IFC support draws two private equity funds to Philippine deals

IFC Support Draws Two Private Equity Funds to Philippine Deals, Signifying Shifting Investment Tides

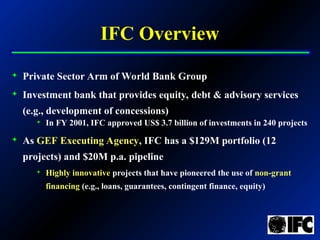

The Philippines' burgeoning economic landscape has just received a major vote of confidence. In a significant development for Southeast Asian emerging markets, the International Finance Corporation (IFC), the private sector arm of the World Bank Group, has successfully leveraged its involvement to attract two major international private equity (PE) funds into high-value deals within the archipelago. This strategic endorsement validates the country's recent strides in macroeconomic stability and regulatory transparency.

For months, the market had whispered about substantial but cautious capital waiting on the sidelines, wary of perceived execution risks unique to the region. However, the official engagement and subsequent de-risking mechanisms provided by the IFC proved to be the pivotal catalyst required to move these large investment commitments from speculation to reality. The influx of capital targets critical sectors, promising a ripple effect across the local economy.

One senior PE partner, speaking off the record, noted the transformation: "The moment the IFC steps in, the entire risk profile changes. It's not just capital; it's an institutional stamp of approval, assuring governance and providing a crucial buffer against regulatory uncertainties. For funds with strict fiduciary duties, that assurance is priceless, especially when navigating complex infrastructure projects or scaling up fast-growth portfolio companies."

This success story highlights a growing trend where Development Finance Institutions (DFIs) like the IFC are acting less as primary financiers and more as sophisticated market makers, bridging the gap between global institutional capital and high-growth, high-impact domestic opportunities.

De-risking the Dragon: How IFC Catalyzed Private Equity Interest

The Philippines, often referred to as the "Dragon Economy" of Southeast Asia, has immense growth potential, but conventional private equity investors traditionally demand higher risk premiums due to political transition concerns and long lead times for infrastructure development. The core function of IFC's recent involvement was to mitigate these perceived risks, essentially making Philippine deals comparable in attractiveness to those in more established markets.

IFC's support structure utilized several sophisticated financial instruments designed to protect the PE funds' downside while ensuring the investments adhered to strict environmental, social, and governance (ESG) standards. This 'blended finance' approach is rapidly becoming the standard operational model for mobilizing large private capital flows into challenging, yet essential, development sectors.

Key mechanisms deployed by the IFC included:

- Mezzanine Financing Guarantees: Providing subordinate debt or guarantees that reduce the exposure of senior equity, making the overall capital stack more secure for PE investors.

- Enhanced Due Diligence and Technical Assistance: Leveraging IFC's deep local expertise to vet projects rigorously, which significantly lowers the administrative burden and political risk assessment for foreign funds.

- Co-investment Commitments: The IFC committed its own capital alongside the PE funds, sharing the risk and signaling to the market that the projects are financially sound and developmentally crucial.

- Standardization of ESG Metrics: Insisting that investments meet global best practices in sustainability, which appeals specifically to institutional investors increasingly focused on ethical deployment of capital.

This calculated de-risking strategy was particularly effective because the two funds involved—one specializing in digital infrastructure and the other in sustainable manufacturing—require large, long-term commitments that are sensitive to policy shifts. The IFC's presence acts as a powerful deterrent against arbitrary regulatory changes, guaranteeing a more predictable operating environment for their respective portfolio companies.

The immediate consequence is a notable tightening of yield spreads for high-quality Philippine assets, a sign that market confidence is rapidly improving. Experts suggest this is the beginning of a sustained trend, provided the regulatory continuity holds.

The Target Sectors and Fund Commitment: Where the Money is Going

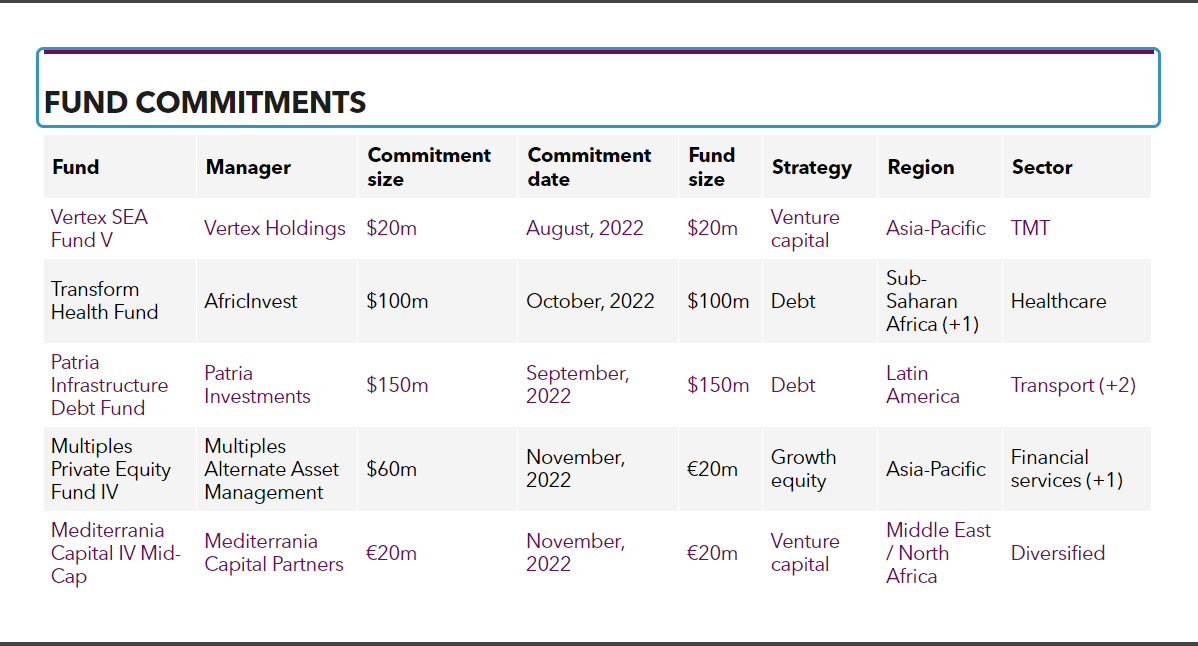

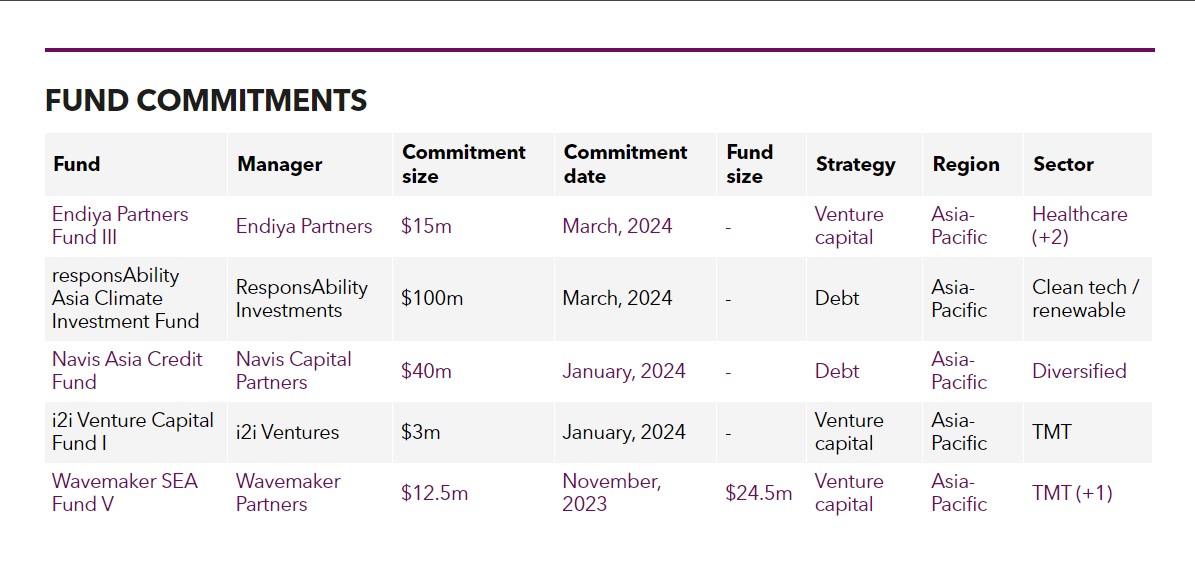

The capital injection is not spread thinly across the economy; it is strategically concentrated into areas identified by both the Philippine government and the IFC as critical bottlenecks for future growth. The two private equity funds, known for their focus on long-term value creation rather than quick flips, have committed hundreds of millions of dollars collectively, with potential follow-on investments expected over the next three to five years.

Fund Alpha, the first to finalize its commitment under the IFC structure, is heavily focused on the country's severe infrastructure gap. Specifically, its investment targets the expansion of digital connectivity and logistics hubs outside of the congested metropolitan centers.

The investment thesis for Fund Alpha centers on:

- Developing Tier 2 and Tier 3 data centers to support the exploding demand for cloud services and fintech operations.

- Funding last-mile delivery infrastructure, including cold chain logistics essential for agriculture and pharmaceutical distribution across the islands.

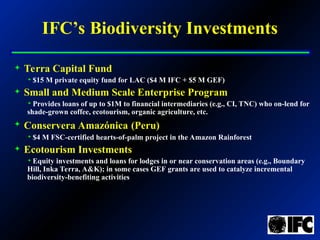

- Investing in renewable energy projects (primarily solar and geothermal) to provide reliable, clean power to support industrial expansion.

Meanwhile, Fund Beta, leveraging the IFC's expertise in emerging market manufacturing, is channeling capital into sustainable industrial parks and the modernization of key export-oriented factories. This fund's commitment is directly linked to boosting the Philippines' competitiveness in the global supply chain, moving beyond traditional BPO (Business Process Outsourcing) services.

A significant portion of Fund Beta's capital is earmarked for upgrading factory automation and implementing resource-efficient technologies. This strategic approach ensures the new investments not only generate financial returns but also adhere to stricter climate mitigation targets, aligning with global sustainable investment mandates.

The involvement of these private equity funds in these crucial sectors demonstrates a sophisticated understanding of the Philippines' unique economic requirements, proving that private capital can be effectively mobilized for developmental impact when appropriate risk-sharing instruments are in place.

Analysts project that the total deal value mobilized, including subsequent leveraging, could exceed $1 billion within the next two years, firmly placing the Philippines back on the radar of global capital allocators looking for growth opportunities in Southeast Asia.

Long-Term Impact: Solidifying the Philippine Investment Climate

The significance of IFC's successful mobilization extends far beyond the immediate financial transactions. It provides a powerful demonstration effect, establishing a precedent that future private equity funds can use as a roadmap for entry into the Philippine market.

By effectively demonstrating that large institutional capital can navigate local complexities with sufficient protection, the IFC is helping to solidify the overall investment climate. This success story mitigates the "first-mover disadvantage" that often plagues frontier and emerging markets.

Furthermore, the focus on sustainable investment and high governance standards elevates the quality of foreign direct investment (FDI) the Philippines is receiving. This is crucial for long-term macroeconomic stability, ensuring that the growth spurred by these deals is durable and inclusive.

The government's consistent commitment to structural reforms, particularly those targeting ease of doing business and infrastructure liberalization, has created the necessary foundational framework. The IFC's support then acted as the accelerant, proving the efficacy of these domestic policy changes to international skeptical investors.

Future implications are numerous:

- Increased Competition: Other international PE firms and institutional investors (e.g., pension funds) will now view similar Philippine assets as lower-risk opportunities, likely driving increased competition for high-quality deals.

- Domino Effect in Neighboring Markets: This success strengthens the case for similar blended finance interventions in neighboring emerging markets in Southeast Asia that face similar infrastructure funding gaps.

- Enhanced Local Capacity: The mandatory governance and ESG training required by the IFC's framework will inevitably improve the operational standards of the local portfolio companies, strengthening local management talent.

- Policy Feedback Loop: The success will encourage the Philippine government to deepen structural reforms, knowing that such efforts directly translate into tangible foreign capital inflows.

Ultimately, the successful attraction of these two key private equity funds underscores the strategic importance of Development Finance Institutions in modern global capital markets. Their ability to provide crucial de-risking mechanisms is proving indispensable for unlocking the trillions of dollars needed to fund critical development and climate transition projects in dynamic economies like the Philippines.

The message is clear: when the right institutional backing meets political will and vast market potential, private capital flows swiftly and decisively. This pivotal moment solidifies the Philippines' position as a preferred destination for impact-driven, high-growth investment in the coming decade.

IFC support draws two private equity funds to Philippine deals

IFC support draws two private equity funds to Philippine deals Wallpapers

Collection of ifc support draws two private equity funds to philippine deals wallpapers for your desktop and mobile devices.

Mesmerizing Ifc Support Draws Two Private Equity Funds To Philippine Deals View Art

Experience the crisp clarity of this stunning ifc support draws two private equity funds to philippine deals image, available in high resolution for all your screens.

Gorgeous Ifc Support Draws Two Private Equity Funds To Philippine Deals Capture Collection

A captivating ifc support draws two private equity funds to philippine deals scene that brings tranquility and beauty to any device.

Detailed Ifc Support Draws Two Private Equity Funds To Philippine Deals View for Mobile

Experience the crisp clarity of this stunning ifc support draws two private equity funds to philippine deals image, available in high resolution for all your screens.

Captivating Ifc Support Draws Two Private Equity Funds To Philippine Deals Moment Art

Immerse yourself in the stunning details of this beautiful ifc support draws two private equity funds to philippine deals wallpaper, designed for a captivating visual experience.

Amazing Ifc Support Draws Two Private Equity Funds To Philippine Deals View Collection

Experience the crisp clarity of this stunning ifc support draws two private equity funds to philippine deals image, available in high resolution for all your screens.

Amazing Ifc Support Draws Two Private Equity Funds To Philippine Deals Wallpaper in 4K

Transform your screen with this vivid ifc support draws two private equity funds to philippine deals artwork, a true masterpiece of digital design.

Serene Ifc Support Draws Two Private Equity Funds To Philippine Deals Capture for Desktop

Discover an amazing ifc support draws two private equity funds to philippine deals background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vivid Ifc Support Draws Two Private Equity Funds To Philippine Deals Moment Photography

Experience the crisp clarity of this stunning ifc support draws two private equity funds to philippine deals image, available in high resolution for all your screens.

Gorgeous Ifc Support Draws Two Private Equity Funds To Philippine Deals Design for Your Screen

A captivating ifc support draws two private equity funds to philippine deals scene that brings tranquility and beauty to any device.

Vivid Ifc Support Draws Two Private Equity Funds To Philippine Deals Picture Nature

Discover an amazing ifc support draws two private equity funds to philippine deals background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Spectacular Ifc Support Draws Two Private Equity Funds To Philippine Deals Scene Collection

Find inspiration with this unique ifc support draws two private equity funds to philippine deals illustration, crafted to provide a fresh look for your background.

Breathtaking Ifc Support Draws Two Private Equity Funds To Philippine Deals Moment Digital Art

Transform your screen with this vivid ifc support draws two private equity funds to philippine deals artwork, a true masterpiece of digital design.

Lush Ifc Support Draws Two Private Equity Funds To Philippine Deals Landscape for Your Screen

This gorgeous ifc support draws two private equity funds to philippine deals photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid Ifc Support Draws Two Private Equity Funds To Philippine Deals Image Digital Art

Explore this high-quality ifc support draws two private equity funds to philippine deals image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Ifc Support Draws Two Private Equity Funds To Philippine Deals Design Art

Explore this high-quality ifc support draws two private equity funds to philippine deals image, perfect for enhancing your desktop or mobile wallpaper.

Vivid Ifc Support Draws Two Private Equity Funds To Philippine Deals View Collection

Explore this high-quality ifc support draws two private equity funds to philippine deals image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Ifc Support Draws Two Private Equity Funds To Philippine Deals Design for Desktop

A captivating ifc support draws two private equity funds to philippine deals scene that brings tranquility and beauty to any device.

Detailed Ifc Support Draws Two Private Equity Funds To Philippine Deals View for Your Screen

Discover an amazing ifc support draws two private equity funds to philippine deals background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous Ifc Support Draws Two Private Equity Funds To Philippine Deals Artwork Nature

Immerse yourself in the stunning details of this beautiful ifc support draws two private equity funds to philippine deals wallpaper, designed for a captivating visual experience.

Artistic Ifc Support Draws Two Private Equity Funds To Philippine Deals Design Illustration

A captivating ifc support draws two private equity funds to philippine deals scene that brings tranquility and beauty to any device.

Download these ifc support draws two private equity funds to philippine deals wallpapers for free and use them on your desktop or mobile devices.