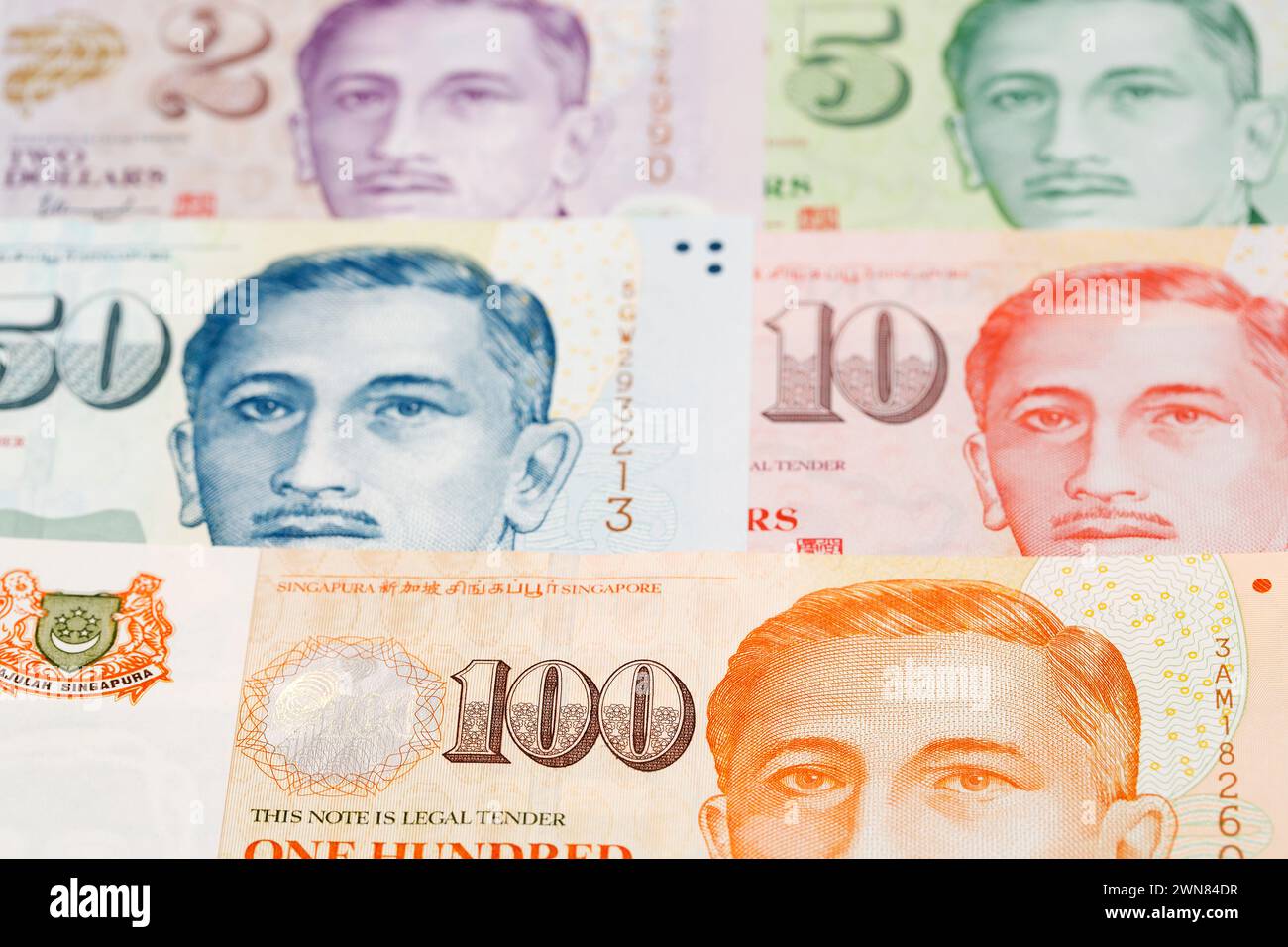

Singapore dollar hits highest in over 11 years versus greenback

Singapore Dollar Hits Highest in Over 11 Years Versus Greenback: What This Means for Your Wallet

For many global investors and Singaporean citizens alike, tracking the currency exchange rate between the Singapore Dollar (SGD) and the US Dollar (USD) is a daily activity. The recent performance of the SGD has delivered a staggering milestone: the currency has just reached its strongest level against the greenback in more than 11 years, surpassing critical resistance thresholds and signaling robust confidence in the Lion City's economic management.

I recall a conversation with a small business owner who relies heavily on importing specialty equipment from the United States. For months, currency volatility had made forecasting costs a nightmare. Now, with the SGD appreciating so dramatically, the certainty and increased purchasing power provide a significant operational buffer. This move is not merely technical market noise; it represents a fundamental divergence in monetary policy and economic health between Singapore and the United States.

The surge above the 1.34 mark against the US dollar has captivated financial markets worldwide. This exceptional strength is largely attributable to the highly proactive stance of the Monetary Authority of Singapore (MAS), which has utilized its unique monetary tools effectively to combat the pervasive threat of imported inflation. This powerful trend elevates Singapore's position as a premier financial safe haven in a turbulent global economy.

While the US Federal Reserve (the Fed) wrestled with a narrative of 'transitory' inflation, the MAS acted decisively, ensuring that the currency remained a strong defense mechanism for domestic purchasing power. This forward-looking policy framework is the core reason why the SGD is now achieving levels unseen since the late 2010s.

Monetary Policy Divergence: How MAS Outpaced the US Federal Reserve

The foundation of the Singapore dollar's dominance lies in the distinct and highly effective monetary policy framework deployed by the MAS. Unlike most central banks that manage interest rates directly, the MAS targets the exchange rate as its primary policy tool, managing the Nominal Effective Exchange Rate (NEER) policy band.

In response to soaring global commodity prices and supply chain disruptions post-2020, the MAS initiated a powerful series of monetary tightening moves. By continually re-centring and steepening the slope of the NEER policy band, the central bank intentionally guided the Singapore dollar into an appreciating path. This was a direct, targeted response aimed at shielding the import-reliant economy from high costs.

- Exchange Rate as Anti-Inflation Tool: Allowing the SGD to strengthen reduces the cost of imports priced in foreign currencies, immediately softening the impact of global price shocks on local consumers and businesses.

- Sequential Tightening: The MAS has revised its NEER policy several times since late 2021, showcasing a sustained commitment to price stability that has often appeared more aggressive and timely than the rate-hike cycles adopted by the Fed.

- Credibility Premium: The clear, predictable execution of policy has built immense credibility in the markets, attracting substantial capital flows from investors seeking a stable currency with guaranteed appreciation potential.

This commitment has allowed Singapore to manage its core inflation more successfully than many of its OECD counterparts. While the US grappled with inflation rates near multi-decade highs, the proactive monetary tightening in Singapore helped temper the worst effects, establishing the SGD as a currency of choice for stability.

The strong macroeconomic fundamentals further reinforce this position. Singapore continues to benefit from high capital inflows, a resilient services sector, and a reputation for unparalleled financial prudence. These underlying strengths provide the necessary confidence for sustained currency appreciation, distinguishing the SGD from other regional currencies which remain vulnerable to US dollar volatility.

The comparison with the US Federal Reserve's handling of its inflation mandate is stark. While the Fed eventually pivoted to aggressive interest rate hikes, the MAS was ahead of the curve, utilizing the exchange rate mechanism to maximum effect. This policy divergence is the single biggest catalyst for the SGD hitting this historic high versus the greenback.

The Real-World Impact: Trade, Travel, and Investment Opportunities

The powerful strengthening of the Singapore dollar immediately translates into tangible effects across trade balances, the cost of living, and investment strategies. The consequences divide the economy into distinct groups of winners and losers, fundamentally altering financial planning for individuals and corporations alike.

Enhanced Purchasing Power for Consumers

The most direct benefit is the immediate boost in purchasing power. For the average Singaporean, essential goods and luxury items imported from the US become cheaper. This effect is profoundly visible in global travel and education expenditures.

- Travel Savings: Singaporeans planning holidays to North America or countries whose currencies track the USD will find their budget stretches significantly further, resulting in lower total expenditure on accommodation, food, and shopping.

- Education Costs: Parents paying tuition fees and living expenses for children studying at American universities see substantial relief, as fewer SGDs are required for the dollar conversion.

- Import Advantage: Businesses importing raw materials, high-tech components, and consumer electronics priced in USD enjoy lower input costs, which can help manage domestic consumer price indices.

This strengthening acts as a form of immediate financial relief, especially in a world struggling with elevated living costs. It's a powerful testament to the central bank's success in protecting the financial well-being of its population through currency management.

Challenges for Export Competitiveness

While consumers benefit, exporters face significant headwinds. Singapore operates a highly sophisticated, trade-dependent economy, and a strong currency can make its goods and services less competitive internationally.

Exporters of high-value manufactured goods, such as specialized electronics and precision tools, must raise their prices in foreign currency terms when converting from the appreciating SGD. This can dampen demand and potentially impact the trade balance, requiring companies to focus even more intensely on productivity gains and niche high-value markets to offset the currency effect.

Similarly, the inbound tourism sector may face pressure, as travel and accommodation within Singapore become more expensive for visitors holding weaker currencies, including the USD.

Looking Ahead: Sustainability and the Fight for Interest Rate Parity

The critical question for investors and policymakers now is whether this historic high is sustainable. The longevity of the SGD's strength against the greenback is intrinsically linked to two primary factors: the future path of US interest rates and the resilience of Singapore's own economic growth amidst potential global headwinds.

Most institutional forecasts suggest that the peak of the US Federal Reserve's tightening cycle is approaching, or perhaps has already passed. As expectations consolidate around a potential pause or even eventual rate cuts in the US, the relative attractiveness of the USD diminishes. If the US faces a significant economic slowdown or recession—a growing risk—the USD would likely weaken further, reinforcing the SGD's trajectory.

The MAS is expected to maintain its moderately hawkish stance for the foreseeable future, prioritizing the defense against inflation until it is firmly within their target range. This commitment ensures that the SGD remains a premium, high-quality asset compared to currencies facing greater domestic inflationary pressures or economic uncertainty.

Key Forecast Drivers:

- US Economic Softening: Signs of significant cooling in the US labor market or sharp drops in CPI (Consumer Price Index) could lead the market to price in early Fed easing, providing immediate upward pressure on the SGD/USD rate.

- Regional Growth: A strong recovery in key Asian trading partners, particularly China, would boost Singapore's export and services sectors, giving the MAS confidence to maintain its current tight policy settings.

- Capital Flows: Continued geopolitical instability elsewhere drives funds into Singapore, recognized globally as a bastion of neutrality and financial stability, creating persistent demand for the SGD.

- MAS Communication: The language used in the next scheduled MAS policy statement will be crucial. Any hint of further tightening or maintaining the current slope will solidify the currency's strength.

While the currency markets are prone to short-term volatility based on daily data releases, the structural drivers—MAS policy superiority and robust domestic economic foundations—suggest that the SGD has established a higher trading range. Analysts are now eyeing the next psychological barriers, anticipating that the momentum behind this eleven-year high versus the greenback will continue, provided global economic instability does not dramatically undermine trade volumes.

The realization of Interest Rate Parity, adjusted for inflation, currently favors the Singapore dollar. Its strong real interest rate, coupled with the confidence in its central bank's management, ensures that global capital views the SGD as a superior repository of value compared to the fluctuating fortunes of the US dollar.

In summary, the achievement of the Singapore dollar hitting its highest level in over 11 years versus the greenback is a powerful and well-earned milestone. It is a direct result of decisive, independent monetary policy and the underlying strength of Singapore's sophisticated economy.

For individuals, this trend translates to higher purchasing power and enhanced financial stability. For global investors, it reaffirms the Lion City's status as a leading safe haven in Asia. As global economic divergence continues, the SGD remains one of the world's best-managed and most resilient currencies, cementing its pivotal role in the global financial landscape for the foreseeable future.

We advise readers to stay tuned for upcoming macroeconomic data releases from both the US and Singapore, which will provide the final clues regarding the sustainability and potential extension of this historic trend.

Singapore dollar hits highest in over 11 years versus greenback

Singapore dollar hits highest in over 11 years versus greenback Wallpapers

Collection of singapore dollar hits highest in over 11 years versus greenback wallpapers for your desktop and mobile devices.

Detailed Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Scene Concept

Explore this high-quality singapore dollar hits highest in over 11 years versus greenback image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Moment in 4K

A captivating singapore dollar hits highest in over 11 years versus greenback scene that brings tranquility and beauty to any device.

Stunning Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Background Collection

A captivating singapore dollar hits highest in over 11 years versus greenback scene that brings tranquility and beauty to any device.

Stunning Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Wallpaper Concept

Immerse yourself in the stunning details of this beautiful singapore dollar hits highest in over 11 years versus greenback wallpaper, designed for a captivating visual experience.

Dynamic Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Picture for Desktop

Immerse yourself in the stunning details of this beautiful singapore dollar hits highest in over 11 years versus greenback wallpaper, designed for a captivating visual experience.

Spectacular Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Capture Photography

Find inspiration with this unique singapore dollar hits highest in over 11 years versus greenback illustration, crafted to provide a fresh look for your background.

Mesmerizing Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Design Collection

Discover an amazing singapore dollar hits highest in over 11 years versus greenback background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Breathtaking Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Abstract Photography

Explore this high-quality singapore dollar hits highest in over 11 years versus greenback image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Moment for Your Screen

Transform your screen with this vivid singapore dollar hits highest in over 11 years versus greenback artwork, a true masterpiece of digital design.

Exquisite Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Image in 4K

Immerse yourself in the stunning details of this beautiful singapore dollar hits highest in over 11 years versus greenback wallpaper, designed for a captivating visual experience.

Serene Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Image Digital Art

Transform your screen with this vivid singapore dollar hits highest in over 11 years versus greenback artwork, a true masterpiece of digital design.

Exquisite Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Scene for Your Screen

Find inspiration with this unique singapore dollar hits highest in over 11 years versus greenback illustration, crafted to provide a fresh look for your background.

Vivid Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Scene Illustration

Explore this high-quality singapore dollar hits highest in over 11 years versus greenback image, perfect for enhancing your desktop or mobile wallpaper.

Lush Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Background Illustration

A captivating singapore dollar hits highest in over 11 years versus greenback scene that brings tranquility and beauty to any device.

Vibrant Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Scene for Your Screen

Transform your screen with this vivid singapore dollar hits highest in over 11 years versus greenback artwork, a true masterpiece of digital design.

Breathtaking Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Picture in 4K

Discover an amazing singapore dollar hits highest in over 11 years versus greenback background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Landscape for Desktop

This gorgeous singapore dollar hits highest in over 11 years versus greenback photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Breathtaking Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Picture in 4K

Transform your screen with this vivid singapore dollar hits highest in over 11 years versus greenback artwork, a true masterpiece of digital design.

Breathtaking Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Photo Art

Experience the crisp clarity of this stunning singapore dollar hits highest in over 11 years versus greenback image, available in high resolution for all your screens.

Lush Singapore Dollar Hits Highest In Over 11 Years Versus Greenback View for Desktop

This gorgeous singapore dollar hits highest in over 11 years versus greenback photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these singapore dollar hits highest in over 11 years versus greenback wallpapers for free and use them on your desktop or mobile devices.