Westpac lifts interest rates by whopping 30 basis points

Westpac Lifts Interest Rates by Whopping 30 Basis Points: Crisis for Homeowners Looms

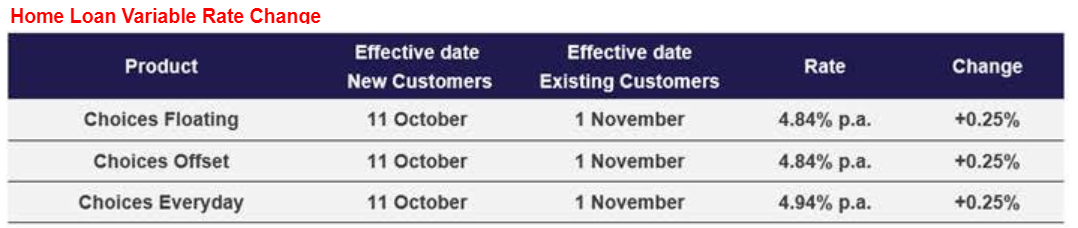

The Australian financial landscape has been rocked this morning as Westpac, one of the nation's 'Big Four' banks, announced an immediate and significant hike to its standard variable mortgage rates. Moving unilaterally and aggressively, the bank confirmed a staggering 30 basis points (BPS) increase, a move that severely deviates from current market expectations and standard protocol.

This decision is significantly higher than the usual increments seen following Reserve Bank of Australia (RBA) cash rate movements. It signals a new phase of intense pressure on Australian households already grappling with surging inflation and stagnant wage growth.

For many Australians, the news landed like a financial punch. Just yesterday, Sarah and Mark, who bought their first home in Sydney 18 months ago, were nervously discussing their rising living costs. They had budgeted for standard RBA movements. Checking their Westpac app this morning, Sarah saw the updated repayment schedule. "It's not just $50 a month anymore," she said, her voice strained. "It's hundreds. We weren't prepared for a move this aggressive."

This whopping 30 basis points rise immediately translates into hundreds of dollars in extra monthly repayments for the average homeowner, placing immense strain on household budgets already stretched thin.

Market analysts are viewing Westpac's decision not just as a defensive measure to protect profit margins, but as a bold, preemptive strike against ongoing pressure on their cost of funding. The immediate question facing millions is simple: Will the other major banks follow suit?

The Shockwave: Why Westpac Moved First and So Aggressively

Historically, commercial banks tend to adjust their variable mortgage rates in tandem with, or shortly after, the RBA adjusts the official cash rate. If the RBA moves by 25 BPS, the banks typically pass on a commensurate amount, often slightly less due to competitive pressures.

Westpac's decision to lift rates by 30 basis points—an unexpected additional 5 BPS above the commonly anticipated increment—suggests internal pressures have reached a critical tipping point. This move underscores the escalating struggle financial institutions face in balancing shareholder expectations against consumer affordability.

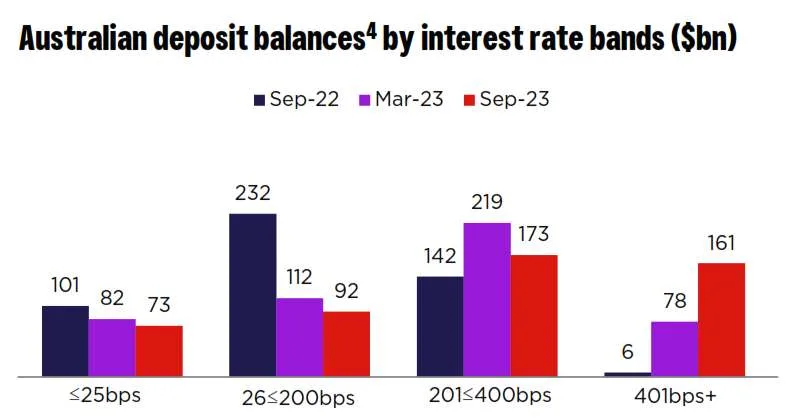

A key driver is the surging cost of wholesale funding. Banks rely heavily on domestic and international money markets to finance their lending activities. As global interest rates remain volatile and competitive pressure for term deposits increases, the cost to Westpac to secure capital has risen sharply.

Industry reports indicate that Westpac's net interest margin (NIM)—a crucial measure of bank profitability—has been under sustained compression. By implementing a 30 BPS hike, the bank is aggressively attempting to expand that margin and reassure investors following underwhelming quarterly results released earlier this year.

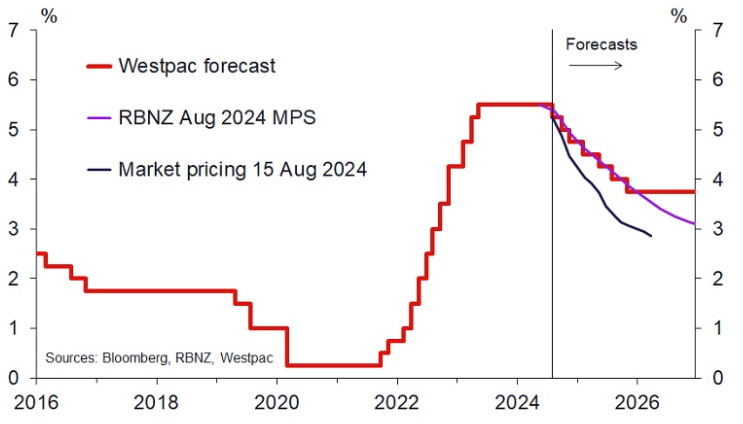

Furthermore, analysts suggest Westpac might be pricing in future RBA movements. They may believe the central bank is behind the curve in tackling inflation and that steeper hikes are inevitable. By moving now, Westpac is positioning itself ahead of the potential curve of sustained economic tightening.

The bank issued a statement acknowledging the difficult decision but emphasized the necessity of maintaining the stability of their loan portfolio and ensuring responsible lending practices in a high-inflation environment. However, this reasoning provides little comfort to struggling homeowners.

- Cost of Funding: International market volatility has made securing capital more expensive.

- Net Interest Margin (NIM): The core profitability metric was under intense pressure and required immediate correction.

- Investor Confidence: A move to protect profitability and deliver stronger returns to shareholders.

- Anticipation of RBA Moves: Westpac may be baking in expectations for further substantial RBA cash rate rises in the coming months.

Crunching the Numbers: What 30 BPS Really Means for Homeowners

For individuals with a variable rate mortgage, this 30 basis points increase is not theoretical—it's immediate and palpable. The impact varies significantly based on the outstanding loan balance, but even small increases on large mortgages result in significant monthly outflows.

Consider the average Australian mortgage holder. If they have a loan of $600,000 outstanding over 25 years, a 30 BPS increase (assuming it adds to an existing rate of 6.00%) means substantial pain.

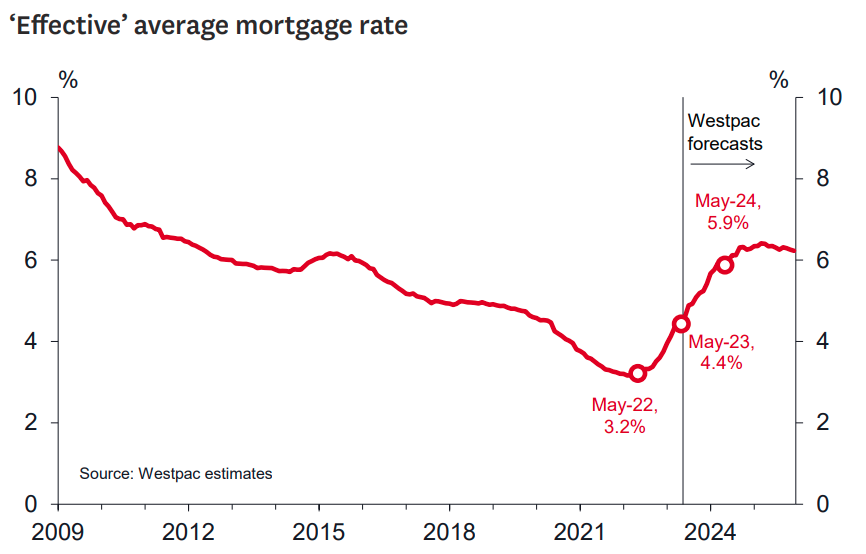

The compounding effect of these increases, coming after a long period of monetary tightening, severely reduces the disposable income available to families. This financial shock is particularly harsh for first-time buyers who entered the market during the low-rate period of 2020-2021.

Here is a breakdown of the estimated monthly increase on typical loan sizes:

| Loan Balance | Monthly Increase (Approx.) | Annual Extra Cost |

|---|---|---|

| $500,000 | $85 | $1,020 |

| $750,000 | $127 | $1,524 |

| $1,200,000 | $203 | $2,436 |

These figures are conservative estimates, demonstrating the immediate escalation of the cost burden. Over the course of a year, the average Westpac customer will be paying well over $1,000 extra purely due to this unilateral decision, compounding previous RBA-driven hikes.

Financial counselling services are bracing for an influx of calls. Many struggling homeowners had already cut back on non-essential spending. This additional hike pushes them closer to genuine financial hardship, risking loan defaults and contributing to stress within the household sector.

The increase also fundamentally alters the housing affordability crisis. Prospective buyers now face higher serviceability buffers and stricter lending criteria, making the barrier to entry even higher than it was just a few months ago. The higher interest environment ensures market volatility remains high.

Ripple Effect: The Future of Australian Banking and Economic Forecasts

Westpac's aggressive move sets a challenging precedent for its competitors. The focus now shifts entirely to Commonwealth Bank (CBA), ANZ, and NAB. Will the other major banks risk losing profit margin by sticking to a smaller increment, or will competitive pressure force them to match the full 30 basis points?

Economists are strongly predicting that the Big Four will move in lockstep. Banking competition, while often touted, rarely holds when profit margins are under severe strain. If the others follow, the widespread financial pain for Australian households will intensify rapidly.

Market Response and Consumer Confidence

The immediate consequence is likely to be a spike in refinancing activity. Westpac customers, angered by the surprise move, are expected to shop around aggressively for better deals from smaller lenders or non-bank financial institutions.

However, refinancing is not an easy solution for everyone. Existing interest rate settings mean that customers seeking to switch banks may not achieve a rate significantly lower than the adjusted Westpac rate, especially if their personal financial circumstances have deteriorated.

Consumer confidence, already fragile due to persistent inflation, is expected to take another severe hit. Households are tightening their belts, impacting retail spending and potentially slowing down key sectors of the domestic economy. This fuels the debate over whether the RBA's current strategy is working.

Leading economic forecasts suggest that if the other Big Four match Westpac's 30 BPS hike, the pressure on the RBA to halt its own rate hiking cycle might increase, fearing they could trigger an unnecessary recession. Conversely, Westpac's decision could be seen as confirmation that the underlying inflationary pressures are far worse than previously communicated.

Ultimately, this whopping 30 basis points lift by Westpac is a loud and clear signal: the era of cheap money is definitively over, and financial institutions are prioritizing balance sheet strength over consumer appeasement. Homeowners must urgently review their budgets and speak to financial advisors to navigate this unpredictable period of market volatility.

The pressure is now squarely on policymakers and the RBA to manage the fallout of what many are calling a significant escalation in Australia's interest rate crisis.

Westpac lifts interest rates by whopping 30 basis points

Westpac lifts interest rates by whopping 30 basis points Wallpapers

Collection of westpac lifts interest rates by whopping 30 basis points wallpapers for your desktop and mobile devices.

Breathtaking Westpac Lifts Interest Rates By Whopping 30 Basis Points Wallpaper Illustration

Transform your screen with this vivid westpac lifts interest rates by whopping 30 basis points artwork, a true masterpiece of digital design.

Exquisite Westpac Lifts Interest Rates By Whopping 30 Basis Points Picture Illustration

Find inspiration with this unique westpac lifts interest rates by whopping 30 basis points illustration, crafted to provide a fresh look for your background.

Exquisite Westpac Lifts Interest Rates By Whopping 30 Basis Points Wallpaper Art

A captivating westpac lifts interest rates by whopping 30 basis points scene that brings tranquility and beauty to any device.

Spectacular Westpac Lifts Interest Rates By Whopping 30 Basis Points Scene for Mobile

A captivating westpac lifts interest rates by whopping 30 basis points scene that brings tranquility and beauty to any device.

Lush Westpac Lifts Interest Rates By Whopping 30 Basis Points Abstract Concept

Find inspiration with this unique westpac lifts interest rates by whopping 30 basis points illustration, crafted to provide a fresh look for your background.

Spectacular Westpac Lifts Interest Rates By Whopping 30 Basis Points Image for Desktop

This gorgeous westpac lifts interest rates by whopping 30 basis points photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid Westpac Lifts Interest Rates By Whopping 30 Basis Points Moment Photography

Transform your screen with this vivid westpac lifts interest rates by whopping 30 basis points artwork, a true masterpiece of digital design.

Exquisite Westpac Lifts Interest Rates By Whopping 30 Basis Points Artwork Illustration

Find inspiration with this unique westpac lifts interest rates by whopping 30 basis points illustration, crafted to provide a fresh look for your background.

Artistic Westpac Lifts Interest Rates By Whopping 30 Basis Points Background Art

This gorgeous westpac lifts interest rates by whopping 30 basis points photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp Westpac Lifts Interest Rates By Whopping 30 Basis Points Scene for Desktop

Immerse yourself in the stunning details of this beautiful westpac lifts interest rates by whopping 30 basis points wallpaper, designed for a captivating visual experience.

Artistic Westpac Lifts Interest Rates By Whopping 30 Basis Points Photo Nature

This gorgeous westpac lifts interest rates by whopping 30 basis points photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing Westpac Lifts Interest Rates By Whopping 30 Basis Points Moment for Mobile

Transform your screen with this vivid westpac lifts interest rates by whopping 30 basis points artwork, a true masterpiece of digital design.

Serene Westpac Lifts Interest Rates By Whopping 30 Basis Points Artwork Nature

Transform your screen with this vivid westpac lifts interest rates by whopping 30 basis points artwork, a true masterpiece of digital design.

Stunning Westpac Lifts Interest Rates By Whopping 30 Basis Points Photo for Mobile

This gorgeous westpac lifts interest rates by whopping 30 basis points photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular Westpac Lifts Interest Rates By Whopping 30 Basis Points Background Collection

Immerse yourself in the stunning details of this beautiful westpac lifts interest rates by whopping 30 basis points wallpaper, designed for a captivating visual experience.

Amazing Westpac Lifts Interest Rates By Whopping 30 Basis Points Landscape in HD

Discover an amazing westpac lifts interest rates by whopping 30 basis points background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Spectacular Westpac Lifts Interest Rates By Whopping 30 Basis Points Landscape in 4K

This gorgeous westpac lifts interest rates by whopping 30 basis points photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene Westpac Lifts Interest Rates By Whopping 30 Basis Points Background in 4K

Explore this high-quality westpac lifts interest rates by whopping 30 basis points image, perfect for enhancing your desktop or mobile wallpaper.

Artistic Westpac Lifts Interest Rates By Whopping 30 Basis Points Design for Your Screen

Immerse yourself in the stunning details of this beautiful westpac lifts interest rates by whopping 30 basis points wallpaper, designed for a captivating visual experience.

Gorgeous Westpac Lifts Interest Rates By Whopping 30 Basis Points Artwork Nature

Find inspiration with this unique westpac lifts interest rates by whopping 30 basis points illustration, crafted to provide a fresh look for your background.

Download these westpac lifts interest rates by whopping 30 basis points wallpapers for free and use them on your desktop or mobile devices.