Why BigBear.ai Stock Could Eventually Go to $0

Why BigBear.ai Stock Could Eventually Go to $0

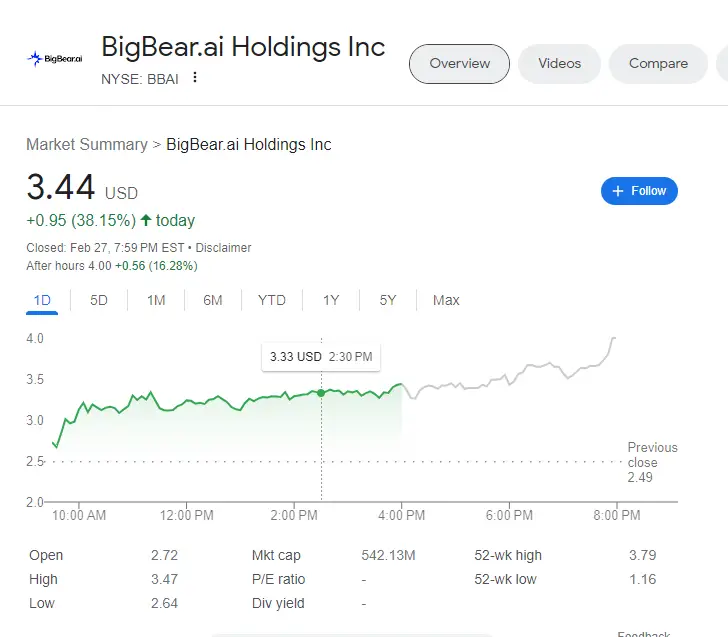

The story of BigBear.ai (BBAI) is a modern lesson in market hype versus financial reality. Launched into the public market via a SPAC merger during the peak of the AI euphoria, BBAI promised to be a critical player in predictive government intelligence and commercial AI solutions.

For a time, the narrative worked. Retail investors, drawn by the prospect of sophisticated AI systems serving the defense sector—a seemingly recession-proof business—bid the stock up aggressively. But the reality of running a high-cost, R&D-intensive business requires mountains of cash, especially when competing with trillion-dollar tech giants. Despite occasional contract wins and bullish forecasts, a deep dive into the BBAI balance sheet reveals systemic issues that paint a grim picture for long-term equity holders.

This isn't about short-term volatility; this is about fundamental solvency. When we strip away the exciting AI buzzwords—the "predictive capabilities" and "decision intelligence"—we are left with a publicly traded entity facing severe structural challenges that suggest its ultimate valuation could regress completely to zero.

The Cash Burn Catastrophe and the Elusive Path to Profitability

The most immediate and pressing concern for BigBear.ai shareholders is the company's inability to generate sustained positive operating cash flow. While the company has grown its top line through strategic acquisitions and securing key government contracts—particularly with the Department of Defense (DoD)—the expenditures required to service these contracts and advance AI technology far outweigh the incoming revenue.

Operating a sophisticated AI enterprise requires massive investment in talent (high-salaried data scientists and engineers) and compute power (accessing powerful, low-latency cloud infrastructure). These costs are fixed and escalating. Unlike mature SaaS companies that can boast high gross margins, BBAI's margins remain thin, trapped between demanding government clients who negotiate aggressively and the high cost of development.

The result is a consistent pattern of net losses. BigBear.ai has repeatedly needed to tap the capital markets simply to keep the lights on and fund necessary R&D. This cycle of financial depletion is unsustainable.

Consider the core metrics:

- Negative Operating Cash Flow: BBAI is consistently bleeding cash from its core business operations. While management may point to adjusted EBITDA improvements, investors must focus on GAAP profitability and actual cash flow. If a company cannot fund its operations organically, it is fundamentally dependent on outside investors.

- Debt Structure: While the company has worked to manage its debt, relying on loans or convertible notes adds servicing costs and further pressure to achieve profitability rapidly. High debt service costs in a rising interest rate environment exacerbate the cash burn rate.

- Lumpy Contract Revenue: Government revenue, while stable once secured, is often "lumpy." It can take time for contracts to ramp up, and revenue recognition can be staggered, creating periods of unexpected cash shortages that require immediate fundraising solutions.

When a company's enterprise value is largely speculative, dependent on future promises of contracts and profitability that are continually deferred, the market loses patience. The company is currently structured to consume capital faster than it can generate it—a direct recipe for eventual insolvency unless a massive, multi-billion dollar contract materializes immediately, which seems highly unlikely given the current defense procurement cycles.

The Hyper-Competitive Landscape and Commoditization of AI

BigBear.ai does not operate in a vacuum. It operates in perhaps the single most competitive technological landscape today: Artificial Intelligence and Machine Learning. While BBAI has carved out a niche specializing in government intelligence, that niche is rapidly being eroded by both technological advancements from hyperscale providers and the internal development efforts of their customers.

The advantage BBAI initially held was proprietary access and specialized algorithms built for defense applications. However, generalized AI tools—powered by giants like Microsoft (Azure), Amazon (AWS), and Google Cloud—are rapidly becoming sophisticated enough to handle much of the heavy lifting required for predictive analytics.

Why is this a danger?

- The Cost Advantage of Giants: Hyperscale cloud providers can offer compute and AI services at a dramatically lower cost than BBAI. They benefit from economies of scale that BBAI simply cannot match. If a government client can utilize Azure Government or AWS GovCloud and customize open-source AI models, the need for a specialized, premium contractor diminishes.

- Internal Development Risk: The DoD and other intelligence agencies are pouring billions into building their *own* in-house AI capabilities (e.g., Project Maven initiatives). As these agencies develop greater internal sophistication, BBAI risks being relegated to providing maintenance or highly niche, non-essential services, rather than being the primary intellectual partner.

- The SPAC Hangover: Many government contractors that went public via SPACs, including BBAI, are still dealing with the perception of overvaluation inherent in the SPAC boom. The competition, in contrast, includes established, profitable defense contractors who are now aggressively incorporating AI into their existing, entrenched contracts.

To survive, BBAI needs truly defensible intellectual property—algorithms that are significantly superior and proprietary enough to justify their high operating expense. If their product can be reasonably replicated by a well-funded internal government team or a slightly customized offering from a cloud giant, their competitive moat quickly evaporates, jeopardizing future sustainable revenue streams.

The Dilution Treadmill: Death by a Thousand Shares

The most devastating consequence of perpetual negative cash flow and intense competition falls directly on the retail shareholder: relentless dilution. When a company cannot generate enough money to survive, it turns to the market to issue new stock, effectively selling pieces of the company to stay afloat.

This is not a one-time event for BigBear.ai; it is a structural necessity given their current cost structure. Every time BBAI performs a secondary offering or converts warrants/notes into equity, the total share count increases. This means that even if the company's market capitalization remains flat, the value of each individual share decreases because the underlying ownership percentage is being spread across a larger pool of shares.

For investors who bought BigBear.ai stock early in its public life, the impact has been severe. The promise of potential growth is constantly offset by the reality of financing needs.

I recall speaking to a technology analyst last year who summed up the danger perfectly: "In highly speculative tech, you don't necessarily fear bankruptcy as much as you fear the dilution spiral. A stock doesn't need to go bankrupt to go to $0; it just needs to issue shares until your percentage ownership is worth pennies."

The current market capitalization, while volatile, must always be weighed against the potential for future capital raises. If the stock price dips significantly—and the company has to raise money when the stock is low—the dilution is exponential, requiring them to issue even more shares to raise the necessary funds.

Furthermore, if the stock price falls below critical thresholds (often required for listing maintenance), the risk of a reverse stock split looms large. While a reverse split consolidates shares and temporarily boosts the per-share price, it is often seen by institutional investors as a sign of desperation, signaling management's failure to maintain shareholder value, leading to further selling pressure.

If BBAI continues to require significant cash infusions without a clear, definitive timeline to self-sustainability, the dilution spiral will eventually crush shareholder value entirely, making the stock virtually worthless.

Conclusion: Solvency Over Speculation

BigBear.ai certainly possesses compelling technology and important government contracts. However, technology potential alone does not guarantee a successful public company. The market ultimately prices in solvency, profitability, and competitive sustainability.

The evidence suggests that BBAI is fighting a losing battle against overwhelming costs, aggressive competition from entrenched giants, and a perpetual reliance on the capital markets. Until the company can demonstrate a fundamental shift toward generating consistent, positive operating cash flow—not just adjusted EBITDA—and prove that its proprietary AI offers a clear, scalable advantage that competitors cannot erode, the structural risks remain too high.

For investors, the risk-reward profile is deeply unfavorable. The path of perpetual dilution and cash burn, coupled with an increasingly commoditized market, creates a significant and plausible scenario where BigBear.ai stock ultimately fades into obscurity, settling at a value approaching $0.

Why BigBear.ai Stock Could Eventually Go to $0

Why BigBear.ai Stock Could Eventually Go to $0 Wallpapers

Collection of why bigbear.ai stock could eventually go to $0 wallpapers for your desktop and mobile devices.

Vivid Why Bigbear.ai Stock Could Eventually Go To $0 Artwork Illustration

Transform your screen with this vivid why bigbear.ai stock could eventually go to $0 artwork, a true masterpiece of digital design.

Lush Why Bigbear.ai Stock Could Eventually Go To $0 Abstract Digital Art

Immerse yourself in the stunning details of this beautiful why bigbear.ai stock could eventually go to $0 wallpaper, designed for a captivating visual experience.

:max_bytes(150000):strip_icc()/GettyImages-2202994400-1451b8c87f284f08bb263f7a178a9c54.jpg)

Breathtaking Why Bigbear.ai Stock Could Eventually Go To $0 Photo Nature

Explore this high-quality why bigbear.ai stock could eventually go to $0 image, perfect for enhancing your desktop or mobile wallpaper.

Lush Why Bigbear.ai Stock Could Eventually Go To $0 Photo Illustration

A captivating why bigbear.ai stock could eventually go to $0 scene that brings tranquility and beauty to any device.

Dynamic Why Bigbear.ai Stock Could Eventually Go To $0 Image Digital Art

This gorgeous why bigbear.ai stock could eventually go to $0 photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp Why Bigbear.ai Stock Could Eventually Go To $0 Scene Art

Immerse yourself in the stunning details of this beautiful why bigbear.ai stock could eventually go to $0 wallpaper, designed for a captivating visual experience.

High-Quality Why Bigbear.ai Stock Could Eventually Go To $0 Abstract Art

Experience the crisp clarity of this stunning why bigbear.ai stock could eventually go to $0 image, available in high resolution for all your screens.

Mesmerizing Why Bigbear.ai Stock Could Eventually Go To $0 Picture Photography

Experience the crisp clarity of this stunning why bigbear.ai stock could eventually go to $0 image, available in high resolution for all your screens.

Spectacular Why Bigbear.ai Stock Could Eventually Go To $0 Scene for Your Screen

Immerse yourself in the stunning details of this beautiful why bigbear.ai stock could eventually go to $0 wallpaper, designed for a captivating visual experience.

Serene Why Bigbear.ai Stock Could Eventually Go To $0 Design Concept

Explore this high-quality why bigbear.ai stock could eventually go to $0 image, perfect for enhancing your desktop or mobile wallpaper.

Artistic Why Bigbear.ai Stock Could Eventually Go To $0 Background Illustration

Immerse yourself in the stunning details of this beautiful why bigbear.ai stock could eventually go to $0 wallpaper, designed for a captivating visual experience.

Artistic Why Bigbear.ai Stock Could Eventually Go To $0 Picture for Your Screen

Find inspiration with this unique why bigbear.ai stock could eventually go to $0 illustration, crafted to provide a fresh look for your background.

Amazing Why Bigbear.ai Stock Could Eventually Go To $0 Scene Digital Art

Transform your screen with this vivid why bigbear.ai stock could eventually go to $0 artwork, a true masterpiece of digital design.

Vibrant Why Bigbear.ai Stock Could Eventually Go To $0 Landscape Illustration

Explore this high-quality why bigbear.ai stock could eventually go to $0 image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Why Bigbear.ai Stock Could Eventually Go To $0 Photo Nature

Experience the crisp clarity of this stunning why bigbear.ai stock could eventually go to $0 image, available in high resolution for all your screens.

Dynamic Why Bigbear.ai Stock Could Eventually Go To $0 Photo Art

A captivating why bigbear.ai stock could eventually go to $0 scene that brings tranquility and beauty to any device.

Gorgeous Why Bigbear.ai Stock Could Eventually Go To $0 Scene Digital Art

Find inspiration with this unique why bigbear.ai stock could eventually go to $0 illustration, crafted to provide a fresh look for your background.

Spectacular Why Bigbear.ai Stock Could Eventually Go To $0 View for Your Screen

A captivating why bigbear.ai stock could eventually go to $0 scene that brings tranquility and beauty to any device.

Vibrant Why Bigbear.ai Stock Could Eventually Go To $0 Landscape Illustration

Transform your screen with this vivid why bigbear.ai stock could eventually go to $0 artwork, a true masterpiece of digital design.

Beautiful Why Bigbear.ai Stock Could Eventually Go To $0 Artwork Concept

Transform your screen with this vivid why bigbear.ai stock could eventually go to $0 artwork, a true masterpiece of digital design.

Download these why bigbear.ai stock could eventually go to $0 wallpapers for free and use them on your desktop or mobile devices.