AMP Shares Crater on CEO’s Last Result: A Corporate Legacy Defined by Loss

AMP Shares Crater on CEO’s Last Result: A Corporate Legacy Defined by Loss

I remember the tense silence on the trading floor just before the announcement dropped. For weeks, market watchers had speculated wildly about what the departing CEO’s final results would reveal for the embattled wealth management giant, AMP. The consensus was cautious optimism, mixed with a dose of realism regarding the firm's entrenched historical issues. No one, however, was truly prepared for the sheer devastation that unfolded the moment the numbers hit the wire.

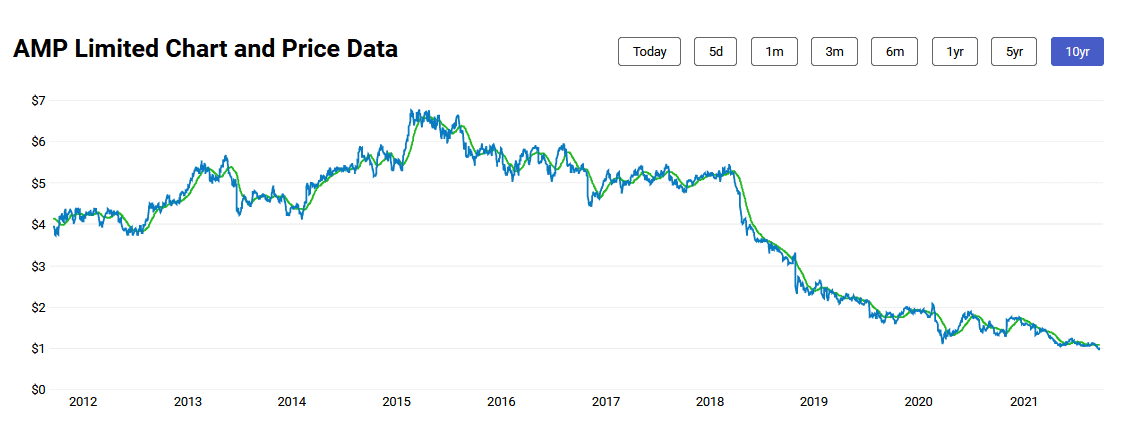

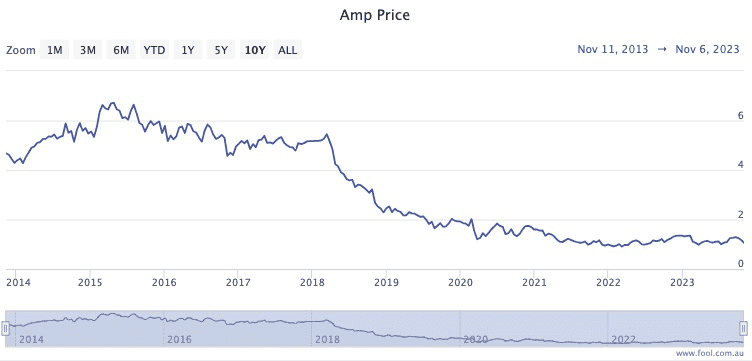

The release wasn't just poor; it was catastrophic. Within minutes, AMP shares cratered, wiping billions off the company’s valuation and triggering a temporary trading halt due to extreme volatility. This wasn't merely a poor quarter; it was the clearest signal yet that the attempts to stabilize the ship had failed under the watch of its outgoing leader, leaving the incoming management team with a monumental, perhaps impossible, cleanup job. The final chapter of the CEO’s tenure has now cemented a legacy of profound corporate disappointment and financial retreat.

For long-suffering retail investors and institutional shareholders alike, the result confirmed their worst fears: the fundamental problems plaguing the firm’s core businesses are far deeper than previously acknowledged, exacerbated by continuous restructuring failures and the lingering shadows of past scandals. The market’s reaction wasn't an overreaction; it was a brutal repricing of inherent risk.

The Immediate Fallout: Why the Market Panicked

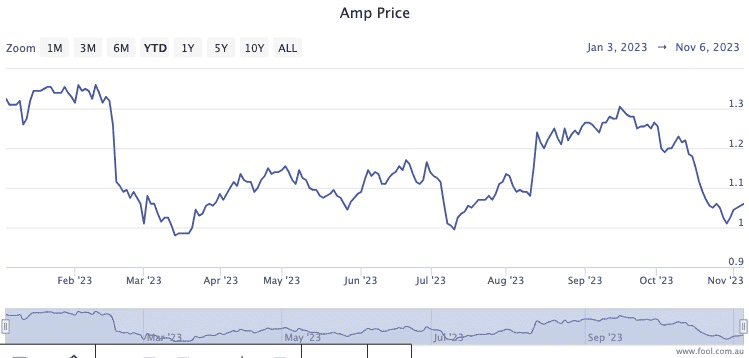

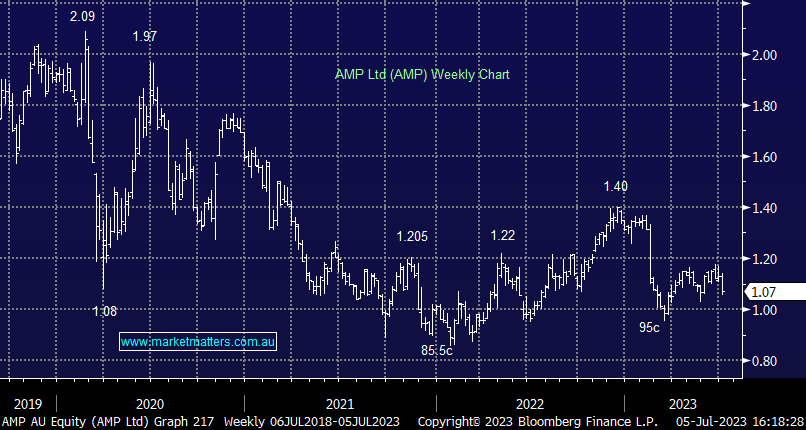

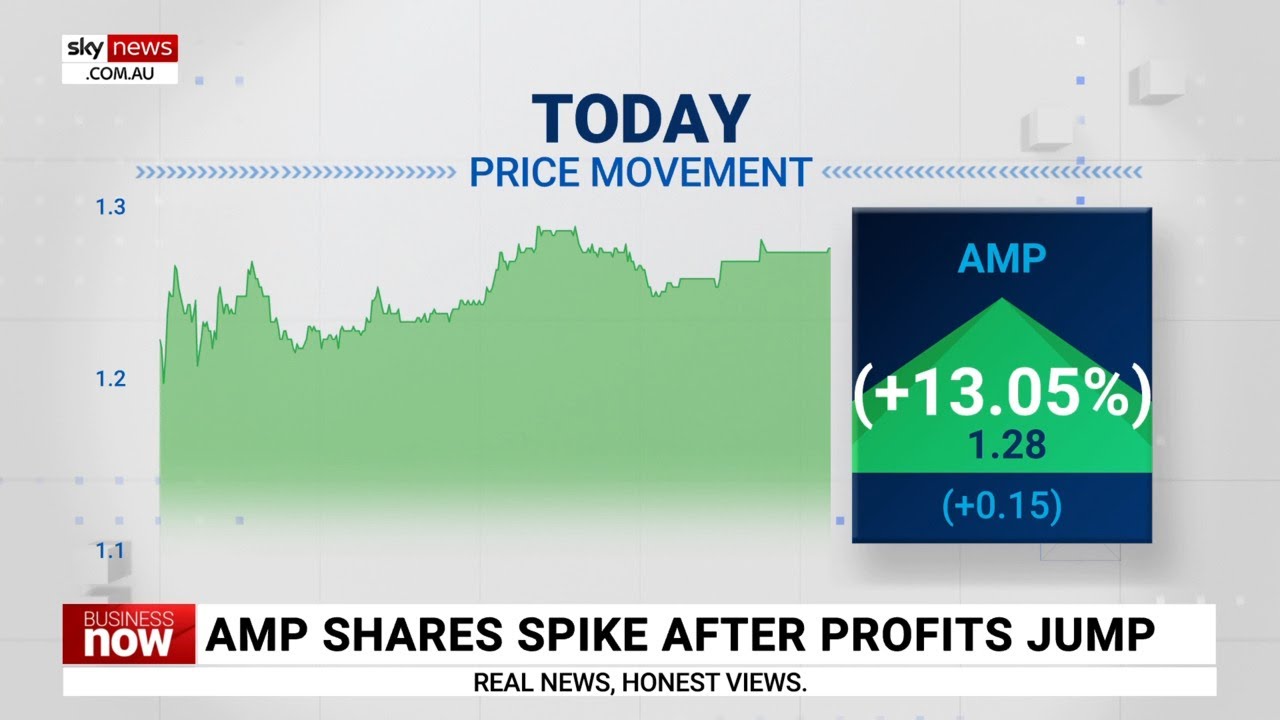

The speed and severity of the share price collapse were shocking. In the initial hours of trading, the stock plummeted more than 25%, hitting multi-decade lows. The selling pressure was relentless, demonstrating a complete breakdown of confidence among major institutional holders. Analysts rapidly downgraded their forecasts, citing a lack of clear path to recovery and fundamental flaws in the firm’s operating performance.

The panic stemmed from two critical disclosures buried deep within the voluminous financial report: staggering non-cash write-downs related to goodwill, and a significant deterioration in the underlying profit generated by the key wealth management division. Investors had priced in some difficulty, but the scale of the impairment charge suggested the value of assets acquired years ago was grossly overstated, meaning the true health of the company was far weaker.

Furthermore, the report offered no credible timeline for arresting the ongoing outflow of funds from its flagship superannuation and retirement products. Net cash outflows accelerated dramatically, signalling that clients were abandoning the firm in droves, driven by competitor aggression and, critically, the reputational damage from years of negative headlines and regulatory scrutiny.

This volatility underscores a crucial reality in the financial services sector: trust is the primary currency. Once severely damaged by the financial advice scandal, rebuilding that trust takes time, transparency, and, most importantly, results. This final report delivered none of the latter.

Key indicators triggering the sharp decline:

- Non-cash write-downs exceeding analyst expectations by 40%.

- Accelerated net cash outflows from the core wealth management business.

- A deep cut to the forward dividend guidance, shocking income investors.

- Increased projected costs associated with the mandated corporate restructure.

- Confirmation of ongoing and expensive regulatory scrutiny following remediation issues.

The severity of the market reaction was further amplified by the absence of a clear turnaround strategy presented alongside the devastating figures. The market interpreted this lack of detailed forward guidance as management admitting defeat on key operational fronts, essentially handing the heavy burden entirely to the next leadership team.

Dissecting the CEO’s Final Performance: Beneath the Write-Downs

The outgoing CEO's final results presentation attempted to focus on "foundational improvements" and "future simplification," but the actual figures painted a grim picture. The reported statutory loss was enormous, primarily driven by the massive write-downs related to historical acquisitions—a tacit admission that past strategies were fundamentally flawed and overvalued.

Beyond the accounting losses, the weakness in the operational performance was stark. The underlying profit, which strips out one-off charges and is often seen as a cleaner measure of business health, missed consensus estimates substantially. This miss was primarily due to escalating compliance costs and lower margins in the advice business, an area meant to be a pillar of AMP’s future growth.

The firm's ongoing battle with the fallout from the Royal Commission became vividly clear. Remediation costs and legal fees related to historical misconduct continued to drain capital, proving to be a persistent, crippling anchor on profitability. Investors realized that the process of fixing the business was not nearing completion; rather, it remains a vast, ongoing expenditure with no guaranteed endpoint.

Crucially, the erosion of the firm’s capital base necessitated a review of its dividend policy. The aggressive dividend cut announced within the report sent panic through the ranks of long-term shareholders who rely on the yield. Many of these investors, often retirees themselves, now faced not only capital losses but also a significant reduction in expected income, fueling further pressure on the stock price. This double blow severely damaged investor loyalty.

The report effectively documented a stalled corporate restructure. While plans for splitting the company or divesting certain assets have been discussed for months, the execution remained slow and the costs of attempting this transformation were spiraling. The market penalized the stock because the cost of fixing the mess appeared to outweigh the potential recovery value, signaling a dangerous value trap.

The Steep Climb Ahead: Restructure and Regulatory Scrutiny

With the outgoing CEO's chapter closed on a disastrous financial note, all eyes turn to the incoming leadership. The challenges facing the new management are immense, defined by an urgent need to stabilize client relationships, streamline the complex organizational structure, and satisfy increasingly aggressive regulators.

The immediate priority must be to halt the accelerating client outflows. This requires more than just marketing; it demands a radical simplification of product offerings and a renewed, transparent commitment to customer value—a commitment that many feel was lacking during the previous administration.

The firm remains under heavy regulatory scrutiny. The Australian Securities and Investments Commission (ASIC) and other regulatory bodies are watching every move, ensuring full compliance and proper remediation payments. Any misstep here could result in massive fines or further restrictions on their financial licenses, posing an existential threat to parts of the business.

The promise of a major corporate restructure remains a key driver for potential value creation, but execution risk is high. Divesting the struggling advice business or spinning off the lucrative funds management arm needs flawless execution to maximize shareholder value. This catastrophic final result will undoubtedly complicate these negotiations, as potential buyers now have leverage due to the confirmed weakness in underlying profit and operating performance.

The path to recovery will be measured not in quarters, but in years. Rebuilding investor confidence, particularly among discouraged retail investors, requires sustained profitability and definitive proof that the company has moved past its culture of misconduct and poor governance.

Ultimately, the cratering of AMP shares on the CEO’s last result is a stark reminder of the immense pressures faced by legacy financial institutions. It highlights how quickly market sentiment can turn hostile when operational failures combine with a history of misconduct. The next chapter for AMP is not about growth, but survival, requiring radical action and a profound shift in corporate strategy to avoid further declines in market valuation. The market has delivered its final, brutal verdict on the leadership transition.

AMP shares crater on CEO’s last result

AMP shares crater on CEO’s last result Wallpapers

Collection of amp shares crater on ceo’s last result wallpapers for your desktop and mobile devices.

Exquisite Amp Shares Crater On Ceo’s Last Result Wallpaper Collection

This gorgeous amp shares crater on ceo’s last result photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing Amp Shares Crater On Ceo’s Last Result Wallpaper in HD

Experience the crisp clarity of this stunning amp shares crater on ceo’s last result image, available in high resolution for all your screens.

Amazing Amp Shares Crater On Ceo’s Last Result Background Concept

Transform your screen with this vivid amp shares crater on ceo’s last result artwork, a true masterpiece of digital design.

Crisp Amp Shares Crater On Ceo’s Last Result Abstract Collection

This gorgeous amp shares crater on ceo’s last result photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Amp Shares Crater On Ceo’s Last Result Landscape Digital Art

Experience the crisp clarity of this stunning amp shares crater on ceo’s last result image, available in high resolution for all your screens.

Beautiful Amp Shares Crater On Ceo’s Last Result Background Concept

Explore this high-quality amp shares crater on ceo’s last result image, perfect for enhancing your desktop or mobile wallpaper.

Vivid Amp Shares Crater On Ceo’s Last Result Artwork in 4K

Transform your screen with this vivid amp shares crater on ceo’s last result artwork, a true masterpiece of digital design.

Detailed Amp Shares Crater On Ceo’s Last Result Artwork Collection

Experience the crisp clarity of this stunning amp shares crater on ceo’s last result image, available in high resolution for all your screens.

Amazing Amp Shares Crater On Ceo’s Last Result Wallpaper in HD

Discover an amazing amp shares crater on ceo’s last result background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic Amp Shares Crater On Ceo’s Last Result Design Collection

Find inspiration with this unique amp shares crater on ceo’s last result illustration, crafted to provide a fresh look for your background.

Spectacular Amp Shares Crater On Ceo’s Last Result Abstract Collection

Immerse yourself in the stunning details of this beautiful amp shares crater on ceo’s last result wallpaper, designed for a captivating visual experience.

Exquisite Amp Shares Crater On Ceo’s Last Result Artwork Art

This gorgeous amp shares crater on ceo’s last result photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Detailed Amp Shares Crater On Ceo’s Last Result Scene Collection

Transform your screen with this vivid amp shares crater on ceo’s last result artwork, a true masterpiece of digital design.

Detailed Amp Shares Crater On Ceo’s Last Result Abstract Art

Explore this high-quality amp shares crater on ceo’s last result image, perfect for enhancing your desktop or mobile wallpaper.

Gorgeous Amp Shares Crater On Ceo’s Last Result Design for Mobile

A captivating amp shares crater on ceo’s last result scene that brings tranquility and beauty to any device.

Breathtaking Amp Shares Crater On Ceo’s Last Result Design Digital Art

Explore this high-quality amp shares crater on ceo’s last result image, perfect for enhancing your desktop or mobile wallpaper.

Amazing Amp Shares Crater On Ceo’s Last Result Moment Photography

Discover an amazing amp shares crater on ceo’s last result background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed Amp Shares Crater On Ceo’s Last Result Artwork Concept

Transform your screen with this vivid amp shares crater on ceo’s last result artwork, a true masterpiece of digital design.

Detailed Amp Shares Crater On Ceo’s Last Result View Art

Explore this high-quality amp shares crater on ceo’s last result image, perfect for enhancing your desktop or mobile wallpaper.

Captivating Amp Shares Crater On Ceo’s Last Result Artwork Collection

A captivating amp shares crater on ceo’s last result scene that brings tranquility and beauty to any device.

Download these amp shares crater on ceo’s last result wallpapers for free and use them on your desktop or mobile devices.