Explainer: How Singapore's unique monetary policy works

Explainer: How Singapore's Unique Monetary Policy Works

When financial analysts worldwide wait with bated breath for the US Federal Reserve (Fed) or the European Central Bank (ECB) to announce an interest rate hike or cut, they are watching the standard, globally accepted playbook of monetary policy. But if you turn your attention to Singapore, you'll notice a peculiar difference: their central bank rarely, if ever, makes headlines about adjusting interest rates.

I remember attending a global economic summit where a seasoned European economist, accustomed to central banks manipulating borrowing costs, looked genuinely confused. "So, if the Monetary Authority of Singapore (MAS) isn't changing the benchmark rate, how are they fighting inflation?" he asked me. That confusion perfectly encapsulates Singapore's extraordinary, exchange-rate-centric approach.

The Republic of Singapore is a small, island nation defined by its extreme economic openness. Trade—exports and imports—dwarfs its Gross Domestic Product (GDP). For the MAS, the fight against inflation and the pursuit of sustainable growth aren't managed by the domestic price of money (interest rates), but almost exclusively by the price of its currency against its trading partners (the exchange rate).

In a world currently obsessed with rate movements, this unique system is a masterclass in economic pragmatism. This explainer breaks down why Singapore operates differently and how the MAS wields the Singapore Dollar (SGD) as its primary policy tool.

Why Singapore Ditched Interest Rates for Exchange Rates

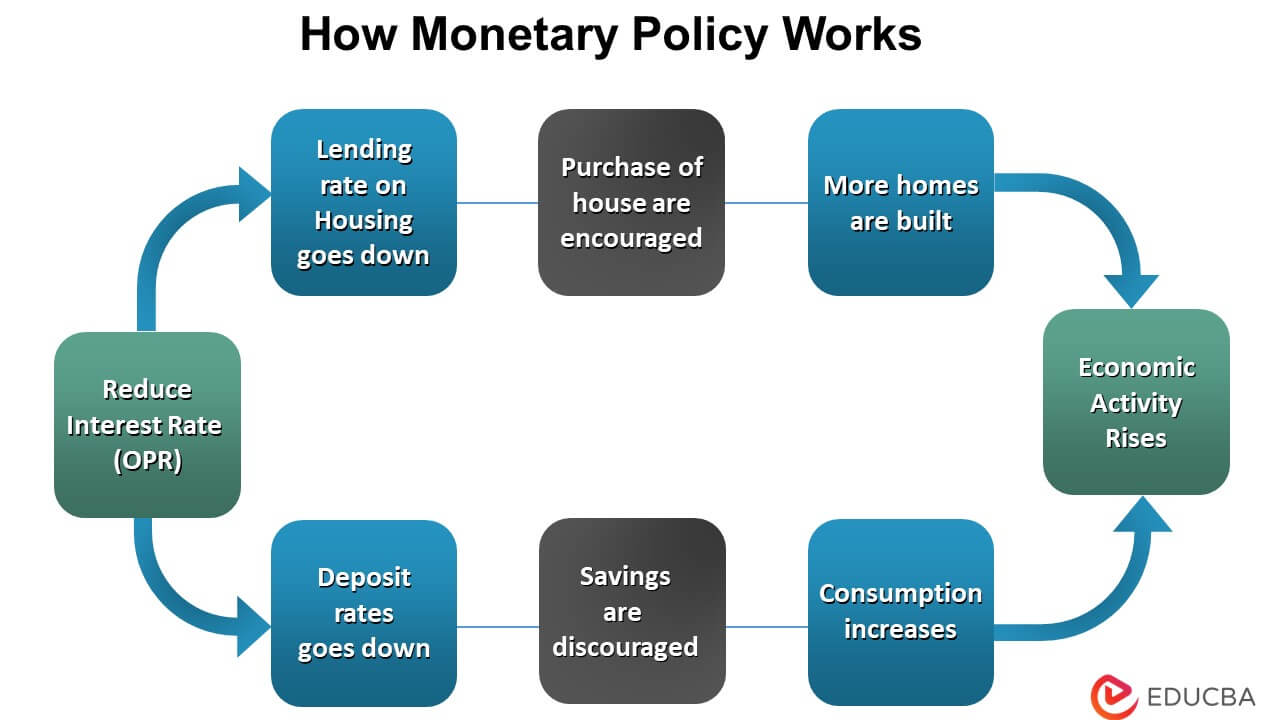

In most large, closed economies (like the US, UK, or Eurozone), the central bank controls domestic inflation by setting a benchmark interest rate. Raising rates makes borrowing expensive, cooling consumption and investment. Lowering rates stimulates activity.

However, Singapore's unique economic geography renders this standard approach highly ineffective. As a highly small and open economy (SOE), domestic output and spending contribute relatively little to overall price pressures. The vast majority of inflation originates from abroad, specifically through the prices of imported goods, services, and raw materials.

If MAS tried to fight inflation purely with interest rates, the policy would leak out instantly. Singapore's lack of capital controls means global capital flows are too powerful. Domestic interest rates are effectively pegged to global rates, specifically US rates, due to the principle of uncovered interest parity (UIP).

Therefore, MAS targets the exchange rate. The exchange rate is the single most important channel through which global price movements enter the domestic economy. This makes the exchange rate the superior anchor for price stability.

The logic is compelling:

- A stronger Singapore Dollar makes imports cheaper, directly reducing imported inflation.

- A weaker Dollar makes imports expensive, fueling domestic price pressures but potentially making Singaporean exports more competitive globally.

By controlling the currency's value, MAS can dampen external price shocks and maintain domestic purchasing power, which is the ultimate goal of monetary policy in Singapore.

The S$NEER Policy: Managing the Basket of Currencies

The key metric the MAS manages is the Singapore Dollar Nominal Effective Exchange Rate, or S$NEER. This is where the complexity—and the brilliance—lies. The S$NEER is not the value of the SGD against just the US Dollar (USD) or the Chinese Yuan (CNY), but rather a weighted average against a "basket" of currencies belonging to Singapore's main trading partners and competitors.

MAS keeps the precise composition of this trade-weighted basket and the exact weights secret. This element of secrecy is vital; it prevents market speculators from precisely gaming or manipulating the S$NEER mechanism.

However, the mechanism through which MAS steers the SGD is transparent: it manages the S$NEER within a predefined, undisclosed policy band. This band is not static; it is designed to move, usually allowing for gradual appreciation over time, reflecting Singapore's productivity growth and long-term goal of low, stable inflation.

You can visualize this policy band as a gently sloping tunnel. MAS commits to intervening in the foreign exchange market to ensure the SGD exchange rate remains within the upper and lower boundaries of this tunnel.

When the S$NEER approaches the upper boundary, it means the SGD is strengthening rapidly (or appreciating too fast). If it hits the lower boundary, the SGD is weakening too fast (or depreciating). MAS intervenes by buying or selling the Singapore Dollar (using its massive foreign reserves) to push the currency back into the target corridor.

This system allows for managed volatility. Market forces are still at play, but the overarching policy ensures stability and prevents disruptive fluctuations, helping businesses plan for imports and exports effectively.

The Three Levers: Slope, Width, and Center

MAS policy adjustments are announced semi-annually (traditionally in April and October) or sometimes during unscheduled statements if urgent conditions arise. When MAS announces a change in its policy stance, they are manipulating one or more of the three key levers that define the S$NEER policy band:

1. The Slope (Gradient)

This is arguably the most crucial lever. It dictates the rate of appreciation or depreciation of the SGD over the coming months. MAS uses the slope to signal its forward outlook on inflation.

- Increasing the Slope (Steepening): Signals a faster, higher appreciation path for the currency. This is the primary tool used to aggressively tighten monetary policy and combat high inflation, as a stronger SGD makes future imports cheaper.

- Zero Slope: Signals MAS is maintaining a neutral stance, aiming to keep the currency stable.

- Negative Slope: Signals a desire for gradual depreciation, often used to boost export competitiveness during periods of weak growth or deflationary risk.

2. The Width (Band Width)

This refers to how wide the S$NEER corridor is. It controls the acceptable level of short-term volatility.

- A wider band allows for greater short-term market fluctuation and gives MAS more flexibility, signaling confidence that market forces will keep the currency stable.

- A narrower band signals MAS's intent to maintain tighter control and reduce market speculation, often employed during periods of extreme global uncertainty.

3. The Center (Mid-point)

This is the level around which the band is centered. Re-centering the band involves shifting the entire corridor upwards or downwards, instantly changing the prevailing level of the exchange rate.

- Re-centering is the most powerful and immediate tool for reacting to major economic shocks or fundamental shifts in long-term equilibrium. Shifting the center upwards is a potent tightening move, immediately increasing the value of the SGD.

For example, during the sharp spike in global inflation following the COVID-19 pandemic and the geopolitical conflicts of 2022–2023, MAS aggressively tightened policy multiple times by steepening the slope. This strong policy stance made the Singapore Dollar one of the most resilient currencies globally, effectively insulating consumers from the worst of the imported price surges.

The Delicate Balance: Interest Rates and Policy Constraints

Although MAS controls the exchange rate, it is important to remember the crucial trade-off: it effectively forgoes control over the domestic interest rate. Singapore's interest rates (like the SORA rates) are highly dependent on global monetary conditions, particularly those set by the US Federal Reserve.

If US interest rates rise sharply, capital will flow out of Singapore in search of higher returns, putting depreciating pressure on the SGD. To maintain the S$NEER within its band, MAS must allow domestic interest rates to rise commensurately to match the global rate environment and maintain capital flow equilibrium.

This reality means that while Singapore's monetary policy shields citizens from imported inflation, it does not shield borrowers from global interest rate hikes. This is a critical, often misunderstood, element of the total macroeconomic landscape in Singapore.

Furthermore, managing the S$NEER requires constant vigilance and immense foreign currency reserves. MAS must be prepared to intervene daily, maintaining its massive reserves to ensure the currency remains within the targeted appreciation path.

In summary, Singapore's monetary policy is a masterclass in adaptation, perfectly tailored for its specific economic structure. By recognizing the limitations of standard interest rate tools in a small, highly globalized market, MAS engineered a system where the price of the currency is the single most effective weapon in maintaining domestic purchasing power and steering the economy toward sustainable, non-inflationary growth. It is a unique, powerful, and effective framework that remains central to the city-state's long-term economic success.

Explainer: How Singapore's unique monetary policy works

Explainer: How Singapore's unique monetary policy works Wallpapers

Collection of explainer: how singapore's unique monetary policy works wallpapers for your desktop and mobile devices.

Mesmerizing Explainer: How Singapore's Unique Monetary Policy Works Photo in 4K

Explore this high-quality explainer: how singapore's unique monetary policy works image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality Explainer: How Singapore's Unique Monetary Policy Works Capture Digital Art

Discover an amazing explainer: how singapore's unique monetary policy works background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing Explainer: How Singapore's Unique Monetary Policy Works Landscape Photography

Transform your screen with this vivid explainer: how singapore's unique monetary policy works artwork, a true masterpiece of digital design.

Beautiful Explainer: How Singapore's Unique Monetary Policy Works Picture Concept

Explore this high-quality explainer: how singapore's unique monetary policy works image, perfect for enhancing your desktop or mobile wallpaper.

Exquisite Explainer: How Singapore's Unique Monetary Policy Works Wallpaper for Mobile

A captivating explainer: how singapore's unique monetary policy works scene that brings tranquility and beauty to any device.

Lush Explainer: How Singapore's Unique Monetary Policy Works Photo in 4K

A captivating explainer: how singapore's unique monetary policy works scene that brings tranquility and beauty to any device.

Stunning Explainer: How Singapore's Unique Monetary Policy Works Abstract for Desktop

Find inspiration with this unique explainer: how singapore's unique monetary policy works illustration, crafted to provide a fresh look for your background.

Serene Explainer: How Singapore's Unique Monetary Policy Works Capture for Your Screen

Discover an amazing explainer: how singapore's unique monetary policy works background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning Explainer: How Singapore's Unique Monetary Policy Works Background Photography

Find inspiration with this unique explainer: how singapore's unique monetary policy works illustration, crafted to provide a fresh look for your background.

Exquisite Explainer: How Singapore's Unique Monetary Policy Works Artwork Concept

A captivating explainer: how singapore's unique monetary policy works scene that brings tranquility and beauty to any device.

Vibrant Explainer: How Singapore's Unique Monetary Policy Works Background Nature

Experience the crisp clarity of this stunning explainer: how singapore's unique monetary policy works image, available in high resolution for all your screens.

Breathtaking Explainer: How Singapore's Unique Monetary Policy Works Picture Nature

Explore this high-quality explainer: how singapore's unique monetary policy works image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality Explainer: How Singapore's Unique Monetary Policy Works Wallpaper Art

Transform your screen with this vivid explainer: how singapore's unique monetary policy works artwork, a true masterpiece of digital design.

Artistic Explainer: How Singapore's Unique Monetary Policy Works Photo Illustration

A captivating explainer: how singapore's unique monetary policy works scene that brings tranquility and beauty to any device.

Serene Explainer: How Singapore's Unique Monetary Policy Works Background in HD

Transform your screen with this vivid explainer: how singapore's unique monetary policy works artwork, a true masterpiece of digital design.

Mesmerizing Explainer: How Singapore's Unique Monetary Policy Works Scene Nature

Transform your screen with this vivid explainer: how singapore's unique monetary policy works artwork, a true masterpiece of digital design.

Gorgeous Explainer: How Singapore's Unique Monetary Policy Works Design Photography

A captivating explainer: how singapore's unique monetary policy works scene that brings tranquility and beauty to any device.

Crisp Explainer: How Singapore's Unique Monetary Policy Works Abstract Art

Find inspiration with this unique explainer: how singapore's unique monetary policy works illustration, crafted to provide a fresh look for your background.

High-Quality Explainer: How Singapore's Unique Monetary Policy Works View Nature

Experience the crisp clarity of this stunning explainer: how singapore's unique monetary policy works image, available in high resolution for all your screens.

Artistic Explainer: How Singapore's Unique Monetary Policy Works Artwork Illustration

Immerse yourself in the stunning details of this beautiful explainer: how singapore's unique monetary policy works wallpaper, designed for a captivating visual experience.

Download these explainer: how singapore's unique monetary policy works wallpapers for free and use them on your desktop or mobile devices.