Dow tumbles nearly 600 points, S&P 500 goes negative for 2026 in tech sector rout: Live updates

Dow tumbles nearly 600 points, S&P 500 goes negative for 2026 in tech sector rout: Live updates

The air on trading floors worldwide is heavy with palpable anxiety. What started as minor jitters quickly escalated into a severe market correction today, leaving no major index unscathed. The relentless selling pressure has cemented a definitive shift in market sentiment, moving decisively into 'risk-off' territory.

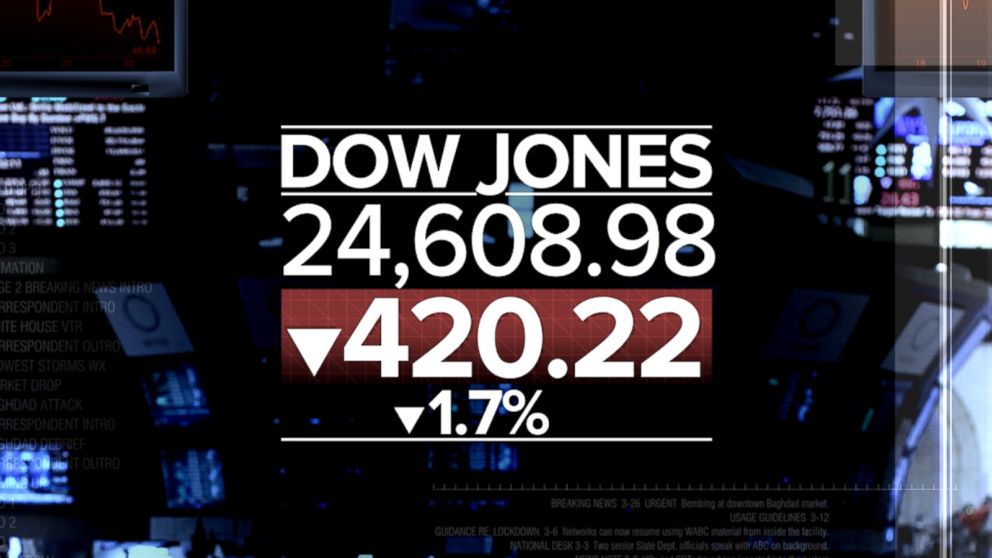

In a devastating display of investor fear, the Dow Jones Industrial Average suffered a dramatic collapse, plummeting nearly 600 points. While the sheer drop in the Dow is alarming, the most critical psychological blow came from the S&P 500. The benchmark index officially wiped out all its remaining gains, dipping into negative territory for the calendar year 2026.

This development signals profound pessimism regarding the economic outlook and the valuation levels of the largest American companies. The epicenter of the damage was, predictably, the technology sector, which continues to bear the brunt of rising interest rate fears and persistent inflation pressures.

This is not merely a correction; it is a reckoning. We track the numbers, analyze the core causes, and assess the immediate impact on global investment strategies.

The Bloody Tally: Analyzing the Indices Crash and Market Breadth

The market opened softly but the pace of selling accelerated dramatically by mid-morning, triggered by weaker-than-expected corporate guidance updates and renewed hawkish signals emanating from Federal Reserve officials. The market breadth was overwhelmingly negative, with declines outpacing advances by a significant margin across both the NYSE and Nasdaq.

The Dow's 587-point slide, representing a drop of approximately 1.7%, was driven largely by steep losses in components sensitive to economic slowdowns, such as industrial giants and consumer discretionary stocks. However, the true pain was concentrated in the Nasdaq Composite, which saw a proportional collapse of over 2.5%, marking one of its worst single-day performances in months.

The crossing of the 2026 threshold by the S&P 500 is the headline that analysts are focusing on. This means that an investor holding a diversified S&P 500 portfolio since January 1st, 2026, has seen zero growth, effectively negating months of volatile gains. This milestone confirms that the lofty valuations established during the initial quarterly rebound were unsustainable given the economic headwinds.

The sudden surge in the Volatility Index (VIX) reflected the panic. It shot up aggressively, breaching the 24 mark and indicating that investors are bracing for continued, extreme price swings in the immediate future.

Key Data Points at the Close:

- Dow Jones Industrial Average: Closed down 587 points (-1.7%).

- S&P 500 Index: Officially went negative for 2026 (-0.2% Year-to-Date).

- Nasdaq Composite: Tumbled more than 2.5%, suffering disproportionate tech losses.

- Worst Performing Sectors: Information Technology, Communication Services, and Consumer Discretionary.

- The Unwinding: Heavy liquidation observed in momentum stocks and highly-leveraged growth investments.

The speed of the decline suggests that forced selling, potentially driven by margin calls in highly speculative portfolios, amplified the fundamental selling caused by macroeconomic fears. Institutional investors are rapidly reducing risk exposure, leading to a scramble for liquidity.

The Tech Reckoning: Why the S&P 500 Went Negative for 2026

The tech sector rout is inextricably linked to the evolving narrative around inflation and central banking. Technology companies, especially those that promise exponential growth but deliver meager current profits, rely heavily on low borrowing costs to fund expansion and maintain high valuations. When the perceived cost of capital increases, their future cash flows are discounted much more severely, leading to massive price adjustments.

The shift became critical when core Consumer Price Index (CPI) data demonstrated continued strength, confirming the Federal Reserve's commitment to an aggressive rate hiking cycle. This realization crushed the momentum trade.

The "Magnificent Seven"—the group of megacap technology stocks that have previously insulated the broader market from larger losses—were key contributors to today's decline. Companies involved in software as a service (SaaS) and specific hardware manufacturing saw their stocks plummet after analysts revised their earnings forecasts downward, citing slower corporate IT spending and geopolitical risks.

Furthermore, persistent supply chain disruptions, particularly the ongoing global semiconductor shortage, continued to pressure earnings visibility for manufacturers. These factors combine to create a perfect storm for high-multiple stocks, fundamentally challenging the assumption of endless, cheap money supporting rapid growth.

Underlying Macro Pressures Driving the Sell-Off:

- Monetary Policy Uncertainty: Heightened anxiety over the speed and terminal rate of the central bank's tightening cycle.

- Higher Corporate Debt Service: Companies with significant debt loads face mounting pressure as refinancing costs surge.

- Geopolitical Headwinds: Ongoing international conflicts and trade tensions add layers of complexity and risk premiums to global tech supply chains.

- Erosion of Pricing Power: Inflationary input costs are rising faster than some companies can pass them on to consumers, squeezing margins.

The market is currently transitioning from a 'growth at any cost' mindset to prioritizing stability, quality earnings, and robust balance sheets. This necessary, albeit painful, adjustment is what caused the S&P 500 to surrender its 2026 gains entirely.

Investor Outlook: Navigating Extreme Volatility and Recession Fears

Today's extreme session serves as a stark warning: the period of relative calm volatility is over. Investor confidence has been severely damaged, and markets are now openly pricing in increased recession fears. The focus is shifting from achieving a "soft landing" to mitigating the damage of a potential full-blown economic contraction.

For investors attempting to navigate this turbulent environment, prudence and restraint are essential. Analysts caution against succumbing to panic selling, which historically locks in losses just before eventual market rebounds.

Instead, this period demands a rigorous focus on portfolio diversification. Money is currently rotating toward sectors considered defensive or non-cyclical. Utilities, healthcare providers, and consumer staples are demonstrating comparative resilience as investors seek safety in companies whose revenues are less sensitive to the economic cycle.

The immediate outlook remains cloudy. Experts predict that volatility will remain high until the next series of key economic indicators are released, including revised GDP estimates and the upcoming commentary following the Federal Open Market Committee (FOMC) meeting.

Immediate Steps for Concerned Investors:

- Review Risk Tolerance: Assess your current exposure to high-beta stocks and ensure your holdings align with a higher-risk environment.

- Increase Cash Position: Having available cash allows investors to strategically deploy capital when high-quality assets become temporarily undervalued due to market panic.

- Look for Quality Value: Focus on established companies with sustainable competitive advantages (moats) and proven ability to generate strong free cash flow, even during recessions.

- Understand the Long Game: Market corrections are an inherent feature of investing. Focus on long-term goals rather than short-term price movements.

- Monitor Bond Market Signals: Pay attention to the yield curve; continued flattening or inversion would intensify concerns about future economic contraction.

The severity of the Dow's nearly 600-point fall underscores the fragility of current market sentiment. While fundamental economic strength still exists in pockets, the speed of this correction suggests that confidence in future corporate earnings has reached a critical low point.

Today's action confirms that the market is prioritizing the immediate threat of monetary tightening over the long-term prospects of high-growth technology. The S&P 500's dip into negative 2026 territory is the clearest signal yet that the cost of fighting inflation will be paid through severe equity devaluation.

We will continue tracking live updates throughout the evening as Asian and European markets prepare to react to this massive U.S. sell-off.

Dow tumbles nearly 600 points, S&P 500 goes negative for 2026 in tech sector rout: Live updates

Dow tumbles nearly 600 points, S&P 500 goes negative for 2026 in tech sector rout: Live updates Wallpapers

Collection of dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates wallpapers for your desktop and mobile devices.

Artistic Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Artwork Art

This gorgeous dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Design Digital Art

This gorgeous dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Design Concept

Explore this high-quality dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates image, perfect for enhancing your desktop or mobile wallpaper.

Artistic Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Abstract for Mobile

A captivating dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates scene that brings tranquility and beauty to any device.

Vivid Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Picture Art

Discover an amazing dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Artwork for Mobile

Immerse yourself in the stunning details of this beautiful dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates wallpaper, designed for a captivating visual experience.

Beautiful Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Capture Illustration

Transform your screen with this vivid dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates artwork, a true masterpiece of digital design.

Detailed Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Landscape for Your Screen

Experience the crisp clarity of this stunning dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates image, available in high resolution for all your screens.

Crisp Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Landscape Art

Find inspiration with this unique dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates illustration, crafted to provide a fresh look for your background.

Serene Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Moment Concept

Transform your screen with this vivid dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates artwork, a true masterpiece of digital design.

Stunning Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Picture for Desktop

A captivating dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates scene that brings tranquility and beauty to any device.

Spectacular Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Landscape Nature

This gorgeous dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Picture Collection

Discover an amazing dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Lush Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Design Concept

Find inspiration with this unique dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates illustration, crafted to provide a fresh look for your background.

Exquisite Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Design in HD

A captivating dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates scene that brings tranquility and beauty to any device.

Serene Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Capture for Mobile

Experience the crisp clarity of this stunning dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates image, available in high resolution for all your screens.

Dynamic Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Landscape Collection

A captivating dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates scene that brings tranquility and beauty to any device.

Detailed Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Scene in 4K

Explore this high-quality dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Wallpaper Collection

Discover an amazing dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Design for Your Screen

Immerse yourself in the stunning details of this beautiful dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates wallpaper, designed for a captivating visual experience.

Download these dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates wallpapers for free and use them on your desktop or mobile devices.