IRAs and Market Impacts: Why Recent Trends Matter

Don't Panic: A Deep Dive into IRAs and Market Impacts: Why Recent Trends Matter to Your Retirement

The global economy is facing a convergence of challenges—stubborn inflation, aggressive interest rate hikes, and geopolitical uncertainty. For millions relying on Individual Retirement Accounts (IRAs), this volatility isn't just noise; it's a direct threat to long-term wealth stability.

As a Senior SEO Content Writer specializing in financial strategy, we are breaking down the complexity. This essential update focuses on IRAs and Market Impacts: Why Recent Trends Matter, providing actionable insights to safeguard and potentially grow your retirement portfolio during these turbulent times. Simply waiting for the storm to pass is not an option; proactive adjustments are key.

The Urgency: Decoding the Current Macroeconomic Trends Impacting IRAs

The investment landscape has fundamentally shifted since the pre-pandemic era of near-zero interest rates. Retirement savers must adjust their expectations—and their holdings—to reflect this new reality.

The Inflationary Squeeze and Fixed Income Stress

Persistent high inflation acts as a stealth tax on savings. While equities might offer some protection, traditional fixed-income investments, staples of many conservative IRA portfolios, suffer significantly. When the cost of living rises rapidly, the real (inflation-adjusted) return on bonds diminishes, eroding purchasing power upon retirement.

The Federal Reserve's rapid response to inflation via rate increases has caused bond prices to plummet. This is a critical factor for older investors who traditionally pivot their IRAs toward safer bonds in the final years before retirement. Understanding duration risk has never been more vital.

Geopolitical Risk and Sector Volatility

Market uncertainty stemming from global conflicts and trade tensions introduces heightened volatility, particularly in specific sectors like energy, defense, and commodities. These rapid sector shifts can disproportionately affect passively managed IRAs that rely heavily on broad index funds. Active monitoring, or consulting a fiduciary, is paramount now.

For deeper background on how the Fed handles monetary policy, see the official analysis: Federal Reserve Monetary Policy.

Direct Impact: How Recent Trends Affect Traditional vs. Roth IRAs

The current market environment affects the perceived value and strategic utility of both Traditional and Roth IRAs differently, primarily due to their tax treatment.

Traditional IRA: Tax Deferral Under Pressure

The Traditional IRA benefit is the upfront tax deduction. However, all withdrawals in retirement are taxed as ordinary income. In an environment where future tax rates are projected to rise due to national debt levels, the deferred tax obligation can become a liability.

Furthermore, Required Minimum Distributions (RMDs) complicate matters. If the market is down significantly when RMDs start, retirees are forced to sell devalued assets and pay taxes on them, locking in losses.

Roth IRA: The Power of Tax-Free Growth in Volatile Times

The Roth IRA, funded with after-tax dollars, offers tax-free growth and withdrawals. This feature is particularly powerful during volatile market periods. Why? Because market declines offer a golden opportunity to contribute to a Roth IRA and purchase assets "on sale" that will compound tax-free.

If you anticipate being in a higher tax bracket in retirement, the current downturn presents an ideal strategic window for a Roth conversion, paying the tax now while asset valuations are temporarily depressed.

[Baca Juga: Mastering the Backdoor Roth Conversion]Strategic Moves: Protecting Your IRA Portfolio Now

Senior investors must look past the 24-hour news cycle and implement defensive yet growth-oriented strategies.

Rebalancing and De-Risking the Core

Market turbulence naturally throws portfolio allocations out of balance. If stocks have fallen sharply, your bond allocation might now be disproportionately large. Rebalancing is essential to return to your target risk profile. Use market dips as opportunities to incrementally buy shares of high-quality, undervalued assets.

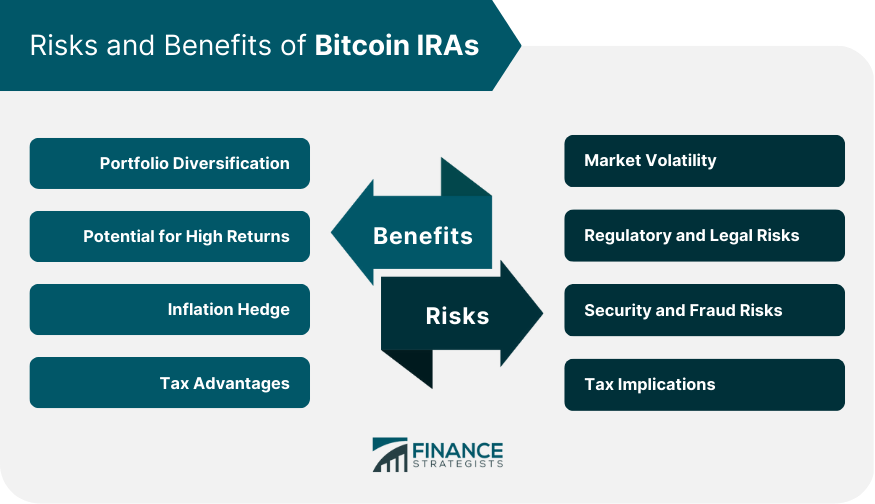

Exploring Non-Traditional IRA Assets

The current environment highlights the need for diversification beyond traditional stocks and bonds.

H4: Real Assets and Inflation Hedges

Assets like Treasury Inflation-Protected Securities (TIPS) or real estate investment trusts (REITs) can provide essential hedges against sustained inflation, offering returns that are potentially less correlated with traditional equity indices.

H4: Quality Over Quantity

Focus on companies with strong balance sheets, consistent cash flows, and pricing power. These "quality" stocks often outperform during economic contractions, mitigating risk within the equity portion of your IRA.

Long-Term Perspective: Contribution Limits and E-E-A-T Adherence

While reacting to trends is necessary, the core of IRA success relies on consistent adherence to fundamental principles and annual limits set by the IRS. Maxing out contributions, especially when market valuations are low, provides maximum long-term benefit.

Ensure you are utilizing the "Catch-Up Contribution" if you are over 50. Ignoring these maximum allowable limits is leaving free growth on the table, regardless of market conditions. For the most up-to-date contribution rules, always check the source: IRS IRA Contribution Limits.

The chart below summarizes how the current economic cycle impacts the typical investor using either IRA type:

| Factor | Traditional IRA Impact | Roth IRA Impact |

|---|---|---|

| Inflation Risk | High; Future tax bill based on inflated nominal value, reducing real withdrawal power. | Lower; Withdrawals are tax-free, protecting against future tax rate hikes/inflation adjustments. |

| Market Decline Opportunity | Good for buying low, but deferred tax liability remains large. | Excellent; Ideal time for Roth conversion or maximizing contributions to lock in tax-free growth. |

| Interest Rate Hikes | Negative for bond holdings; potential drag on conservative portfolios. | Similar bond impact, but higher cash yields offer temporary opportunity in money markets. |

Conclusion: The Necessity of Active Management in Modern IRAs

The age of passive investing based on historical averages needs an aggressive update. The reality of IRAs and Market Impacts: Why Recent Trends Matter dictates that retirement savers must adopt a dynamic, actively informed approach. The recent trends—high inflation, elevated interest rates, and geopolitical shifts—are not temporary blips; they are foundational economic shifts.

By understanding how these forces uniquely affect your Traditional or Roth IRA, adjusting portfolio allocations, and maximizing tax-advantaged contributions, you can navigate volatility and secure your financial future.

[Baca Juga: Advanced Risk Management for Pre-Retirees]Frequently Asked Questions (FAQ)

Should I stop contributing to my IRA during a major market downturn?

Absolutely not. Market downturns are arguably the best time to contribute to an IRA. You are buying assets at lower prices, which maximizes your potential tax-advantaged growth when the market eventually recovers (known as dollar-cost averaging).

Is now a good time to perform a Roth conversion?

For many, yes. If your IRA portfolio assets have declined in value, converting them to a Roth IRA now means you pay less tax on the conversion amount. The subsequent growth will be tax-free, making it a highly effective strategy for volatile periods.

How should I adjust my bond holdings given high interest rates?

Instead of relying purely on long-duration bonds (which are highly sensitive to rate hikes), consider shifting to short-duration bond funds, CDs, or high-yield savings accounts. These offer better current yields and less principal risk than long-term fixed income in a rising rate environment.

What is the most effective hedge against current inflation within an IRA?

While no single asset is a perfect hedge, a diversified mix of commodities (via funds), TIPS (Treasury Inflation-Protected Securities), and real estate exposure (via REITs or private funds) typically offers the best protection against persistent cost increases.

IRAs and Market Impacts: Why Recent Trends Matter

IRAs and Market Impacts: Why Recent Trends Matter Wallpapers

Collection of iras and market impacts: why recent trends matter wallpapers for your desktop and mobile devices.

Amazing Iras And Market Impacts: Why Recent Trends Matter Scene in HD

Discover an amazing iras and market impacts: why recent trends matter background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene Iras And Market Impacts: Why Recent Trends Matter Abstract Photography

Experience the crisp clarity of this stunning iras and market impacts: why recent trends matter image, available in high resolution for all your screens.

Lush Iras And Market Impacts: Why Recent Trends Matter Artwork Concept

Immerse yourself in the stunning details of this beautiful iras and market impacts: why recent trends matter wallpaper, designed for a captivating visual experience.

Detailed Iras And Market Impacts: Why Recent Trends Matter Image Concept

Discover an amazing iras and market impacts: why recent trends matter background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Iras And Market Impacts: Why Recent Trends Matter Artwork Concept

A captivating iras and market impacts: why recent trends matter scene that brings tranquility and beauty to any device.

Crisp Iras And Market Impacts: Why Recent Trends Matter Design Photography

Find inspiration with this unique iras and market impacts: why recent trends matter illustration, crafted to provide a fresh look for your background.

Captivating Iras And Market Impacts: Why Recent Trends Matter Capture Art

This gorgeous iras and market impacts: why recent trends matter photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating Iras And Market Impacts: Why Recent Trends Matter Abstract in HD

Immerse yourself in the stunning details of this beautiful iras and market impacts: why recent trends matter wallpaper, designed for a captivating visual experience.

Serene Iras And Market Impacts: Why Recent Trends Matter Background Illustration

Discover an amazing iras and market impacts: why recent trends matter background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Spectacular Iras And Market Impacts: Why Recent Trends Matter Photo for Your Screen

A captivating iras and market impacts: why recent trends matter scene that brings tranquility and beauty to any device.

Spectacular Iras And Market Impacts: Why Recent Trends Matter Scene in 4K

This gorgeous iras and market impacts: why recent trends matter photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush Iras And Market Impacts: Why Recent Trends Matter Picture Concept

Find inspiration with this unique iras and market impacts: why recent trends matter illustration, crafted to provide a fresh look for your background.

Crisp Iras And Market Impacts: Why Recent Trends Matter View for Desktop

Find inspiration with this unique iras and market impacts: why recent trends matter illustration, crafted to provide a fresh look for your background.

Vivid Iras And Market Impacts: Why Recent Trends Matter Capture Concept

Experience the crisp clarity of this stunning iras and market impacts: why recent trends matter image, available in high resolution for all your screens.

Beautiful Iras And Market Impacts: Why Recent Trends Matter Image for Desktop

Explore this high-quality iras and market impacts: why recent trends matter image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality Iras And Market Impacts: Why Recent Trends Matter Photo Art

Experience the crisp clarity of this stunning iras and market impacts: why recent trends matter image, available in high resolution for all your screens.

Gorgeous Iras And Market Impacts: Why Recent Trends Matter Picture in HD

Find inspiration with this unique iras and market impacts: why recent trends matter illustration, crafted to provide a fresh look for your background.

Gorgeous Iras And Market Impacts: Why Recent Trends Matter Wallpaper Photography

This gorgeous iras and market impacts: why recent trends matter photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Iras And Market Impacts: Why Recent Trends Matter View Photography

Discover an amazing iras and market impacts: why recent trends matter background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Captivating Iras And Market Impacts: Why Recent Trends Matter Moment Art

This gorgeous iras and market impacts: why recent trends matter photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these iras and market impacts: why recent trends matter wallpapers for free and use them on your desktop or mobile devices.