DBS and OCBC hit record highs; will the rally continue in 2026?

DBS and OCBC Hit Record Highs: Will the Rally Continue in 2026?

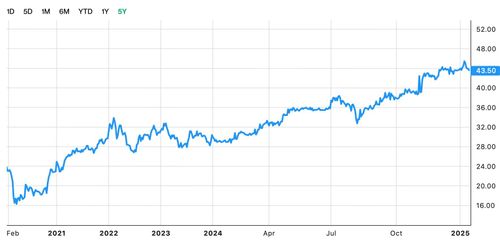

The first half of 2024 has been nothing short of spectacular for Singapore's banking giants. DBS Group Holdings (DBS) and Oversea-Chinese Banking Corporation (OCBC) have successfully breached critical psychological levels, hitting historic record highs. This aggressive uptrend has delighted long-term shareholders and signaled the robust health of the Singapore banking sector amidst global economic uncertainty.

I recall speaking to a seasoned investor, Mr. Lim, just six months ago. He was cautious, wondering if the post-pandemic surge had peaked. Now, with DBS crossing the $35 mark and OCBC solidly above $14, his skepticism has transformed into cautious optimism. The question on everyone's mind is crucial: Is this simply a cyclical peak fueled by high interest rates, or are these institutions fundamentally positioned for sustained growth? More importantly, what happens when we look ahead to 2026?

Our analysis dives deep into the core drivers of this unprecedented rally, examines the macro headwinds expected in 2025, and provides a forward-looking forecast on whether these financial behemoths can maintain their current trajectory through the pivotal year of 2026.

The current market sentiment is undeniably bullish, driven by exceptional earnings reports and strong capital bases. However, investors must look beyond the immediate gains to understand the long-term sustainability of this performance.

The Momentum Drivers: Why Did DBS and OCBC Soar?

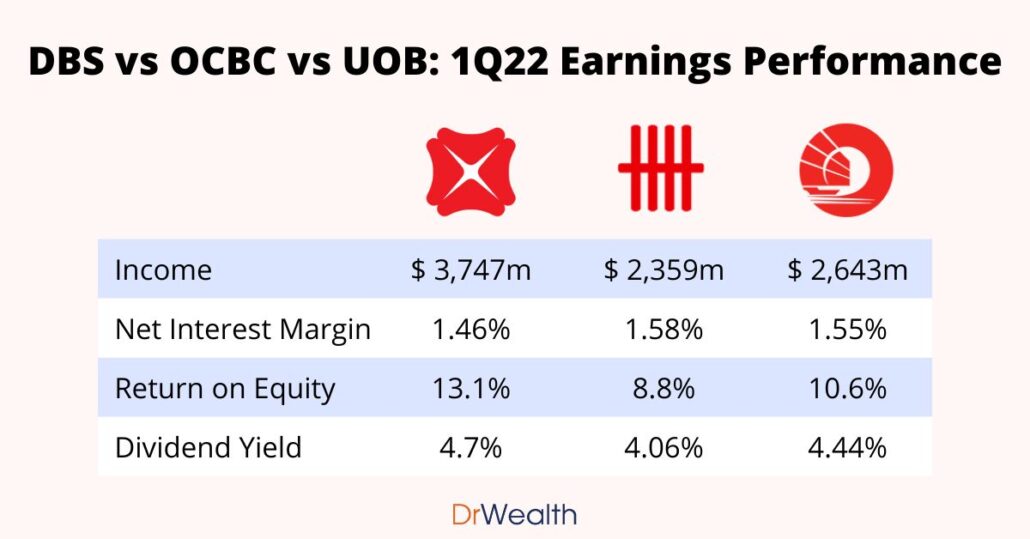

The primary catalyst behind the record performance of both DBS and OCBC is straightforward: the prolonged global high-interest rate environment. The U.S. Federal Reserve's hawkish stance, mirrored by central banks across Asia, allowed banks to significantly widen their Net Interest Margins (NIMs).

These margins represent the difference between the interest income banks earn on loans and the interest they pay on deposits. For the past two years, this differential has swelled, translating directly into massive bottom-line growth. Both banks have repeatedly outperformed analyst expectations, leading to several positive target price revisions.

Beyond the interest rate play, both banks demonstrated impressive growth in their non-interest income streams, particularly in their wealth management divisions. Singapore's status as a safe haven and a key hub for high-net-worth individuals continues to attract substantial capital, benefiting the strong franchise strength of both institutions.

Key drivers propelling the rally include:

- Elevated Net Interest Margins (NIMs): The immediate and most significant factor boosting profitability.

- Robust Loan Growth in ASEAN: Targeted expansion in key markets like Indonesia, Vietnam, and Greater China has diversified their revenue base away from purely domestic reliance.

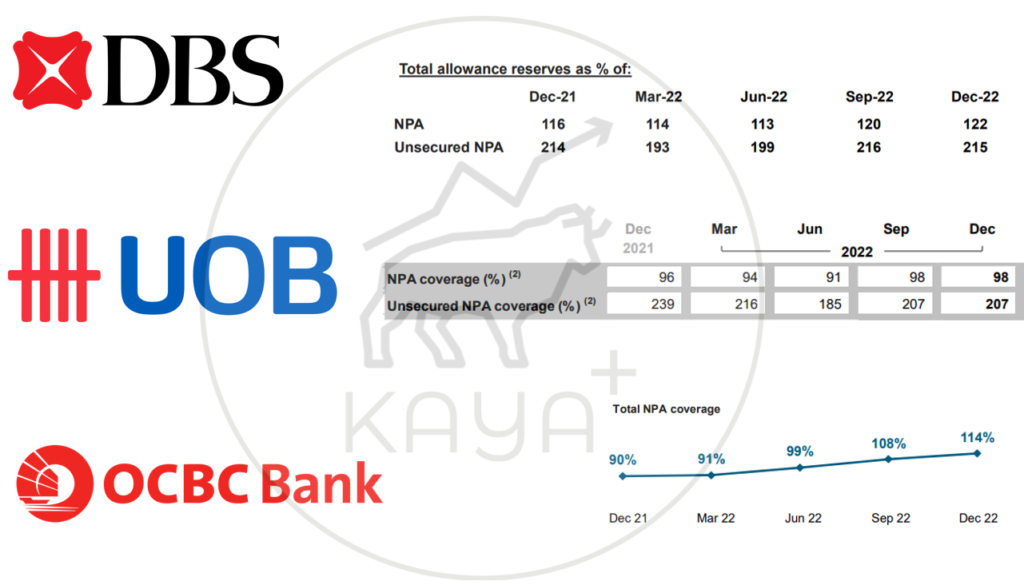

- Strong Asset Quality: Both banks maintain conservative loan books and strong provisions, keeping impaired loan ratios low despite global economic deceleration fears.

- Fee Income Resilience: Wealth management and trading income have held up surprisingly well, compensating for mild slowdowns in other areas like transactional fees.

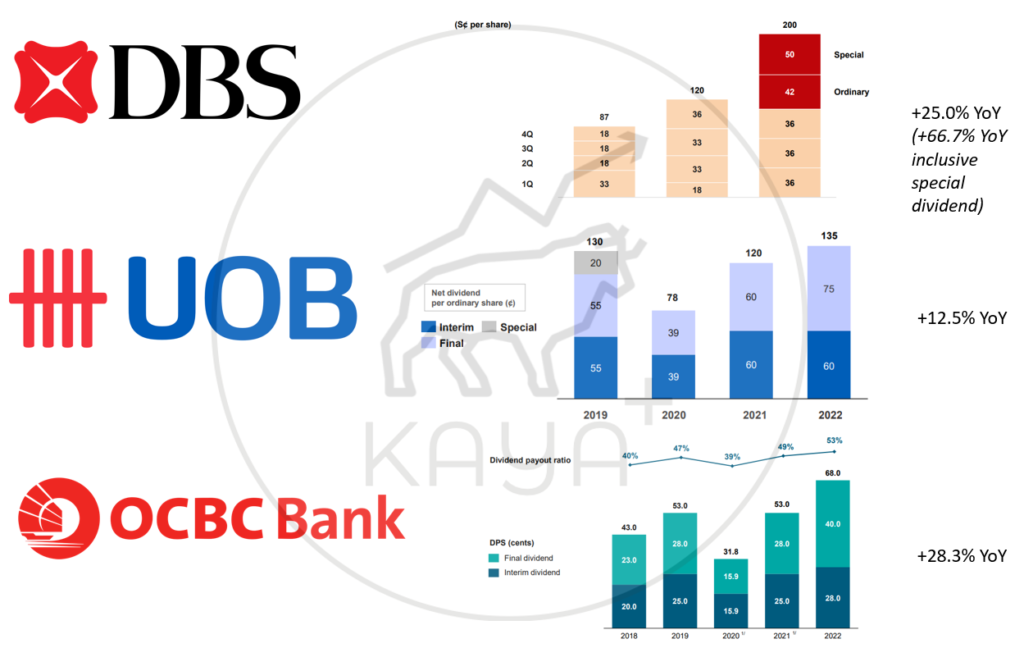

- Attractive Dividend Yields: Regular, often progressive, dividend payouts make these stocks essential components of conservative, income-focused portfolios, driving continuous demand.

This period has allowed the banks to fortify their balance sheets, ensuring they possess some of the strongest capital adequacy ratios globally. This financial fortress is vital for weathering potential economic downturns anticipated in the later part of the decade.

The Headwinds and Tailwinds: Navigating the 2025/2026 Landscape

Looking ahead to 2025 and 2026, the macroeconomic picture becomes murkier. The primary threat to continued exceptional performance is the widely anticipated pivot by global central banks, leading to interest rate normalization.

If central banks begin aggressive rate cuts, we will inevitably see NIM compression. This means the engine that drove the 2024 rally will start to sputter. Analysts project that if the U.S. Federal Funds Rate drops substantially by late 2025, bank profitability derived from traditional lending will decrease.

However, the banks are not standing still. They are actively positioning themselves to mitigate this risk through strategic growth in non-rate sensitive areas.

Anticipated Headwinds (Risks):

- Interest Rate Normalization: The most significant threat, leading to immediate pressure on Net Interest Income (NII).

- Slowing Global Growth: A substantial slowdown in key trading partners, particularly China, could impact trade finance activities.

- Geopolitical Stability: Heightened US-China tensions or further regional conflicts could disrupt supply chains and investor confidence, forcing capital to the sidelines.

- Regulatory Scrutiny: As profits rise, regulators often impose stricter capital requirements or levy higher operational costs (e.g., cybersecurity compliance).

Anticipated Tailwinds (Opportunities):

- Digital Transformation Payoff: Years of heavy investment in digital infrastructure are now paying dividends through lower cost-to-income ratios and better customer engagement.

- Fee Income Growth: As rates stabilize, capital markets activity often picks up (IPOs, M&A), boosting advisory and brokerage fees significantly.

- ASEAN Demographic Dividend: The continued economic expansion and growing middle class in Southeast Asia provide a long runway for retail banking and SME lending growth.

- Sustainable Finance Mandates: Both banks are leaders in green financing, tapping into massive demand for sustainable investment products and green bond underwriting.

The ability of DBS and OCBC to successfully transition their revenue streams—from relying on interest rate cycles to consistent fee generation—will be the defining factor determining if they can sustain the rally into 2026.

Market forecasts suggest that while the growth *rate* might slow down from the explosive 2024 figures, the absolute profitability should remain highly elevated due to efficient cost management and diversified business lines. The goal is no longer exponential profit growth, but stable, compounding returns.

Valuation and Dividend Outlook: Is There Still Value Left?

When stocks hit record highs, the immediate concern is valuation. Are DBS and OCBC now overbought? Traditionally, bank stocks are valued using the Price-to-Book (P/B) ratio. Historically, a P/B of 1.2x to 1.5x was considered standard for quality regional banks.

Current valuations place both DBS and OCBC trading comfortably above these historical averages, reflecting their premier status and superior Return on Equity (ROE). While they are certainly not "cheap" by traditional metrics, a high P/B is justified by two major factors: stability and dividends.

The stability derived from Singapore's strong regulatory environment makes them safer bets compared to peers in volatile emerging markets. This "safety premium" attracts global institutional investors seeking low-risk exposure to Asian economic growth.

Furthermore, the commitment to dividends acts as a continuous floor for the stock price. Both banks are known for their progressive dividend policies, linking payouts to profitability rather than just fixed amounts. DBS, in particular, has repeatedly emphasized its ability to sustain an attractive dividend yield, often above 5% based on current payouts.

For investors focused on long-term accumulation and passive income, the stocks continue to look appealing, even if capital appreciation slows down in 2025 and 2026. They effectively function as high-grade proxy bonds with growth potential.

Investor action points for the coming two years:

- Monitor NIM trends closely: Watch for official guidance on expected NIM compression rates from management.

- Analyze Fee Income Growth: Ensure non-interest income streams are picking up pace to offset lower NII.

- Check Capital Allocation: Observe whether banks use excess capital primarily for increased dividends, share buybacks, or strategic acquisitions.

- Diversification Focus: Look for sustained strong performance from the regional business segments, indicating successful strategic diversification.

Ultimately, the rally continuing into 2026 depends less on generating new record highs every quarter and more on delivering predictable, high-quality earnings. The growth narrative will shift from interest rate uplift to operational excellence and regional dominance.

While the explosive growth seen in 2024 is unlikely to be repeated year-on-year, the foundation laid—superior capitalization, robust asset quality, and diversified revenue—suggests that DBS and OCBC are well-equipped to maintain their position as regional financial powerhouses. They remain excellent cornerstone investments for a portfolio seeking exposure to stable Asian financial growth through 2026 and beyond.

DBS and OCBC hit record highs; will the rally continue in 2026?

DBS and OCBC hit record highs; will the rally continue in 2026? Wallpapers

Collection of dbs and ocbc hit record highs; will the rally continue in 2026? wallpapers for your desktop and mobile devices.

Vivid Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Scene Concept

Discover an amazing dbs and ocbc hit record highs; will the rally continue in 2026? background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Landscape Art

Transform your screen with this vivid dbs and ocbc hit record highs; will the rally continue in 2026? artwork, a true masterpiece of digital design.

Crisp Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Moment Concept

A captivating dbs and ocbc hit record highs; will the rally continue in 2026? scene that brings tranquility and beauty to any device.

Exquisite Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Abstract Digital Art

This gorgeous dbs and ocbc hit record highs; will the rally continue in 2026? photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Image for Your Screen

This gorgeous dbs and ocbc hit record highs; will the rally continue in 2026? photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? View in HD

Experience the crisp clarity of this stunning dbs and ocbc hit record highs; will the rally continue in 2026? image, available in high resolution for all your screens.

Stunning Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Scene for Mobile

Find inspiration with this unique dbs and ocbc hit record highs; will the rally continue in 2026? illustration, crafted to provide a fresh look for your background.

Captivating Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Wallpaper Art

Immerse yourself in the stunning details of this beautiful dbs and ocbc hit record highs; will the rally continue in 2026? wallpaper, designed for a captivating visual experience.

Gorgeous Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Image Collection

Immerse yourself in the stunning details of this beautiful dbs and ocbc hit record highs; will the rally continue in 2026? wallpaper, designed for a captivating visual experience.

Vibrant Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Moment Concept

Transform your screen with this vivid dbs and ocbc hit record highs; will the rally continue in 2026? artwork, a true masterpiece of digital design.

Spectacular Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Moment Photography

Immerse yourself in the stunning details of this beautiful dbs and ocbc hit record highs; will the rally continue in 2026? wallpaper, designed for a captivating visual experience.

Breathtaking Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Moment for Desktop

Discover an amazing dbs and ocbc hit record highs; will the rally continue in 2026? background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Scene for Your Screen

Discover an amazing dbs and ocbc hit record highs; will the rally continue in 2026? background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Dynamic Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Landscape for Desktop

A captivating dbs and ocbc hit record highs; will the rally continue in 2026? scene that brings tranquility and beauty to any device.

Captivating Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Capture Concept

Immerse yourself in the stunning details of this beautiful dbs and ocbc hit record highs; will the rally continue in 2026? wallpaper, designed for a captivating visual experience.

High-Quality Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Wallpaper Photography

Transform your screen with this vivid dbs and ocbc hit record highs; will the rally continue in 2026? artwork, a true masterpiece of digital design.

Vibrant Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Capture Digital Art

Discover an amazing dbs and ocbc hit record highs; will the rally continue in 2026? background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Design in HD

A captivating dbs and ocbc hit record highs; will the rally continue in 2026? scene that brings tranquility and beauty to any device.

Vibrant Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Photo Photography

Explore this high-quality dbs and ocbc hit record highs; will the rally continue in 2026? image, perfect for enhancing your desktop or mobile wallpaper.

Captivating Dbs And Ocbc Hit Record Highs; Will The Rally Continue In 2026? Wallpaper Collection

Immerse yourself in the stunning details of this beautiful dbs and ocbc hit record highs; will the rally continue in 2026? wallpaper, designed for a captivating visual experience.

Download these dbs and ocbc hit record highs; will the rally continue in 2026? wallpapers for free and use them on your desktop or mobile devices.