Singapore bank wealth fees surge 44% to defy NIM squeeze

Singapore Bank Wealth Fees Surge 44% to Defy NIM Squeeze

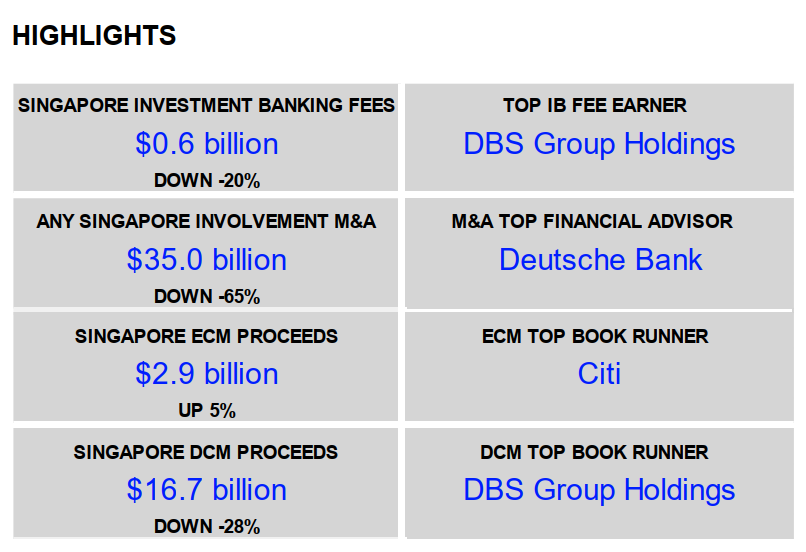

Singapore's banking giants have delivered a stunning financial performance update, defying expectations of cooling profits. The key driver? A massive, unprecedented surge in wealth management fees. Recent quarterly reports reveal that income generated from fees associated with wealth management and private banking services rocketed by an average of 44% across the major players.

This explosive growth is not merely a strong quarter; it signals a fundamental strategic shift. As Net Interest Margins (NIM) begin to stabilize or even contract slightly following aggressive rate hike cycles, fee income has emerged as the indispensable buffer, guaranteeing profitability and insulating Singaporean banks from global economic volatility.

The Story Behind the Numbers: A Client Anecdote

Just six months ago, I spoke with Mr. Chen, a seasoned relationship manager at a prominent local bank's private wealth division. He expressed concern about margin compression but was optimistic about *cross-selling*. "Clients are moving assets here for stability, not just cheap credit," he told me. "They need complex trust setups, sophisticated asset management, and advisory services. Those aren't priced based on Fed rates; they're priced based on value and expertise." This personal observation perfectly mirrors the industry's massive pivot: moving away from reliance on lending spread and deeply into high-margin advisory services.

The Wealth Management Dynamo: Deconstructing the 44% Leap

The 44% figure is an aggregate benchmark, reflecting substantial gains primarily driven by the private banking segments of banks like DBS, OCBC, and UOB. This fee surge is underpinned by three critical factors: AUM influx, market recovery confidence, and sophisticated service bundling.

The sheer volume of Assets Under Management (AUM) flowing into Singapore has been historic. Due to geopolitical tensions and economic uncertainty in other regions, Singapore has firmly cemented its position as Asia's preferred safe haven for capital. This influx, often referred to as "flight to quality," directly translates into higher management fees.

Furthermore, increased client activity—brokerage fees, trading commissions, and foreign exchange conversions—contributed significantly. As market sentiment improved in the first half of the year, high-net-worth individuals (HNWIs) were more inclined to restructure portfolios, purchase structured products, and engage in capital market transactions, all of which generate lucrative, non-interest income.

Key drivers of the fee income boom include:

- Custody and Trust Services: Complex estate planning and corporate wealth structuring, essential for ultra-HNWIs.

- Asset Management Fees: Driven by new product launches and higher valuations of existing actively managed funds.

- Advisory and Brokerage Commissions: Increased trading volumes, particularly cross-border transactions involving high-growth sectors.

- Bancassurance: Strong sales of investment-linked insurance products, providing upfront commissions.

Analysts highlight that the focus is shifting from generic fund management to highly customized, high-touch services. These bespoke services naturally command premium pricing, boosting the overall fee margin dramatically.

NIM Squeeze and Strategic Buffer: How Fees Insulate Profitability

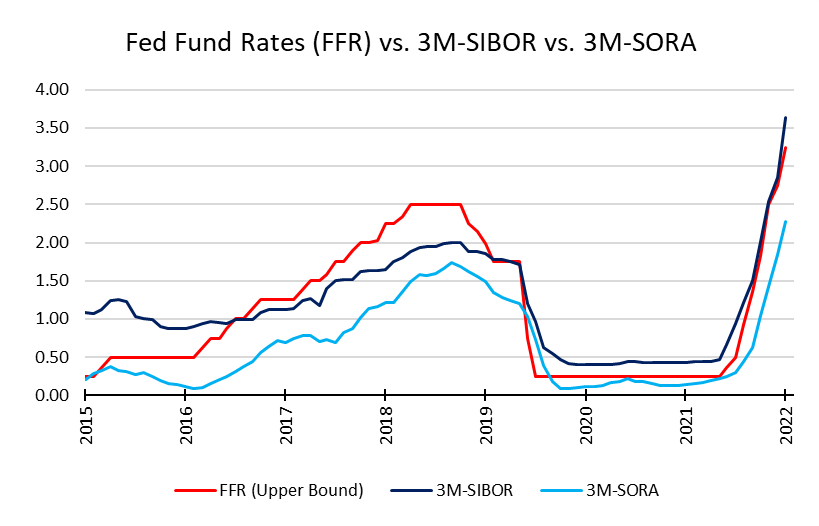

The term "NIM squeeze" refers to the tightening profitability derived from a bank's traditional lending business. When central banks pause or reverse interest rate hikes, or when the cost of deposits (the rate banks pay to savers) rises faster than the yield on loans, the Net Interest Margin contracts.

While Singaporean banks have benefited immensely from high interest rates over the past two years, the environment is rapidly changing. Economic headwinds mean lending growth is moderating, and competition for stable deposits is intensifying. This is where the reliability of wealth management fees becomes invaluable.

Fee income is inherently less sensitive to rate cycles than loan income. It provides a stable, recurring revenue stream that diversifies the bank's profit mix. For DBS, OCBC, and UOB, achieving greater balance between interest income and fee income has been a long-term strategic goal, now realized with spectacular effect.

This reliance on wealth fees allows the banks to maintain robust shareholder returns even if the global economy slows down. It transforms them from simple lending institutions into sophisticated, well-diversified financial services conglomerates.

The strategy involves deep integration:

Bankers are utilizing sophisticated analytics and relationship mapping to ensure that wealth clients are not just holding savings accounts but are utilizing the full spectrum of services—from corporate finance advice for their businesses to private wealth management for their families. This holistic approach ensures higher client stickiness and maximized revenue per client, significantly boosting fee generation.

The Future Outlook: Sustainability and Regulatory Scrutiny

While the 44% surge is celebratory, the crucial question for investors and analysts is the sustainability of this growth trajectory. Can Singapore maintain this momentum, particularly if global markets face renewed volatility?

Several factors suggest strong continuation, albeit perhaps at a slower, more sustainable pace:

- Regional Hub Dominance: Singapore's political stability and highly developed legal framework make it unmatched in the ASEAN region for cross-border wealth management. This structural advantage ensures continued AUM flow.

- Digital Transformation: Significant investments in wealth technology (WealthTech) allow banks to serve the burgeoning affluent and mass-affluent segments more efficiently, expanding the addressable market beyond traditional ultra-HNWIs.

- China Re-engagement: While some capital flows were volatile, the long-term trend of Chinese wealth seeking international diversification heavily favors Singapore.

However, the rapid growth also invites closer regulatory scrutiny. High fees can sometimes be perceived as detrimental to client interest, especially in volatile market conditions. The Monetary Authority of Singapore (MAS) is keenly focused on fee transparency and suitability assessments.

Banks must navigate the fine line between maximizing profits and maintaining client trust. Ensuring clarity on performance fees, management expenses, and brokerage costs will be critical to sustaining the ethical high ground that attracts international capital in the first place. Any misstep in transparency could risk the reputation gains accumulated over the last few years.

Market volatility remains the primary external threat. A sharp or prolonged market downturn could significantly reduce the value of AUM, leading to a natural decrease in ad valorem (value-based) fees. However, the diversification into fixed advisory fees and transactional income means the banks are far better insulated than in previous cycles.

In conclusion, the astounding 44% surge in wealth fees is the clear signal that Singapore's banking heavyweights have successfully transitioned their business models. They have traded dependence on fluctuating interest spreads for the stability and profitability of high-value wealth advisory. This strategic pivot ensures they are well-positioned to weather future economic challenges, marking a definitive new era for Singaporean finance.

Singapore bank wealth fees surge 44% to defy NIM squeeze

Singapore bank wealth fees surge 44% to defy NIM squeeze Wallpapers

Collection of singapore bank wealth fees surge 44% to defy nim squeeze wallpapers for your desktop and mobile devices.

Captivating Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Wallpaper for Your Screen

A captivating singapore bank wealth fees surge 44% to defy nim squeeze scene that brings tranquility and beauty to any device.

Gorgeous Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze View Art

Immerse yourself in the stunning details of this beautiful singapore bank wealth fees surge 44% to defy nim squeeze wallpaper, designed for a captivating visual experience.

Gorgeous Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Picture Photography

This gorgeous singapore bank wealth fees surge 44% to defy nim squeeze photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Exquisite Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Image Illustration

Find inspiration with this unique singapore bank wealth fees surge 44% to defy nim squeeze illustration, crafted to provide a fresh look for your background.

Stunning Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Background for Your Screen

Find inspiration with this unique singapore bank wealth fees surge 44% to defy nim squeeze illustration, crafted to provide a fresh look for your background.

Breathtaking Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Abstract Digital Art

Transform your screen with this vivid singapore bank wealth fees surge 44% to defy nim squeeze artwork, a true masterpiece of digital design.

Artistic Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Photo Illustration

A captivating singapore bank wealth fees surge 44% to defy nim squeeze scene that brings tranquility and beauty to any device.

Artistic Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Artwork Photography

A captivating singapore bank wealth fees surge 44% to defy nim squeeze scene that brings tranquility and beauty to any device.

Crisp Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Artwork Photography

This gorgeous singapore bank wealth fees surge 44% to defy nim squeeze photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Background Concept

Transform your screen with this vivid singapore bank wealth fees surge 44% to defy nim squeeze artwork, a true masterpiece of digital design.

Lush Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Design for Mobile

A captivating singapore bank wealth fees surge 44% to defy nim squeeze scene that brings tranquility and beauty to any device.

High-Quality Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Artwork for Desktop

Transform your screen with this vivid singapore bank wealth fees surge 44% to defy nim squeeze artwork, a true masterpiece of digital design.

Beautiful Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Moment in HD

Experience the crisp clarity of this stunning singapore bank wealth fees surge 44% to defy nim squeeze image, available in high resolution for all your screens.

Detailed Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Background Illustration

Experience the crisp clarity of this stunning singapore bank wealth fees surge 44% to defy nim squeeze image, available in high resolution for all your screens.

Beautiful Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Capture Nature

Experience the crisp clarity of this stunning singapore bank wealth fees surge 44% to defy nim squeeze image, available in high resolution for all your screens.

Vibrant Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Scene Illustration

Explore this high-quality singapore bank wealth fees surge 44% to defy nim squeeze image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze View for Mobile

Discover an amazing singapore bank wealth fees surge 44% to defy nim squeeze background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vibrant Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Image for Mobile

Explore this high-quality singapore bank wealth fees surge 44% to defy nim squeeze image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Wallpaper in 4K

This gorgeous singapore bank wealth fees surge 44% to defy nim squeeze photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Design Digital Art

Transform your screen with this vivid singapore bank wealth fees surge 44% to defy nim squeeze artwork, a true masterpiece of digital design.

Download these singapore bank wealth fees surge 44% to defy nim squeeze wallpapers for free and use them on your desktop or mobile devices.