid us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? artwork, a true masterpiece of digital design.

Serene Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Image Digital Art

Transform your screen with this vivid us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? artwork, a true masterpiece of digital design.

Captivating Us 2025 Tax Returns: What Is The Deadline To File Taxes? What Happens If You Miss It During The 2026 Tax Filing Season? Image Nature

Immerse yourself in the stunning details of this beautiful us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? wallpaper, designed for a captivating visual experience.

Download these us 2025 tax returns: what is the deadline to file taxes? what happens if you miss it during the 2026 tax filing season? wallpapers for free and use them on your desktop or mobile devices.