Global week ahead: Fed's December decision to inform world's central banks

Global Week Ahead: Fed's December Decision to Inform World's Central Banks

The financial world holds its breath. This is more than just another Federal Reserve meeting; it is arguably the most consequential monetary policy announcement of the year. The Fed's December decision is not just about American interest rates—it is the gravitational center informing and redirecting the strategies of the world's central banks, from the European Central Bank (ECB) to emerging market institutions navigating currency stress.

I remember sitting through the minutes leading up to the Chairman's press conference during last year's pivotal shift. The air in the trading room was thick, almost static. Every trader was poised, knowing that a single phrase—a reference to "transitory" inflation or a slight alteration in the "dot plot"—could wipe out fortunes or unlock massive gains. This week carries that same electrifying tension, amplified by compounding geopolitical and economic headwinds.

Markets are looking for clarity. Will the Fed signal a softer landing, or will Chair Jerome Powell double down on the commitment to tame inflation, even if it risks a deeper recession? The answer will dictate the pace of global economic activity well into the first half of the new year, influencing everything from the price of oil to sovereign debt yields across continents.

The core theme of the week is synchronization vs. divergence. If the Fed slows its pace, it grants breathing room to other central banks struggling with imported inflation. If the Fed remains aggressive, however, the pressure on global monetary policy divergence becomes acute, potentially destabilizing weaker economies.

The Anatomy of the Fed's December Dilemma: Data Dependency vs. Forward Guidance

The Federal Open Market Committee (FOMC) enters this meeting balancing two highly contradictory sets of data. On one hand, core inflation remains stubbornly elevated, fueled by a tight labor market where wage growth continues to put upward pressure on prices. On the other hand, leading economic indicators point strongly toward a looming slowdown, suggesting that past rate hikes have yet to fully filter through the system.

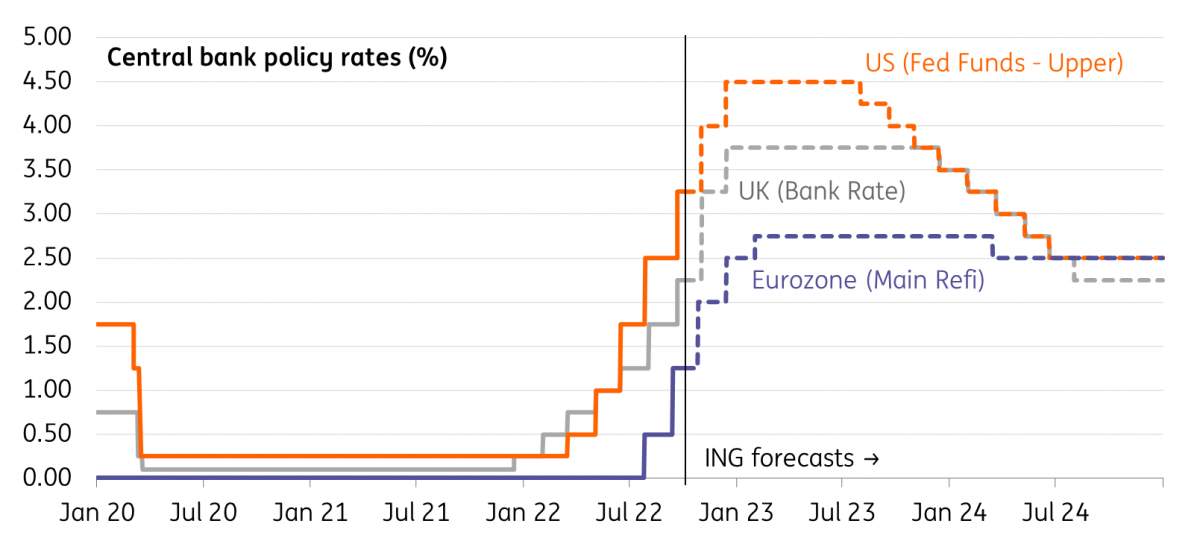

The primary concern for the Fed is managing expectations surrounding the final destination of the Fed funds rate. Analysts widely anticipate a moderation in the pace of tightening, moving away from aggressive 75-basis-point hikes. However, the crucial factor lies in the 'terminal rate'—the highest point the Fed expects rates to reach before pausing.

The market is desperately trying to front-run the peak. A higher-than-expected terminal rate outlined in the updated dot plot would signal a sustained period of restrictive policy, triggering sharp volatility in equity and bond markets globally. Conversely, if the Fed hints at an earlier pause in 2023, risk assets could enjoy a powerful, albeit brief, relief rally.

Key indicators the FOMC is scrutinizing this week:

- Core PCE Inflation: The Fed's preferred inflation metric remains the ultimate hurdle. Any sign of persistent acceleration undermines the case for slower hikes.

- Unemployment Rate: The strength of the job market has been the biggest surprise of the year. Continued low unemployment gives the Fed cover to maintain tight policy settings.

- Quantitative Tightening (QT): While rate hikes dominate headlines, the ongoing reduction of the Fed's balance sheet (QT) is quietly draining liquidity, adding a layer of hidden tightening that exacerbates global dollar scarcity.

- Yield Curve Inversion: The deep inversion of the U.S. Treasury yield curve signals high recession probability. The Fed must address this without panicking the public or the financial sector.

The language surrounding forward guidance will be critical. If Powell emphasizes "data dependency" and avoids firm commitments, it buys the Fed flexibility. If he sounds hawkishly resolute about reaching the 2% inflation target regardless of short-term economic pain, expect the dollar to surge and emerging market stress to accelerate rapidly.

Ripple Effect: How the Fed's Stance Translates Globally

The Federal Reserve's decisions do not happen in isolation. Due to the U.S. dollar's status as the world's primary reserve currency, every movement in the Fed funds rate sends seismic waves across global financial markets. This mechanism is the direct cause of the current global economic deceleration.

When the Fed tightens aggressively, the dollar index strengthens dramatically. This dollar appreciation has devastating consequences for economies that rely heavily on dollar-denominated debt—a category that includes most emerging markets and many European corporations. Servicing that debt becomes exponentially more expensive as local currencies depreciate against the surging USD.

Emerging markets (EM) are already facing severe capital flight. Countries relying on commodity exports or external financing have been forced to implement dramatic, often painful, rate hikes of their own just to defend their currencies and contain imported inflationary pressures. A hawkish Fed in December means this pressure continues, potentially leading to sovereign debt crises in the most vulnerable nations.

The pressure is also intense on developed market central banks. The European Central Bank (ECB) and the Bank of England (BoE) must decide if they can afford to slow their tightening cycle even slightly, or if the strong dollar mandates continued aggressive hikes to prevent catastrophic currency depreciation against the USD.

For the ECB, a continued aggressive Fed stance heightens the challenge of fragmentation risk—the worry that large interest rate hikes disproportionately punish fiscally weaker Eurozone members. For the BoE, the balance is delicate: combating persistently high UK inflation while navigating a deep domestic recession. A highly aggressive Fed severely limits their policy maneuverability.

A soft pivot from the Fed, however, could provide the first real window for global financial conditions to loosen since late 2021. This would immediately relieve currency stress and improve the outlook for global trade volumes, offering a crucial lifeline to countries teetering on the edge of crisis.

Central Bank Dominoes: Following the Leader or Diverging?

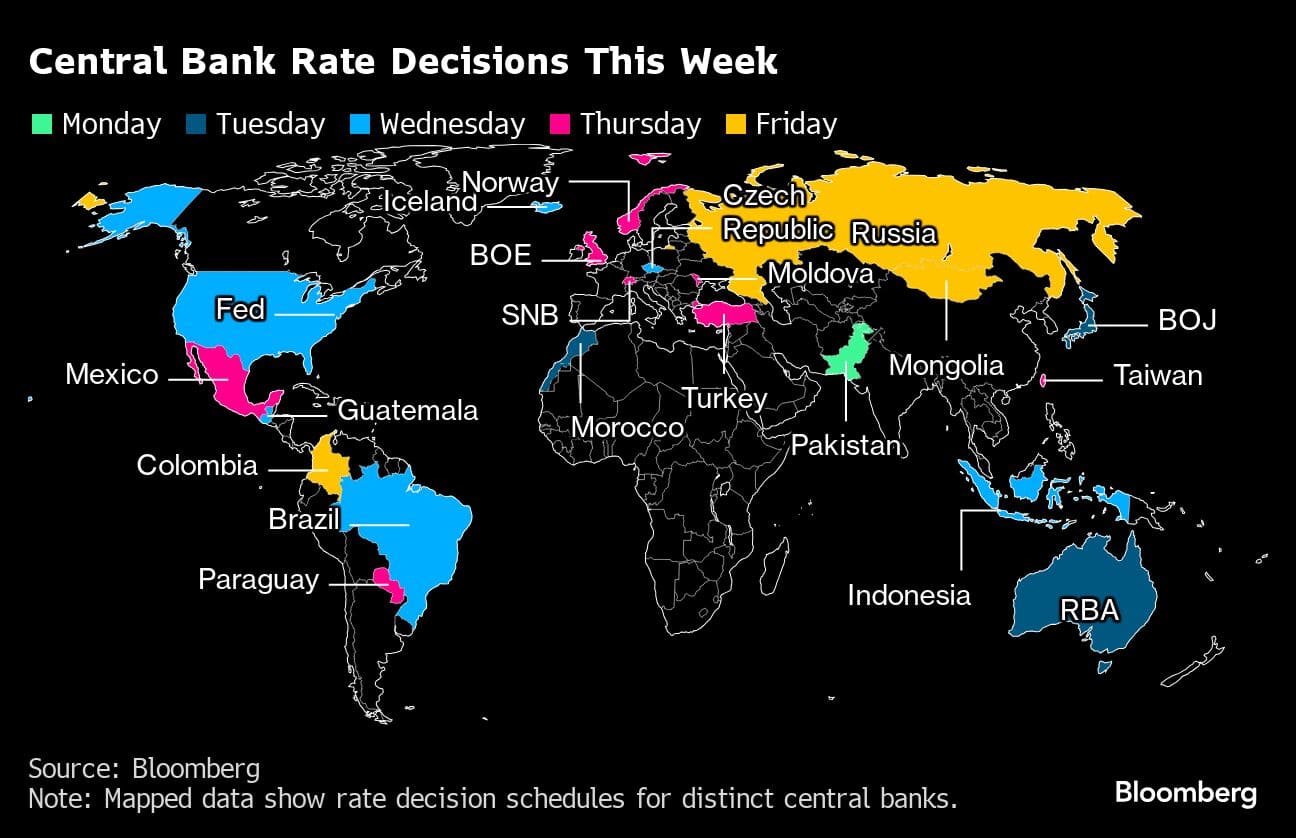

Following the Fed's pronouncement, attention immediately turns to its major global counterparts. The December decision acts as the starting pistol for a flurry of subsequent rate reviews, each central bank trying to calibrate its monetary policy response in the wake of the giant American footprint.

The coming week and the weeks immediately following will reveal the extent of synchronized tightening still required, or if monetary policy divergence is finally feasible.

The Bank of England's Tightrope Walk

The BoE faces the most challenging domestic backdrop among the G7 economies. Inflation remains high, yet the UK economy is already showing clear signs of recession. If the Fed signals a willingness to accept slower growth to beat inflation, the BoE may feel compelled to mirror that hawkish commitment, even if it deepens the UK's economic woes.

- Prediction Focus: Analysts are watching for any language suggesting a shift in the BoE's inflation outlook beyond the current quarter, particularly concerning labor market tightness.

- Risk Factor: Further depreciation of the pound sterling against the dollar if the BoE hints at an early pause, fearing political pressure over recession severity.

The European Central Bank's Inflation Fight

The ECB has been playing catch-up, dealing with inflation fueled largely by soaring energy prices following geopolitical conflicts. They have made clear their commitment to rate hikes, but their ceiling is lower due to potential debt sustainability issues within the Eurozone periphery.

A highly hawkish Fed complicates the ECB's task. The ECB must raise rates high enough to maintain relative currency stability and curb imported inflation, but not so high that they trigger a Eurozone financial crisis. The Fed's actions will directly influence the required magnitude of the ECB's rate moves.

Asia's Balancing Act: BoJ and Beyond

Asia represents the most fascinating potential for divergence. The Bank of Japan (BoJ) has stubbornly maintained its ultra-loose policy setting (yield curve control) despite massive inflationary pressures, seeking to preserve the fragile recovery of the Japanese economy.

If the Fed signals a terminal rate significantly higher than anticipated, the pressure on the Japanese yen will become unbearable. This dynamic could finally force the BoJ's hand, leading to an unexpected policy shift that would reverberate through global fixed income markets, particularly by unwinding massive Japanese carry trades.

In summary, the December FOMC meeting is the ultimate macroeconomic risk event of the quarter. It will either confirm the world is heading toward a synchronized, engineered slowdown aimed at curing inflation, or it will provide the initial framework for a global soft landing. Traders, CEOs, and global finance ministers alike are now waiting for the gavel to drop.

The outcome will define the investment landscape for months to come, emphasizing the interconnected nature of global monetary policy in the face of persistent inflation and geopolitical instability.

Global week ahead: Fed's December decision to inform world's central banks

Global week ahead: Fed's December decision to inform world's central banks Wallpapers

Collection of global week ahead: fed's december decision to inform world's central banks wallpapers for your desktop and mobile devices.

Mesmerizing Global Week Ahead: Fed's December Decision To Inform World's Central Banks Moment for Desktop

Discover an amazing global week ahead: fed's december decision to inform world's central banks background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Spectacular Global Week Ahead: Fed's December Decision To Inform World's Central Banks Artwork Photography

Find inspiration with this unique global week ahead: fed's december decision to inform world's central banks illustration, crafted to provide a fresh look for your background.

Lush Global Week Ahead: Fed's December Decision To Inform World's Central Banks Design Concept

Immerse yourself in the stunning details of this beautiful global week ahead: fed's december decision to inform world's central banks wallpaper, designed for a captivating visual experience.

Spectacular Global Week Ahead: Fed's December Decision To Inform World's Central Banks Landscape Collection

Find inspiration with this unique global week ahead: fed's december decision to inform world's central banks illustration, crafted to provide a fresh look for your background.

Crisp Global Week Ahead: Fed's December Decision To Inform World's Central Banks Picture for Your Screen

Immerse yourself in the stunning details of this beautiful global week ahead: fed's december decision to inform world's central banks wallpaper, designed for a captivating visual experience.

Crisp Global Week Ahead: Fed's December Decision To Inform World's Central Banks Wallpaper in 4K

This gorgeous global week ahead: fed's december decision to inform world's central banks photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Detailed Global Week Ahead: Fed's December Decision To Inform World's Central Banks Photo Art

Explore this high-quality global week ahead: fed's december decision to inform world's central banks image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Global Week Ahead: Fed's December Decision To Inform World's Central Banks Background Nature

Discover an amazing global week ahead: fed's december decision to inform world's central banks background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene Global Week Ahead: Fed's December Decision To Inform World's Central Banks View in HD

Transform your screen with this vivid global week ahead: fed's december decision to inform world's central banks artwork, a true masterpiece of digital design.

Artistic Global Week Ahead: Fed's December Decision To Inform World's Central Banks Picture Nature

Immerse yourself in the stunning details of this beautiful global week ahead: fed's december decision to inform world's central banks wallpaper, designed for a captivating visual experience.

Detailed Global Week Ahead: Fed's December Decision To Inform World's Central Banks Artwork in 4K

Explore this high-quality global week ahead: fed's december decision to inform world's central banks image, perfect for enhancing your desktop or mobile wallpaper.

Stunning Global Week Ahead: Fed's December Decision To Inform World's Central Banks Photo for Mobile

Find inspiration with this unique global week ahead: fed's december decision to inform world's central banks illustration, crafted to provide a fresh look for your background.

Dynamic Global Week Ahead: Fed's December Decision To Inform World's Central Banks Artwork in HD

Find inspiration with this unique global week ahead: fed's december decision to inform world's central banks illustration, crafted to provide a fresh look for your background.

Captivating Global Week Ahead: Fed's December Decision To Inform World's Central Banks Image Digital Art

Find inspiration with this unique global week ahead: fed's december decision to inform world's central banks illustration, crafted to provide a fresh look for your background.

Spectacular Global Week Ahead: Fed's December Decision To Inform World's Central Banks Scene for Mobile

Immerse yourself in the stunning details of this beautiful global week ahead: fed's december decision to inform world's central banks wallpaper, designed for a captivating visual experience.

Serene Global Week Ahead: Fed's December Decision To Inform World's Central Banks Design in HD

Transform your screen with this vivid global week ahead: fed's december decision to inform world's central banks artwork, a true masterpiece of digital design.

Mesmerizing Global Week Ahead: Fed's December Decision To Inform World's Central Banks Design Digital Art

Explore this high-quality global week ahead: fed's december decision to inform world's central banks image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Global Week Ahead: Fed's December Decision To Inform World's Central Banks Design Concept

Experience the crisp clarity of this stunning global week ahead: fed's december decision to inform world's central banks image, available in high resolution for all your screens.

Spectacular Global Week Ahead: Fed's December Decision To Inform World's Central Banks Moment in 4K

This gorgeous global week ahead: fed's december decision to inform world's central banks photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant Global Week Ahead: Fed's December Decision To Inform World's Central Banks Background for Mobile

Transform your screen with this vivid global week ahead: fed's december decision to inform world's central banks artwork, a true masterpiece of digital design.

Download these global week ahead: fed's december decision to inform world's central banks wallpapers for free and use them on your desktop or mobile devices.