Top 25 mortgage lenders accept BTC as proof of assets for the first time—Gen Z finds a way out of its "too much cryptocurrency, too little housing" dilemma.

Top 25 Mortgage Lenders Accept BTC as Proof of Assets for the First Time—Gen Z Finds a Way Out of Its "Too Much Cryptocurrency, Too Little Housing" Dilemma.

For years, a silent but significant economic divide has plagued younger generations: Gen Z amassed considerable wealth in digital assets, primarily Bitcoin (BTC), but remained locked out of traditional housing markets. They had the capital, verified through decentralized finance (DeFi) platforms, yet conventional banking requirements demanded stacks of paper documentation, months of traditional bank statements, and a general skepticism toward crypto holdings.

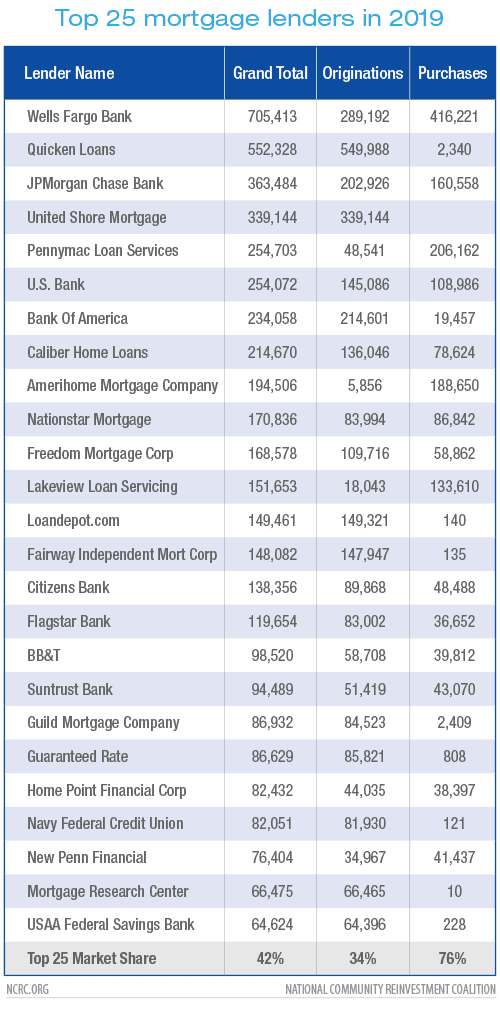

That all changed this week. A landmark coalition of the country's Top 25 mortgage lenders—including major names previously resistant to crypto integration—announced a coordinated policy shift. For the first time ever, verifiable Bitcoin holdings will be accepted as legitimate proof of assets when calculating down payment eligibility and reserves.

This news is not just a policy update; it's a financial revolution. It immediately validates hundreds of billions of dollars in collective Gen Z wealth and offers a clear pathway out of the debilitating "too much cryptocurrency, too little housing" dilemma that has defined the post-pandemic housing struggle for young professionals.

Think of Elias, a 24-year-old software developer from Austin. Elias had managed to accumulate nearly $150,000 in BTC since 2020. Every mortgage application he submitted was rejected because, despite the substantial value of his portfolio, it was deemed "unverifiable" or "too volatile" by underwriters. Now, Elias is pre-approved. This shift isn't theoretical; it is already changing lives.

The Institutional Adoption Breakthrough: How Lenders Are Verifying BTC Assets

The core roadblock to mainstream Bitcoin asset verification has always been trust and compliance. Traditional lenders feared market volatility, complex Know Your Customer (KYC) requirements, and Anti-Money Laundering (AML) risks associated with decentralized currencies. The breakthrough was achieved through the integration of sophisticated third-party validation platforms.

The consortium of 25 lenders has adopted a uniform set of compliance standards, heavily supported by new fintech infrastructure providers specializing in blockchain data aggregation. These tools provide a clear, real-time snapshot of an applicant's holdings without requiring the transfer of the underlying assets. This maintains client privacy while satisfying regulatory scrutiny.

Under the new protocol, lenders are focusing on several key areas to ensure the viability and stability of the crypto assets being used as proof:

- Custodial Verification: Assets must be held in regulated, qualified custodians (e.g., licensed institutional crypto platforms) for a minimum established period, usually 60 to 90 days, similar to seasoning requirements for traditional funds.

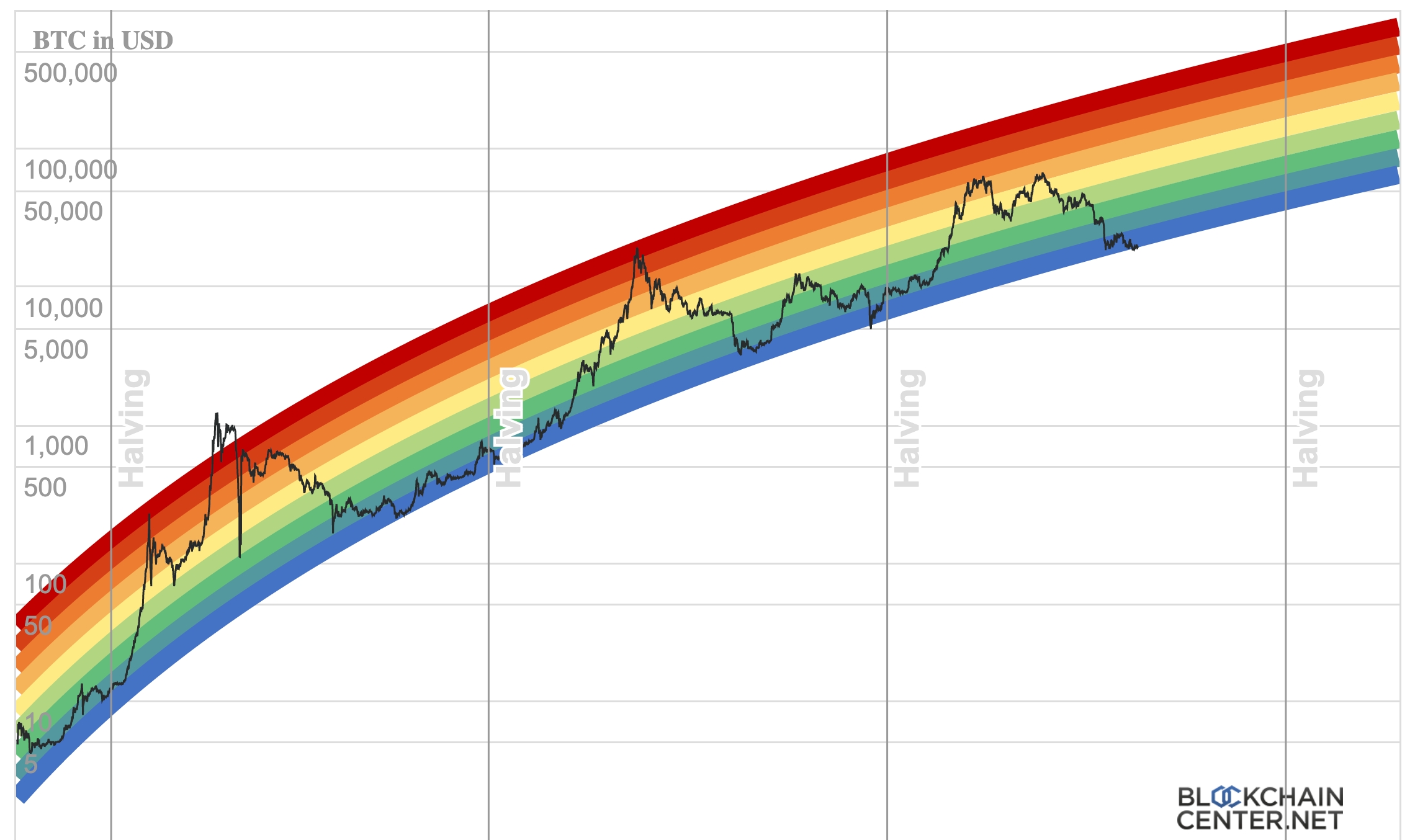

- Liquidity Haircut: Recognizing BTC's inherent volatility, lenders are applying a "liquidity haircut." This means the full market value of the BTC is not counted. Typically, only 70% to 80% of the current market value is used for asset calculation purposes, creating a necessary buffer against sudden price drops.

- Source of Funds (SOF): Rigorous review of the funds' original source is mandatory to prevent money laundering. This includes tracing exchange history and initial purchase records, a process facilitated by advanced blockchain analysis tools.

This formalized approach marks a major step toward institutional adoption. It moves Bitcoin from a speculative asset class to a recognized and standardized form of collateralizable wealth, fundamentally altering the landscape of conventional financing.

Gen Z's Housing Revolution: Bridging the Wealth and Affordability Gap

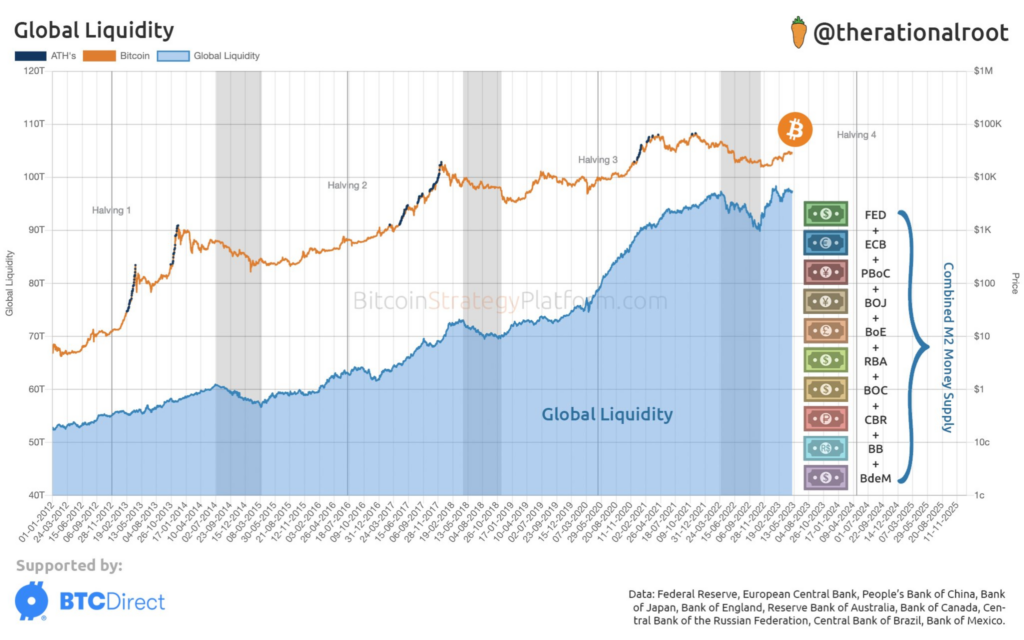

The timing of this policy change is critical. Gen Z, often characterized by skepticism towards centralized banking, were early adopters of cryptocurrency. Many leveraged early investments to create significant wealth that existed entirely outside the traditional financial ecosystem. This created an ironic wealth paradox: financially rich but housing poor.

This acceptance by top lenders finally allows these first-time homebuyers to utilize their actual savings. They no longer need to liquidate their BTC into fiat currency months in advance, incurring significant capital gains taxes and losing potential future appreciation, just to satisfy arbitrary documentation rules.

The implications for the housing affordability crisis, particularly in high-cost-of-living areas, are profound. By tapping into this previously inaccessible pool of digital wealth, demand is expected to see a controlled but noticeable spike, potentially leading to increased transaction volume in the middle and luxury markets where Gen Z wealth is most concentrated.

Furthermore, this policy validates the choice of asset diversification championed by younger investors. It acknowledges that modern wealth creation utilizes varied instruments, not just traditional stocks and bonds.

Pioneering lenders involved in this initiative report that their goal is not just to capture a new demographic, but to modernize archaic lending practices. They see the writing on the wall: the future of finance is digital, and underwriters must adapt to digital asset portfolios.

The Path Ahead: Volatility Management and Future Standardized Practices

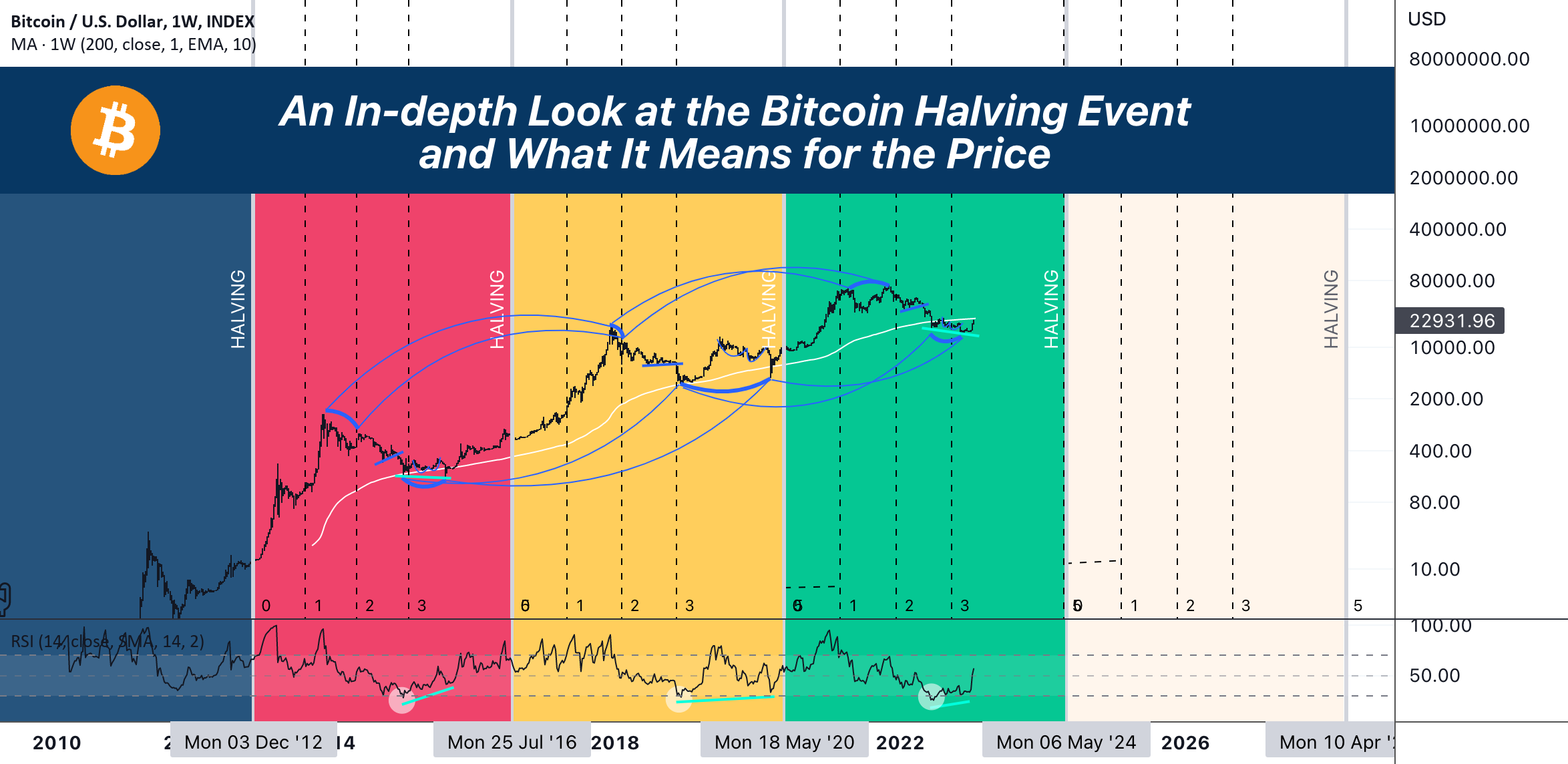

While the excitement surrounding this announcement is warranted, industry analysts and regulatory bodies are quick to stress the need for continued caution, primarily regarding market volatility. Bitcoin's price swings remain the primary risk factor for lenders.

The current framework successfully addresses this risk through the liquidity haircut and strict seasoning requirements. However, lenders will need dynamic monitoring tools to ensure that asset coverage ratios remain sufficient during the underwriting process, which can often take 30 to 60 days.

Future iterations of this policy will likely involve the inclusion of other major cryptocurrencies. While Bitcoin and Ethereum (ETH) are the immediate focus due to their market capitalization and liquidity, the broader adoption of a digital asset portfolio verification standard is inevitable.

The industry anticipates several developments in the next 12 to 18 months:

- Acceptance of ETH and Stablecoins: Expansion beyond BTC to include highly liquid assets like Ethereum and potentially regulated, fiat-backed stablecoins for reserve calculations.

- Automated Re-Verification: Development of tools that automatically check the value of the BTC collateral daily during the closing process, ensuring the borrower's reserves have not dropped below the required threshold.

- Government-Backed Guidance: As private industry leads, regulatory bodies like the Federal Housing Finance Agency (FHFA) will be pressured to release formal guidance, solidifying these practices across all federally-backed mortgages.

This move by the Top 25 mortgage lenders is more than just a regulatory concession; it is a foundational step toward financial inclusivity. It recognizes a new generation's economic power and transforms the definition of "credible wealth."

For millions of Gen Z investors who felt locked out of the American Dream due to outdated financial rules, the ability to leverage their digital success into tangible homeownership is the defining financial story of the year. The traditional housing market has officially entered the crypto age.

Top 25 mortgage lenders accept BTC as proof of assets for the first time—Gen Z finds a way out of its "too much cryptocurrency, too little housing" dilemma.

Top 25 mortgage lenders accept BTC as proof of assets for the first time—Gen Z finds a way out of its "too much cryptocurrency, too little housing" dilemma. Wallpapers

Collection of top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. wallpapers for your desktop and mobile devices.

Captivating Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Capture for Your Screen

This gorgeous top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Design in HD

Experience the crisp clarity of this stunning top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. image, available in high resolution for all your screens.

Spectacular Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Moment Nature

This gorgeous top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Photo Collection

Explore this high-quality top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. image, perfect for enhancing your desktop or mobile wallpaper.

Captivating Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Picture Concept

Find inspiration with this unique top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. illustration, crafted to provide a fresh look for your background.

Amazing Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Wallpaper in HD

Explore this high-quality top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. image, perfect for enhancing your desktop or mobile wallpaper.

Vivid Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Wallpaper Digital Art

Discover an amazing top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Image in 4K

Find inspiration with this unique top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. illustration, crafted to provide a fresh look for your background.

Crisp Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Picture Photography

Immerse yourself in the stunning details of this beautiful top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. wallpaper, designed for a captivating visual experience.

Artistic Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Landscape Collection

Immerse yourself in the stunning details of this beautiful top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. wallpaper, designed for a captivating visual experience.

Beautiful Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Abstract for Mobile

Explore this high-quality top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. image, perfect for enhancing your desktop or mobile wallpaper.

Artistic Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Photo Illustration

A captivating top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. scene that brings tranquility and beauty to any device.

Mesmerizing Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. View in 4K

Transform your screen with this vivid top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. artwork, a true masterpiece of digital design.

Amazing Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Abstract Photography

Experience the crisp clarity of this stunning top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. image, available in high resolution for all your screens.

Lush Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Capture Digital Art

A captivating top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. scene that brings tranquility and beauty to any device.

Serene Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Design Collection

Transform your screen with this vivid top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. artwork, a true masterpiece of digital design.

Artistic Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Image for Mobile

A captivating top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. scene that brings tranquility and beauty to any device.

Beautiful Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Artwork for Mobile

Transform your screen with this vivid top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. artwork, a true masterpiece of digital design.

Gorgeous Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Wallpaper Collection

Find inspiration with this unique top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. illustration, crafted to provide a fresh look for your background.

Spectacular Top 25 Mortgage Lenders Accept Btc As Proof Of Assets For The First Time—gen Z Finds A Way Out Of Its "too Much Cryptocurrency, Too Little Housing" Dilemma. Image for Your Screen

Immerse yourself in the stunning details of this beautiful top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. wallpaper, designed for a captivating visual experience.

Download these top 25 mortgage lenders accept btc as proof of assets for the first time—gen z finds a way out of its "too much cryptocurrency, too little housing" dilemma. wallpapers for free and use them on your desktop or mobile devices.