Microsoft lost $357 billion in market cap as stock plunged most since 2020

Microsoft Lost $357 Billion in Market Cap as Stock Plunged Most Since 2020: What Triggered the Record Sell-Off?

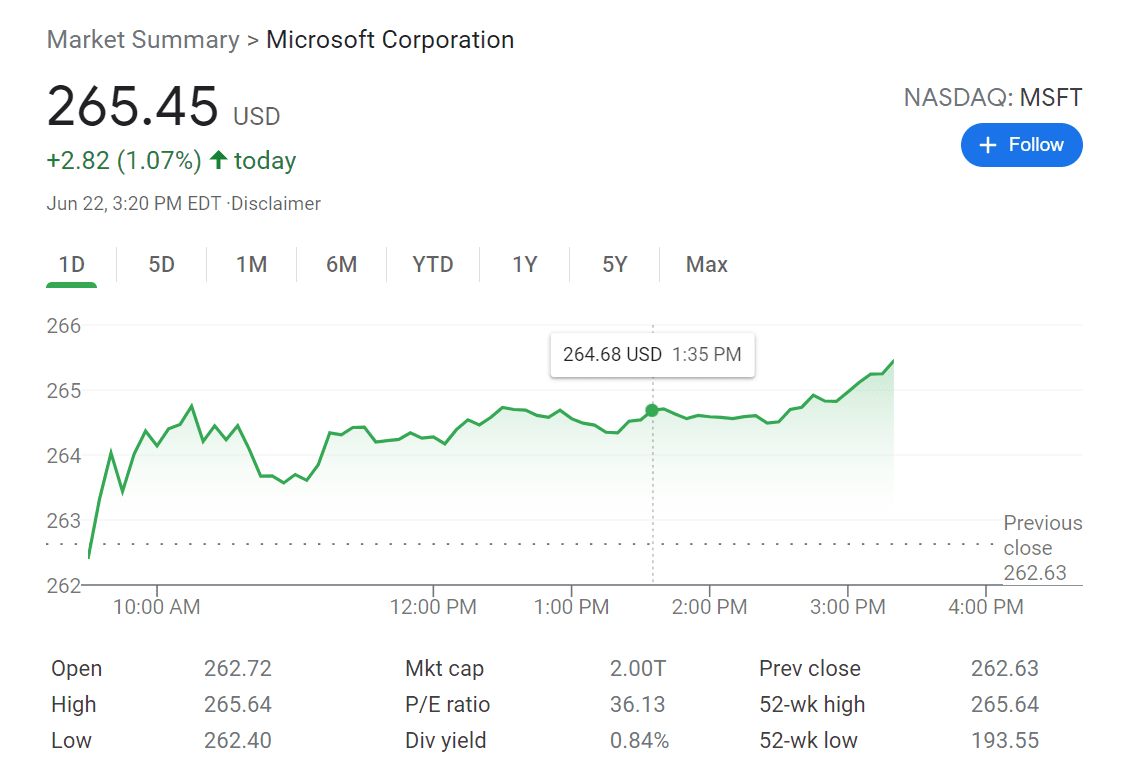

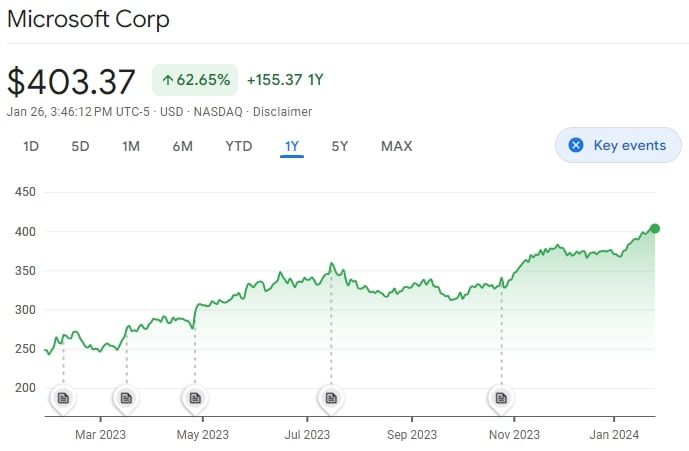

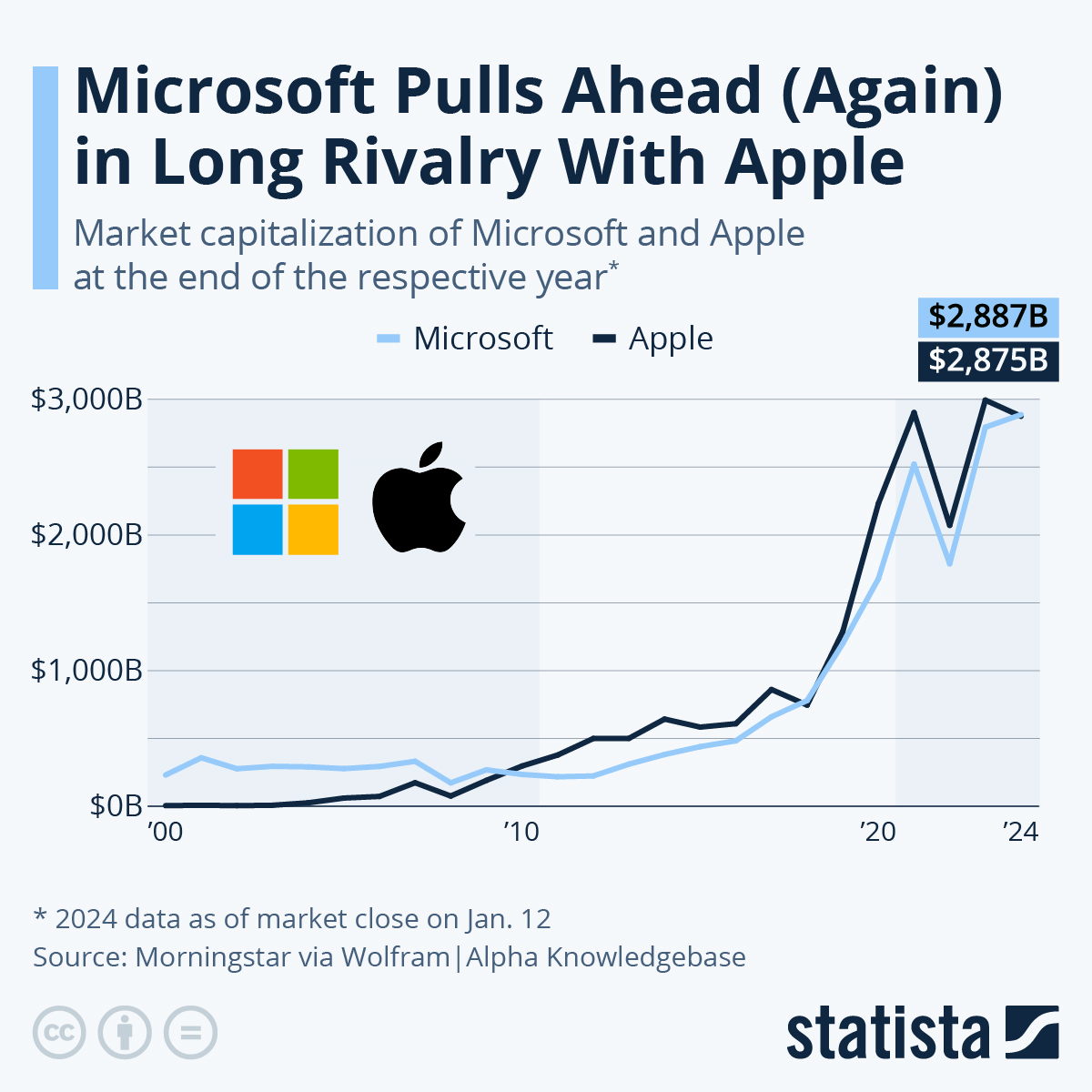

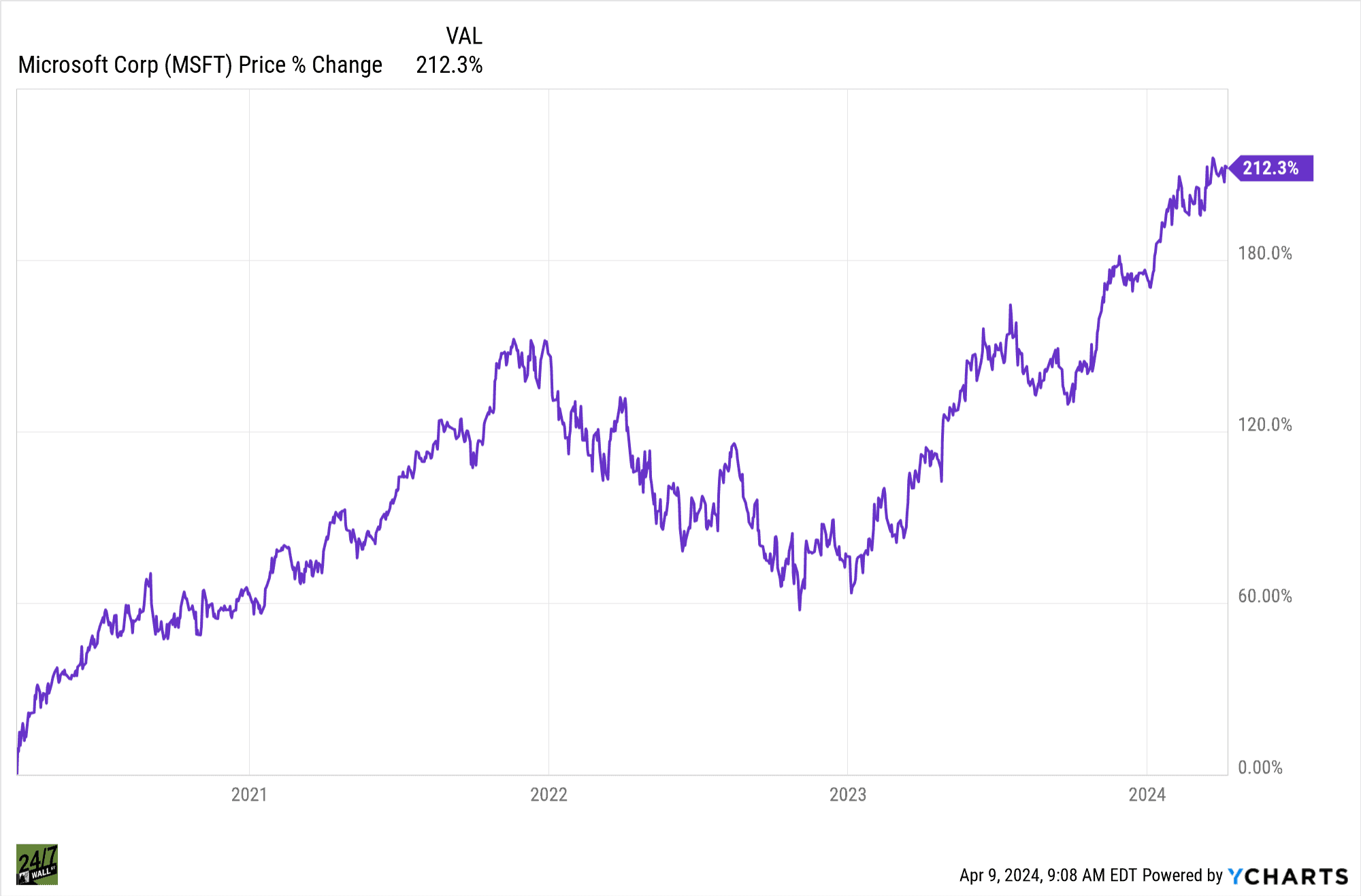

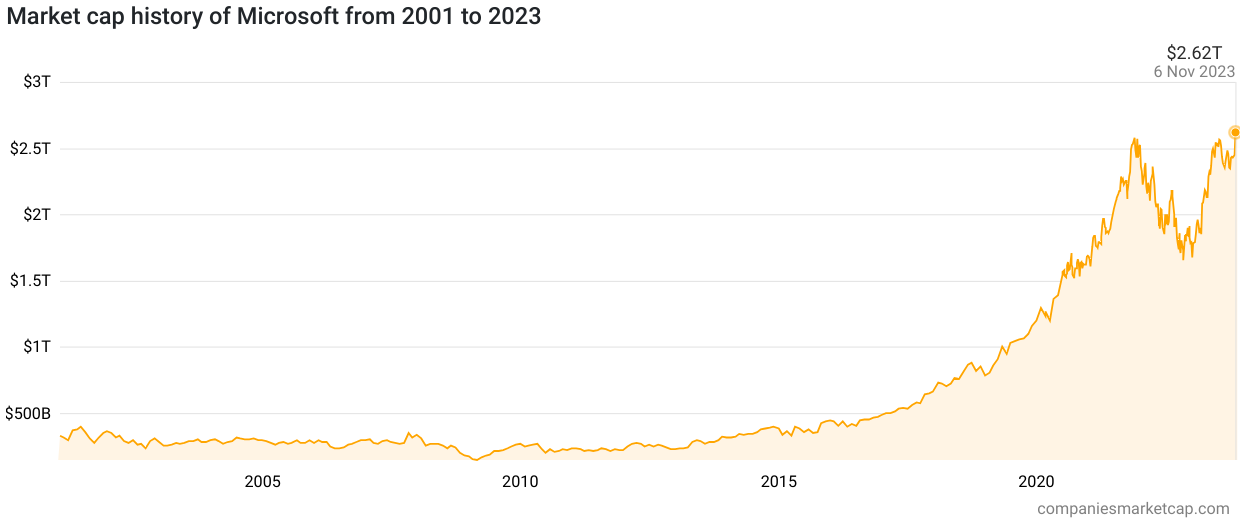

The tech world woke up to a seismic shift this week as Microsoft Corporation experienced one of its most brutal trading sessions in recent history. Following a disappointing quarterly earnings report and cautious forward guidance, the stock price plummeted, wiping out an estimated $357 billion in market capitalization. This steep decline marks the most severe single-day percentage drop for the Redmond giant since the early days of the COVID-19 pandemic in 2020, signaling deep investor concerns about the immediate future of the technology sector.

For many investors who rely on Microsoft's stable growth—often seen as a safer harbor compared to riskier tech plays—the volatility was jarring. I remember vividly watching the opening bell, anticipating a slight dip due to the prevailing macroeconomic headwinds. Instead, the screen flashed deep red. The immediate reaction across financial news outlets was one of shock: how could a company synonymous with enterprise resilience take such a massive, sudden hit? This wasn't just a technical correction; it was a fundamental repricing based on shifting economic realities and operational forecasts.

The core issue lies not in outright failure, but in the deceleration of high-margin business segments that had powered the stock through the bull run. When a company valued in the trillions misses even slightly on expectations, the resulting cascade effect is amplified across the global market.

The Catalysts Behind the Record Plunge: Cloud Slowdown and PC Market Slump

The primary driver for the monumental market cap loss was the underwhelming performance and, critically, the outlook provided for Microsoft's key growth engines. While overall revenue remained robust, investors zeroed in on two specific weak spots: the slowing trajectory of the Intelligent Cloud division, particularly Azure, and the pronounced contraction in the Personal Computing segment.

Microsoft's dominance over the last decade has been intrinsically linked to the success of its cloud infrastructure platform, Azure. CEO Satya Nadella has consistently championed the migration to the cloud, making Azure the company's most important long-term growth driver. However, the most recent quarterly earnings report showed signs that the hyper-growth phase might be moderating faster than analysts had modeled.

- Azure Growth Deceleration: While Azure still posted impressive year-over-year growth figures, the rate of increase fell short of the aggressive targets set by Wall Street. Customers, facing increased costs due to inflation and rising interest rates, are beginning to optimize their existing cloud spending rather than immediately launching new, large-scale projects.

- Personal Computing Collapse: The post-pandemic boom in PC sales has officially ended. The Windows, Devices, and Xbox segments—which form the backbone of the Personal Computing division—were hit hard. The decline in global PC shipments directly impacted Windows OEM revenue, creating a substantial drag on overall profitability.

- Currency Headwinds: A significant portion of Microsoft's revenue is generated internationally. The strength of the US Dollar against other major currencies created powerful currency headwinds, reducing the value of international sales when converted back to USD, further squeezing margins.

This confluence of internal operational shifts and external macroeconomic pressures created the perfect storm. The market reacted violently not to the current numbers, but to the forward guidance offered by leadership, which suggested that these slowdowns would persist for the foreseeable future. High growth stocks require high growth expectations, and any signal of deceleration prompts aggressive selling.

Assessing the Damage: $357 Billion Wipeout and Investor Sentiment

The $357 billion market cap reduction is more than just a large number; it represents a significant shift in investor sentiment regarding the safety and reliable growth narrative long associated with Microsoft. This single-day erosion highlights the fragility of valuations in the current high-interest-rate environment where the Federal Reserve is actively seeking to cool economic activity.

When investors move into a "risk-off" mood, they scrutinize valuations that rely heavily on future growth discounted at higher rates. The stock market's sharp reaction indicates that the valuation premium previously assigned to Microsoft—based on the certainty of cloud expansion—is now being questioned. The scale of the sell-off brings into sharp focus the impact of generalized macroeconomic pressures on even the most well-capitalized tech behemoths.

The ripple effects of Microsoft's plunge were immediately felt across the wider tech sector. Other companies reliant on enterprise software spending and cloud infrastructure—often LSI keywords in market analysis—also saw their stocks dip sharply, suggesting that the issues Microsoft reported are systemic rather than isolated. This includes key competitors and dependent partners who are also grappling with slowing corporate spending and tighter IT budgets.

- Valuation Reassessment: Analysts are rapidly adjusting their price targets, moving away from optimism toward a more cautious outlook that factors in prolonged economic uncertainty and increased operating expenses.

- Historical Context: While the dollar amount is staggering, the percentage plunge puts it in line with the most severe corrections experienced during periods of extreme global uncertainty, reinforcing the seriousness of the economic climate.

- Impact on Tech Hiring: The pressure on the bottom line is already visible in operational adjustments. Alongside many Big Tech firms, Microsoft has signaled a slowdown in hiring and, in some cases, instituted targeted layoffs to control costs and improve operational efficiency amid slowing revenue growth.

The speed and depth of the sell-off underscore a critical lesson for the modern market: in an environment defined by high inflation and aggressive monetary tightening, even the most established and diversified blue-chip tech stocks are vulnerable to the collective anxiety about future profitability.

The Path Forward: Microsoft's Strategy Amid Macro Headwinds

Despite the immediate market pain, Microsoft remains a financial powerhouse with deep resources and diversified revenue streams. The crucial question now for CEO Satya Nadella and the management team is how they plan to navigate this period of heightened macroeconomic headwinds and restore investor confidence.

The strategy moving forward appears to be a dual focus: maintaining strong momentum in long-term strategic areas while ruthlessly optimizing costs in mature and slowing divisions. This means protecting the investment necessary for future growth while exercising extreme fiscal discipline elsewhere.

Key strategic priorities articulated by the company include:

The emphasis on cost control is paramount. Management has committed to controlling operating expenses, ensuring that every dollar spent generates maximum return. This commitment to efficiency is seen as essential to boosting margins even if top-line revenue growth moderates.

- Doubling Down on AI and Productivity: Investments in integrating Artificial Intelligence (AI) across the entire product suite—from Azure services to Microsoft 365 (formerly Office)—remain a top priority. Productivity tools are seen as recession-resistant, as businesses will always look for software that helps them do more with fewer people.

- Strategic Gaming Investment: Despite regulatory hurdles, the acquisition of Activision Blizzard is still viewed as a transformative move that secures Microsoft's future relevance in the booming gaming and metaverse segments, providing a much-needed diversification away from reliance solely on enterprise IT spending.

- Cloud Optimization Focus: Instead of focusing on securing massive new contracts, the current focus shifts to helping existing Azure clients optimize their cloud consumption. This involves providing tools that encourage efficient use of resources, ensuring customer retention and maximizing revenue from current users rather than onboarding new ones.

While the immediate financial quarter was disappointing, analysts often point to Microsoft's historical resilience. The company has demonstrated an ability to pivot and adapt to previous economic downturns, leveraging its deep relationships with enterprise clients. The current stock plunge, while severe, may ultimately represent a necessary recalibration rather than a structural failure.

Investors will now watch subsequent quarterly reports with extreme caution, focusing less on headline revenue numbers and more on margin health, disciplined spending, and the sustained growth rate of Azure, the ultimate barometer of Microsoft's long-term health in the new era of constrained economic growth. The journey to recovering the lost $357 billion in market cap will be slow, reliant on operational execution, and highly sensitive to external economic indicators.

Microsoft lost $357 billion in market cap as stock plunged most since 2020

Microsoft lost $357 billion in market cap as stock plunged most since 2020 Wallpapers

Collection of microsoft lost $357 billion in market cap as stock plunged most since 2020 wallpapers for your desktop and mobile devices.

Gorgeous Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Abstract Collection

Find inspiration with this unique microsoft lost $357 billion in market cap as stock plunged most since 2020 illustration, crafted to provide a fresh look for your background.

Beautiful Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Artwork for Mobile

Explore this high-quality microsoft lost $357 billion in market cap as stock plunged most since 2020 image, perfect for enhancing your desktop or mobile wallpaper.

Exquisite Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Scene Photography

Immerse yourself in the stunning details of this beautiful microsoft lost $357 billion in market cap as stock plunged most since 2020 wallpaper, designed for a captivating visual experience.

Crisp Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Moment for Mobile

This gorgeous microsoft lost $357 billion in market cap as stock plunged most since 2020 photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Abstract Art

Experience the crisp clarity of this stunning microsoft lost $357 billion in market cap as stock plunged most since 2020 image, available in high resolution for all your screens.

High-Quality Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Image for Your Screen

Explore this high-quality microsoft lost $357 billion in market cap as stock plunged most since 2020 image, perfect for enhancing your desktop or mobile wallpaper.

Exquisite Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Picture for Mobile

Find inspiration with this unique microsoft lost $357 billion in market cap as stock plunged most since 2020 illustration, crafted to provide a fresh look for your background.

Exquisite Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Scene Concept

A captivating microsoft lost $357 billion in market cap as stock plunged most since 2020 scene that brings tranquility and beauty to any device.

Vivid Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Photo for Your Screen

Transform your screen with this vivid microsoft lost $357 billion in market cap as stock plunged most since 2020 artwork, a true masterpiece of digital design.

Captivating Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Image Art

This gorgeous microsoft lost $357 billion in market cap as stock plunged most since 2020 photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 View Nature

Transform your screen with this vivid microsoft lost $357 billion in market cap as stock plunged most since 2020 artwork, a true masterpiece of digital design.

Spectacular Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Capture Photography

Immerse yourself in the stunning details of this beautiful microsoft lost $357 billion in market cap as stock plunged most since 2020 wallpaper, designed for a captivating visual experience.

Dynamic Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Design Nature

A captivating microsoft lost $357 billion in market cap as stock plunged most since 2020 scene that brings tranquility and beauty to any device.

Vibrant Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Photo Art

Explore this high-quality microsoft lost $357 billion in market cap as stock plunged most since 2020 image, perfect for enhancing your desktop or mobile wallpaper.

Captivating Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Design for Mobile

A captivating microsoft lost $357 billion in market cap as stock plunged most since 2020 scene that brings tranquility and beauty to any device.

Stunning Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Image for Your Screen

This gorgeous microsoft lost $357 billion in market cap as stock plunged most since 2020 photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/16189668/bHvaS0k.png)

Exquisite Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Picture in 4K

Find inspiration with this unique microsoft lost $357 billion in market cap as stock plunged most since 2020 illustration, crafted to provide a fresh look for your background.

Dynamic Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Artwork Photography

Immerse yourself in the stunning details of this beautiful microsoft lost $357 billion in market cap as stock plunged most since 2020 wallpaper, designed for a captivating visual experience.

High-Quality Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Abstract Photography

Discover an amazing microsoft lost $357 billion in market cap as stock plunged most since 2020 background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing Microsoft Lost $357 Billion In Market Cap As Stock Plunged Most Since 2020 Artwork Collection

Experience the crisp clarity of this stunning microsoft lost $357 billion in market cap as stock plunged most since 2020 image, available in high resolution for all your screens.

Download these microsoft lost $357 billion in market cap as stock plunged most since 2020 wallpapers for free and use them on your desktop or mobile devices.