Global stock markets fall sharply over AI bubble fears

Global stock markets fall sharply over AI bubble fears

The financial world is reeling this week as investors confront a harsh reality: global stock markets fall sharply over AI bubble fears. Major indices across the US, Europe, and Asia have experienced significant losses, wiping out billions in value that were fueled by the euphoric promise of Artificial Intelligence.

If you've checked your portfolio recently, you know the volatility is intense. This sudden and widespread sell-off marks a critical turning point. The market's confidence in the seemingly endless growth potential of Generative AI companies is now being seriously questioned by institutional investors.

Is this merely a healthy correction, or are we witnessing the beginning of a larger, more painful bubble burst? We need to dive into the core triggers and strategic outlooks right now.

What Triggered the Sell-Off? Understanding the AI Bubble Anxiety

The primary driver behind the recent downturn is a mounting concern over valuations. For the last 18 months, AI-exposed stocks have enjoyed stratospheric gains, often based on future promises rather than current profitability.

Several high-profile earnings reports recently failed to meet the lofty expectations set by the market. This sparked a rush for the exits. When growth rates slow even slightly, investors holding massively overvalued stocks often panic, leading to cascading selling pressure.

Furthermore, analysts are now openly questioning the total addressable market (TAM) for many AI applications. While AI is transformative, the infrastructure required is incredibly expensive, and the competition is heating up rapidly.

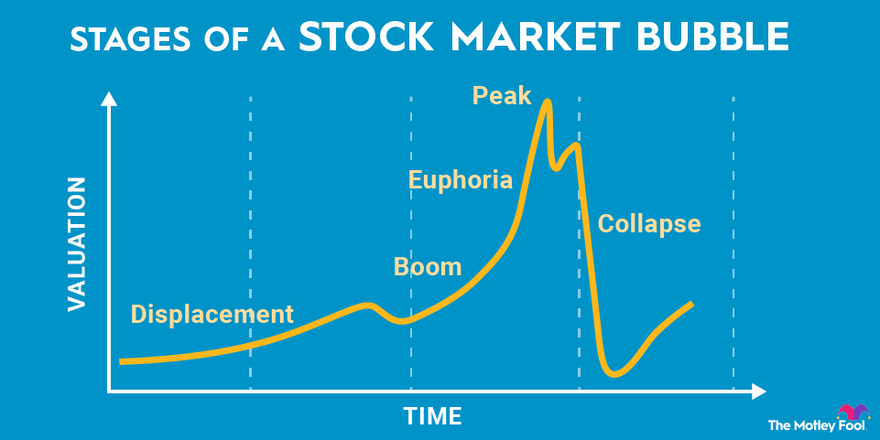

Parallels to the Dot-Com Bust: History Rhymes, Not Repeats

It is impossible to discuss the current environment without drawing comparisons to the late 1990s. While today's companies generally possess stronger balance sheets and actual revenue streams, the underlying enthusiasm and speculative trading feel eerily similar to the Dot-Com era.

The fear is that many smaller, non-profitable AI startups could face collapse if venture capital funding dries up during this correction. This sentiment is fueling the narrative that global stock markets fall sharply over AI bubble fears, recalling the volatility of twenty years ago.

We can identify key areas where the current situation mirrors the Dot-Com bust:

- **Focus on Potential:** Valuations are often calculated based on revenue projections five or more years out, ignoring current cash flow realities.

- **Retail Hype:** Significant participation by less experienced retail traders chasing quick, exponential gains in "must-own" AI stocks.

- **Over-Concentration:** A massive portion of market gains is concentrated in a handful of leading tech giants, making the entire market highly susceptible to their individual performance.

Key Companies Experiencing the Sharpest Declines

The decline is not uniform; it is heavily concentrated among companies seen as central to the AI revolution. Chipmakers, specifically those specializing in AI accelerators, have taken a severe beating due to profit-taking and fears of slowing hyperscaler spending.

Software and platform companies that heavily invested in integrating GenAI features are also seeing their multiples compress. Investors are asking: does this AI feature truly justify a 50x earnings multiple?

Here are some sectors feeling the most pressure:

- Semiconductor manufacturers linked to Data Center GPU sales.

- Cloud service providers with high exposure to capital expenditures (CapEx).

- Newly public SaaS companies whose entire thesis relies on disruptive AI technology.

- Robotics and autonomous vehicle technology firms, often labeled under the broad "AI" umbrella.

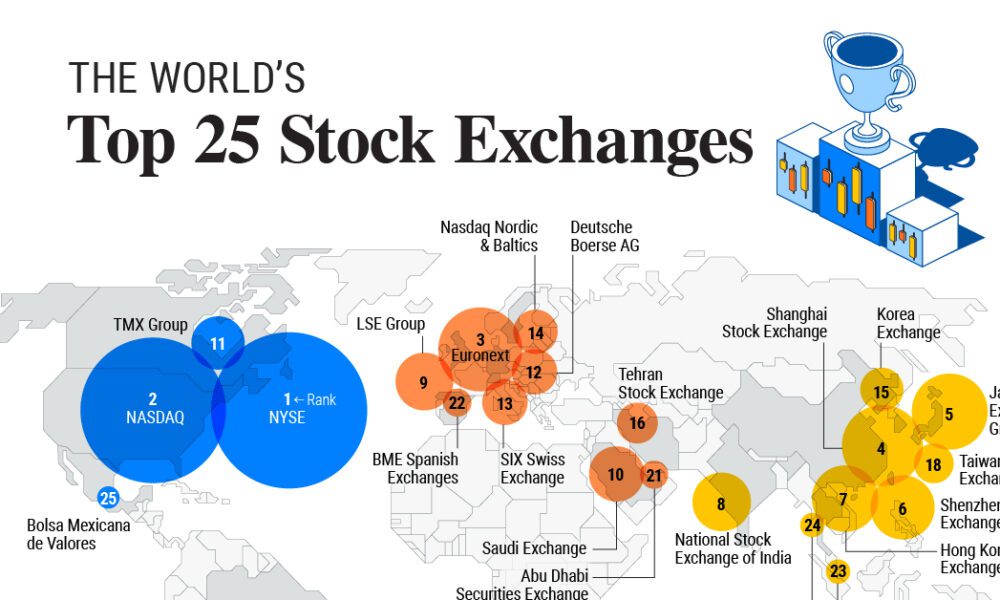

The Impact Across Continents: Volatility from Wall Street to Asia

The interconnected nature of modern finance means that when Wall Street sneezes, the rest of the world catches a cold. This correction is truly global. Asian tech hubs, particularly those in Korea and Taiwan which supply crucial AI hardware, have seen corresponding sharp declines.

European markets, while perhaps less exposed to pure AI plays, are suffering from the overall bearish sentiment. Economic uncertainty, coupled with high interest rates in some regions, exacerbates the anxiety sparked by the tech sector sell-off.

Furthermore, capital flight from emerging markets often accelerates during periods of developed market volatility. This creates a challenging environment for diversification outside of the immediate AI sector.

How Major Indices Reacted (S&P 500, Nasdaq, Nikkei)

The Nasdaq Composite, heavily weighted toward technology, has been the epicenter of the crisis. It entered official correction territory, dropping more than 10% from its recent peak in just a few trading sessions. This swift movement underscores the depth of concern.

The broader S&P 500 is also down significantly, demonstrating that the pain is spreading beyond pure tech stocks. When companies like Nvidia and Microsoft drop, the sheer weight of their market capitalization drags the entire index lower.

In Asia, the ripple effect was immediately felt. The Nikkei in Japan, which has recently enjoyed strong growth due to semiconductor linkage, experienced its steepest single-day drop in months. This confirms that the narrative—that global stock markets fall sharply over AI bubble fears—is now driving investor behavior everywhere.

Investor Strategy Amidst the Downturn: Should You Panic?

For the average investor, emotional decision-making is the biggest threat during market corrections. The immediate impulse is often to sell everything to prevent further loss.

However, financial advisors stress the importance of maintaining a long-term perspective. Corrections are a normal, inevitable part of the market cycle. They often cleanse excesses and create opportunities for disciplined investors.

Now is the time to review your allocation and risk tolerance. Do your current holdings still align with your financial goals? Avoid trying to perfectly time the bottom; focus instead on quality assets.

Identifying Stable Sectors Outside of High-Flying Tech

While the tech sector takes a hit, certain defensive sectors typically prove more resilient during broad market downturns. These areas provide essential goods and services, meaning demand remains relatively stable regardless of economic volatility.

Looking for companies with strong dividend yields, low debt, and predictable earnings can provide a crucial ballast for your portfolio. This stability can help offset the sharp movements seen in growth stocks.

Consider focusing on these defensive areas during the current instability:

- **Consumer Staples:** Companies that produce household goods, food, and beverages (people still buy groceries, even during a recession).

- **Utilities:** Electric, gas, and water providers are regulated monopolies with highly predictable cash flows.

- **Healthcare:** Demand for essential pharmaceuticals, medical devices, and health services is non-cyclical.

- **Value Stocks:** Companies trading at low price-to-earnings ratios, which may have been ignored during the AI frenzy.

Conclusion

The current environment where global stock markets fall sharply over AI bubble fears is unnerving, but it is not unprecedented. The sharp correction is a necessary adjustment, forcing the market to distinguish between genuine technological progress and speculative froth.

While the short-term outlook remains volatile, the underlying technology of AI is undeniably transformative. The key difference between now and previous bubbles is that AI is generating real, though highly concentrated, revenue today.

Investors must exercise caution, embrace diversification, and prioritize companies with robust fundamentals. Navigating this downturn requires patience and a commitment to long-term investment principles, rather than succumbing to panic.

Frequently Asked Questions (FAQ)

- What exactly is meant by the "AI Bubble"?

- The AI Bubble refers to the theory that the valuations of many companies associated with Artificial Intelligence have far outpaced their actual current earnings or reasonable near-term profit expectations, driven primarily by speculative enthusiasm.

- Is this correction worse than the 2020 COVID crash?

- The nature of the crash is different. The COVID crash was driven by unexpected economic shutdowns; this downturn is focused specifically on valuation and sector concentration risks within technology. While the percentage drop in the Nasdaq is significant, the overall economic backdrop is currently stronger than it was in March 2020.

- Will AI technology companies disappear if the bubble bursts?

- No. AI is a foundational technology. A burst bubble primarily means that stock prices will drop significantly, especially for non-profitable or poorly managed companies. The market correction cleanses speculative excesses, but the leading companies with strong technology and market share will likely survive and consolidate their position.

- How long might it take for the market to recover?

- Recovery times vary widely. If the correction is truly related to an AI bubble bursting, volatility could persist for several quarters as investors re-price assets based on realistic earnings projections. However, broad market recoveries historically average around 12 to 18 months, depending on macroeconomic factors like inflation and interest rates.

Global stock markets fall sharply over AI bubble fears

Global stock markets fall sharply over AI bubble fears Wallpapers

Collection of global stock markets fall sharply over ai bubble fears wallpapers for your desktop and mobile devices.

Spectacular Global Stock Markets Fall Sharply Over Ai Bubble Fears Landscape Collection

Immerse yourself in the stunning details of this beautiful global stock markets fall sharply over ai bubble fears wallpaper, designed for a captivating visual experience.

Exquisite Global Stock Markets Fall Sharply Over Ai Bubble Fears Landscape for Mobile

Immerse yourself in the stunning details of this beautiful global stock markets fall sharply over ai bubble fears wallpaper, designed for a captivating visual experience.

Crisp Global Stock Markets Fall Sharply Over Ai Bubble Fears Design for Your Screen

Find inspiration with this unique global stock markets fall sharply over ai bubble fears illustration, crafted to provide a fresh look for your background.

Artistic Global Stock Markets Fall Sharply Over Ai Bubble Fears Wallpaper Nature

This gorgeous global stock markets fall sharply over ai bubble fears photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Gorgeous Global Stock Markets Fall Sharply Over Ai Bubble Fears Photo Nature

A captivating global stock markets fall sharply over ai bubble fears scene that brings tranquility and beauty to any device.

Breathtaking Global Stock Markets Fall Sharply Over Ai Bubble Fears Wallpaper Digital Art

Explore this high-quality global stock markets fall sharply over ai bubble fears image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking Global Stock Markets Fall Sharply Over Ai Bubble Fears Wallpaper in HD

Discover an amazing global stock markets fall sharply over ai bubble fears background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite Global Stock Markets Fall Sharply Over Ai Bubble Fears Picture Nature

Immerse yourself in the stunning details of this beautiful global stock markets fall sharply over ai bubble fears wallpaper, designed for a captivating visual experience.

Stunning Global Stock Markets Fall Sharply Over Ai Bubble Fears Background Art

Find inspiration with this unique global stock markets fall sharply over ai bubble fears illustration, crafted to provide a fresh look for your background.

Serene Global Stock Markets Fall Sharply Over Ai Bubble Fears Design Photography

Discover an amazing global stock markets fall sharply over ai bubble fears background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vivid Global Stock Markets Fall Sharply Over Ai Bubble Fears Landscape for Mobile

Experience the crisp clarity of this stunning global stock markets fall sharply over ai bubble fears image, available in high resolution for all your screens.

Spectacular Global Stock Markets Fall Sharply Over Ai Bubble Fears Artwork Art

This gorgeous global stock markets fall sharply over ai bubble fears photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush Global Stock Markets Fall Sharply Over Ai Bubble Fears Artwork in 4K

Immerse yourself in the stunning details of this beautiful global stock markets fall sharply over ai bubble fears wallpaper, designed for a captivating visual experience.

Gorgeous Global Stock Markets Fall Sharply Over Ai Bubble Fears Abstract Concept

Immerse yourself in the stunning details of this beautiful global stock markets fall sharply over ai bubble fears wallpaper, designed for a captivating visual experience.

Lush Global Stock Markets Fall Sharply Over Ai Bubble Fears View Photography

This gorgeous global stock markets fall sharply over ai bubble fears photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular Global Stock Markets Fall Sharply Over Ai Bubble Fears Abstract Photography

Immerse yourself in the stunning details of this beautiful global stock markets fall sharply over ai bubble fears wallpaper, designed for a captivating visual experience.

Stunning Global Stock Markets Fall Sharply Over Ai Bubble Fears Abstract for Your Screen

Find inspiration with this unique global stock markets fall sharply over ai bubble fears illustration, crafted to provide a fresh look for your background.

Stunning Global Stock Markets Fall Sharply Over Ai Bubble Fears Capture Nature

A captivating global stock markets fall sharply over ai bubble fears scene that brings tranquility and beauty to any device.

Breathtaking Global Stock Markets Fall Sharply Over Ai Bubble Fears Moment Art

Experience the crisp clarity of this stunning global stock markets fall sharply over ai bubble fears image, available in high resolution for all your screens.

Spectacular Global Stock Markets Fall Sharply Over Ai Bubble Fears Abstract in 4K

Find inspiration with this unique global stock markets fall sharply over ai bubble fears illustration, crafted to provide a fresh look for your background.

Download these global stock markets fall sharply over ai bubble fears wallpapers for free and use them on your desktop or mobile devices.