Fuel prices tumble in November

Fuel prices tumble in November: A Comprehensive Trending Update

If you've been dreading your weekly trip to the pump, we have some excellent news for you. Following weeks of gradual decline, the highly anticipated energy shift has finally arrived: Fuel prices tumble in November across numerous markets, offering significant relief to consumers and businesses alike. This dramatic reversal is a pivotal moment in the energy sector, driven by a complex interplay of global supply dynamics and tempering demand forecasts.

For millions of motorists, this drop translates directly into substantial savings just as the holiday season approaches. But why exactly are fuel prices experiencing such a steep decline, and can we expect this trend to hold into the new year? We dive deep into the factors driving the market shift, analyzing the geopolitical and economic pressures that have caused fuel prices to suddenly collapse.

Understanding the forces behind this downward trend is crucial for planning your budget and anticipating future market behavior. Let's break down the key elements contributing to why Fuel prices tumble in November.

Analyzing the Steep Decline in Fuel Costs

The core reason behind the drop is a shift in the fundamental supply-demand equation globally. For much of the year, supply constraints and heightened geopolitical tensions kept prices artificially inflated. However, November saw several key factors converge, overwhelming the bullish market sentiment that had previously dominated.

A primary driver has been the unexpectedly robust output from non-OPEC+ nations, particularly the United States. Coupled with softening global demand projections—partially linked to economic slowdowns in major consuming nations—the market quickly moved from a deficit expectation to a surplus reality. This is the mechanism that allowed Fuel prices tumble in November with such severity.

Decoding Global Oil Supply Surpluses

Crucially, the decisions made by major oil-producing entities have played a massive role. While OPEC+ maintained tight control over their quotas, the rise in production elsewhere has negated some of their efforts to prop up prices. Market traders reacted swiftly to these supply figures, pushing crude oil benchmarks like Brent and WTI significantly lower.

Furthermore, concerns over the effectiveness of current production cuts have spooked the market. Investors worry that adherence to quotas might slip, leading to an even greater glut. The combination of high current inventory and future uncertainty drove rapid selling in the futures market.

Key factors contributing to the supply surplus include:

- Record high output from U.S. shale fields.

- Weaker-than-expected compliance with voluntary production cuts by some allied nations.

- A reduction in seasonal demand in some northern hemisphere regions post-summer driving season.

- Increased storage capacity usage indicating ample supply buffers.

The Role of Inventory and Futures Trading

Inventory levels are a strong indicator of immediate supply health. November saw consistent, unexpected builds in crude oil and gasoline inventories, particularly in the United States. When inventory builds are higher than forecasted, it signals that refiners and distributors have plenty of stock, easing immediate price pressure.

This physical market reality was amplified by futures trading. Speculators who had bet on higher prices quickly liquidated their positions when the data pointed toward a surplus. This wave of selling accelerated the drop, causing a domino effect that ensured Fuel prices tumble in November rapidly.

Real Savings: What the Tumble Means for Your Wallet

The most tangible result of this price reduction is the immediate relief felt by consumers. Reduced fuel costs act as a form of non-taxable stimulus, putting more discretionary income back into household budgets. This is particularly timely, given the persistent high costs associated with inflation in other sectors.

Economists suggest that a significant and sustained drop in fuel prices can also help moderate overall inflation rates, as transportation costs are embedded in the price of nearly every good and service. This ripple effect benefits the economy far beyond the gas pump.

Here is how the drop impacts daily life and finances:

- **Reduced Commuting Costs:** Daily drivers and delivery service workers see instant, direct savings on operational expenses.

- **Lower Shipping and Logistics Costs:** Companies transport goods more cheaply, potentially leading to lower retail prices for consumer products in the coming weeks.

- **Holiday Travel Boost:** Families planning travel for Thanksgiving and Christmas benefit significantly from cheaper airfare (linked to jet fuel) and lower road trip costs.

- **Increased Discretionary Spending:** Savings at the pump can be redirected to other purchases, supporting general economic activity.

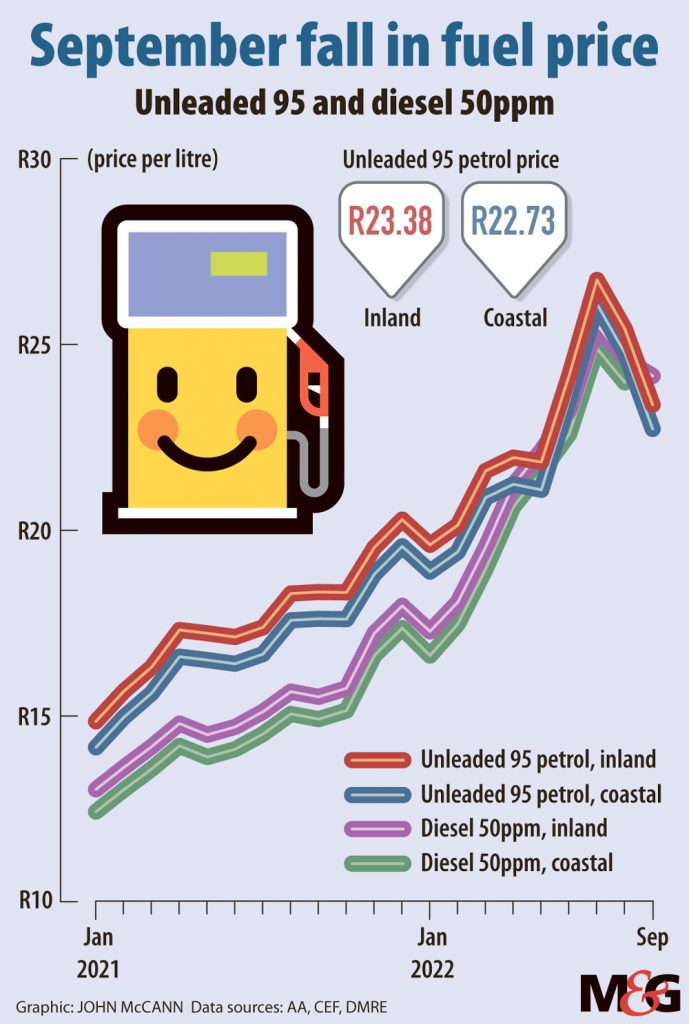

Regional Variations in Price Drops

While the overall trend confirms that Fuel prices tumble in November, it is important to note that the degree of the drop varies by region. Local taxes, state-specific refining costs, and distribution infrastructure influence the final price at the pump.

Coastal regions, often closer to major refining hubs, sometimes see the price change reflected faster than rural areas. Conversely, regions with high environmental taxes or complex blending requirements might see their baseline prices remain higher, even with the drop in crude oil costs.

Looking Ahead: Energy Market Outlook Post-November

The big question now is whether the market can sustain these lower prices. The momentum gathered when Fuel prices tumble in November suggests a prolonged period of modest pricing is possible, provided current supply dynamics remain stable.

However, volatility is inherent in the energy market. Any unexpected supply disruption, such as a major storm in a key producing region or a dramatic shift in geopolitical tensions, could reverse this trend almost instantly. Additionally, OPEC+ is closely monitoring the situation and may announce deeper cuts if they feel prices have fallen too far below their comfort level.

Geopolitical Stability and Crude Oil Benchmarks

The ongoing situation in the Middle East continues to pose the largest risk to price stability. While current conflict has not directly impacted major supply routes, the risk premium remains built into the price structure. Any escalation could quickly send benchmarks spiking upward, erasing the gains consumers have enjoyed.

Market analysts are currently watching the upcoming OPEC+ meetings very closely. Their collective decision on production targets for the first quarter of the next year will largely dictate whether we see further declines or a stabilization (or even slight rebound) from the current low prices achieved as Fuel prices tumble in November.

Consumer Expectations for the Winter Season

Traditionally, winter months bring an overall reduction in gasoline demand, as less driving occurs. This seasonal pattern typically reinforces lower prices, barring significant cold snaps that dramatically increase demand for heating oil or natural gas, which can indirectly influence crude prices.

Therefore, if global stability holds and production remains strong, consumers can reasonably expect these favorable prices, which began when Fuel prices tumble in November, to continue providing budgetary relief through much of the early part of the new year.

Conclusion: Seizing the Moment of Savings

The dramatic news that Fuel prices tumble in November is a welcome development, rooted primarily in robust global supply exceeding tempered demand expectations. This trend offers immediate, tangible savings for consumers and acts as a beneficial deflationary force in the wider economy.

While the long-term outlook remains susceptible to geopolitical risks and OPEC+ decisions, the current market structure favors continued price moderation. Motorists should enjoy these lower prices while keeping a watchful eye on international events that could swiftly shift the supply-demand balance back in favor of high costs. For now, however, fill up and enjoy the extra cash in your pocket.

Frequently Asked Questions (FAQ)

- Why did fuel prices tumble specifically in November?

- The price drop in November was triggered by a confluence of factors, including higher-than-expected crude oil inventory builds, record U.S. production levels, and weakened global demand forecasts due to economic concerns. This surplus supply quickly shifted market sentiment.

- Is this price drop expected to last?

- While current market fundamentals (high supply) support continued low prices, sustainability depends heavily on two volatile factors: future decisions by OPEC+ regarding production cuts and the stability of geopolitical situations, particularly in oil-producing regions.

- How much of the price drop is reflected in the retail price?

- Retail prices generally lag behind crude oil price drops, but the impact is significant. The exact percentage varies regionally based on state taxes, local refining costs, and distribution markups. Most consumers are seeing substantial relief at the pump compared to mid-year highs.

- Does the drop in crude oil price affect heating oil prices?

- Yes. Crude oil is the primary feedstock for heating oil (distillate fuel). When crude prices drop significantly, heating oil prices usually follow suit, offering dual relief to consumers who rely on both gasoline for transportation and oil for home heating.

- What should consumers watch for that could cause prices to rise again?

- Consumers should closely watch for announcements from the OPEC+ coalition regarding deeper production cuts, major infrastructure disruptions (like pipeline failures), and any significant escalation of international conflicts near key oil chokepoints.

Fuel prices tumble in November

Fuel prices tumble in November Wallpapers

Collection of fuel prices tumble in november wallpapers for your desktop and mobile devices.

Artistic Fuel Prices Tumble In November Artwork for Desktop

This gorgeous fuel prices tumble in november photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid Fuel Prices Tumble In November Photo Photography

Experience the crisp clarity of this stunning fuel prices tumble in november image, available in high resolution for all your screens.

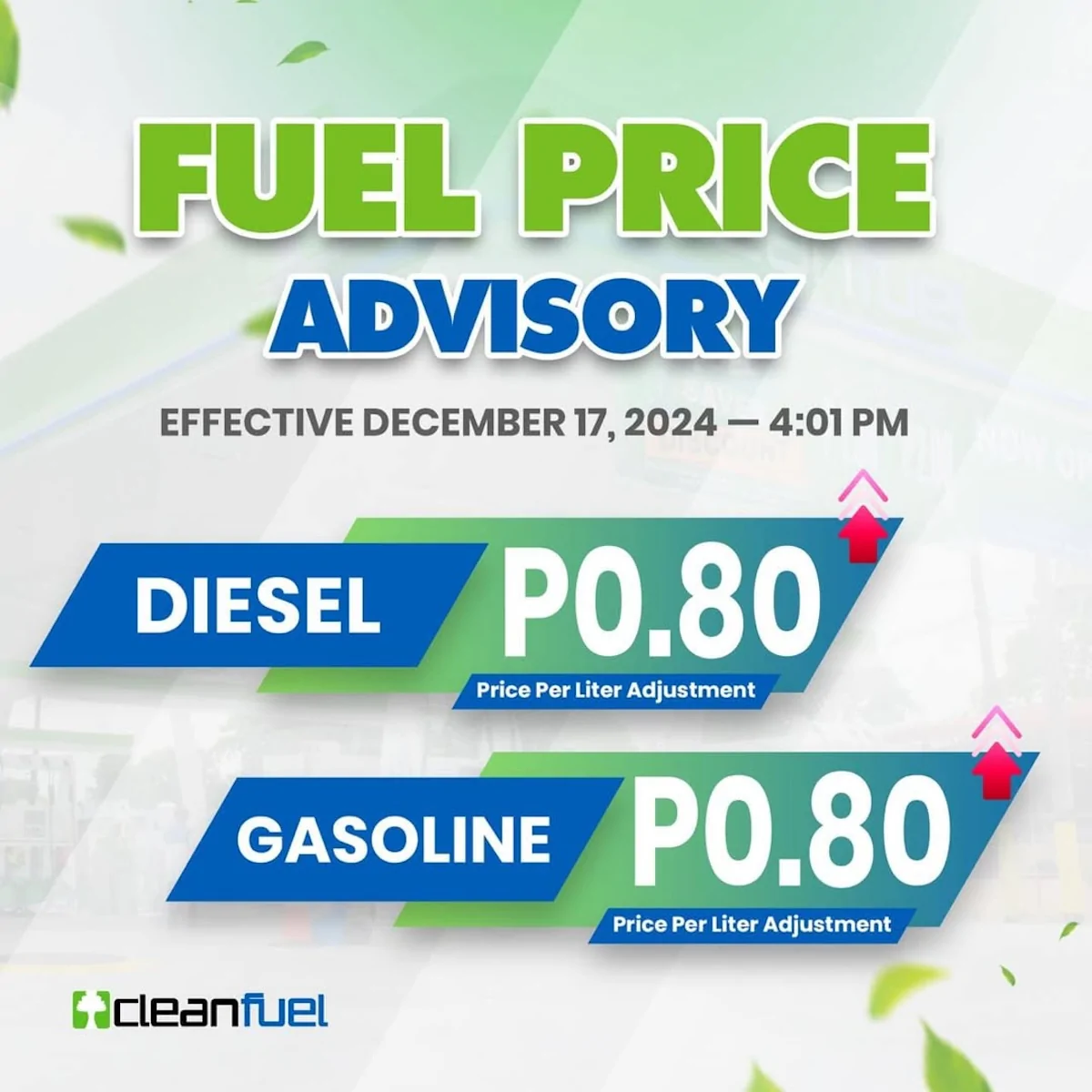

Stunning Fuel Prices Tumble In November Photo in HD

Find inspiration with this unique fuel prices tumble in november illustration, crafted to provide a fresh look for your background.

Vivid Fuel Prices Tumble In November Artwork in 4K

Explore this high-quality fuel prices tumble in november image, perfect for enhancing your desktop or mobile wallpaper.

Captivating Fuel Prices Tumble In November Artwork for Desktop

Find inspiration with this unique fuel prices tumble in november illustration, crafted to provide a fresh look for your background.

Mesmerizing Fuel Prices Tumble In November Image in HD

Experience the crisp clarity of this stunning fuel prices tumble in november image, available in high resolution for all your screens.

Vivid Fuel Prices Tumble In November Picture Digital Art

Discover an amazing fuel prices tumble in november background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic Fuel Prices Tumble In November Scene Digital Art

Immerse yourself in the stunning details of this beautiful fuel prices tumble in november wallpaper, designed for a captivating visual experience.

Vivid Fuel Prices Tumble In November Design Nature

Explore this high-quality fuel prices tumble in november image, perfect for enhancing your desktop or mobile wallpaper.

Vivid Fuel Prices Tumble In November Photo Digital Art

Explore this high-quality fuel prices tumble in november image, perfect for enhancing your desktop or mobile wallpaper.

Exquisite Fuel Prices Tumble In November Landscape Illustration

A captivating fuel prices tumble in november scene that brings tranquility and beauty to any device.

Breathtaking Fuel Prices Tumble In November Picture Art

Discover an amazing fuel prices tumble in november background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed Fuel Prices Tumble In November Abstract Collection

Transform your screen with this vivid fuel prices tumble in november artwork, a true masterpiece of digital design.

Amazing Fuel Prices Tumble In November Wallpaper Nature

Experience the crisp clarity of this stunning fuel prices tumble in november image, available in high resolution for all your screens.

Detailed Fuel Prices Tumble In November Design Illustration

Discover an amazing fuel prices tumble in november background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous Fuel Prices Tumble In November Background Nature

Immerse yourself in the stunning details of this beautiful fuel prices tumble in november wallpaper, designed for a captivating visual experience.

Stunning Fuel Prices Tumble In November Scene Collection

A captivating fuel prices tumble in november scene that brings tranquility and beauty to any device.

Artistic Fuel Prices Tumble In November Scene Illustration

A captivating fuel prices tumble in november scene that brings tranquility and beauty to any device.

Artistic Fuel Prices Tumble In November Abstract Nature

Immerse yourself in the stunning details of this beautiful fuel prices tumble in november wallpaper, designed for a captivating visual experience.

Spectacular Fuel Prices Tumble In November Landscape in 4K

This gorgeous fuel prices tumble in november photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these fuel prices tumble in november wallpapers for free and use them on your desktop or mobile devices.