Capitec Bank Loan Applications

Capitec Bank Loan Applications: A Comprehensive Guide to Products, Requirements, and Process

I. Introduction to Capitec Bank's Lending Solutions

Capitec Bank has established itself as a prominent financial institution committed to providing accessible and transparent credit solutions. The bank's operational philosophy centers on simplifying financial management for its clientele, offering personalized credit offers and leveraging digital convenience to enhance the customer experience. This approach is evident in its emphasis on tailoring financial products to individual affordability and credit profiles.

The bank's strategic direction heavily leans into a digital-first origination model. The repeated emphasis on online and mobile application channels for various loan products, coupled with the absence of a readily available, generic "application form" for new loans in its public documents library, indicates a deliberate shift. This is not merely about offering convenience; it represents a fundamental transformation designed to streamline internal processes, reduce administrative overhead, and potentially accelerate decision-making through automated affordability assessments. This digital emphasis empowers customers by enabling them to apply from virtually any location, at any time, aligning with contemporary consumer expectations for instant access and self-service capabilities.

Capitec offers a diverse portfolio of credit products designed to cater to a wide array of financial needs. This includes personal loans for general purposes, access facilities that provide revolving credit, specialized home loans, credit for home improvement projects, and vehicle loans. Each of these products is structured with distinct features, benefits, and repayment terms to suit different client requirements.

II. General Application Pathways and Foundational Requirements

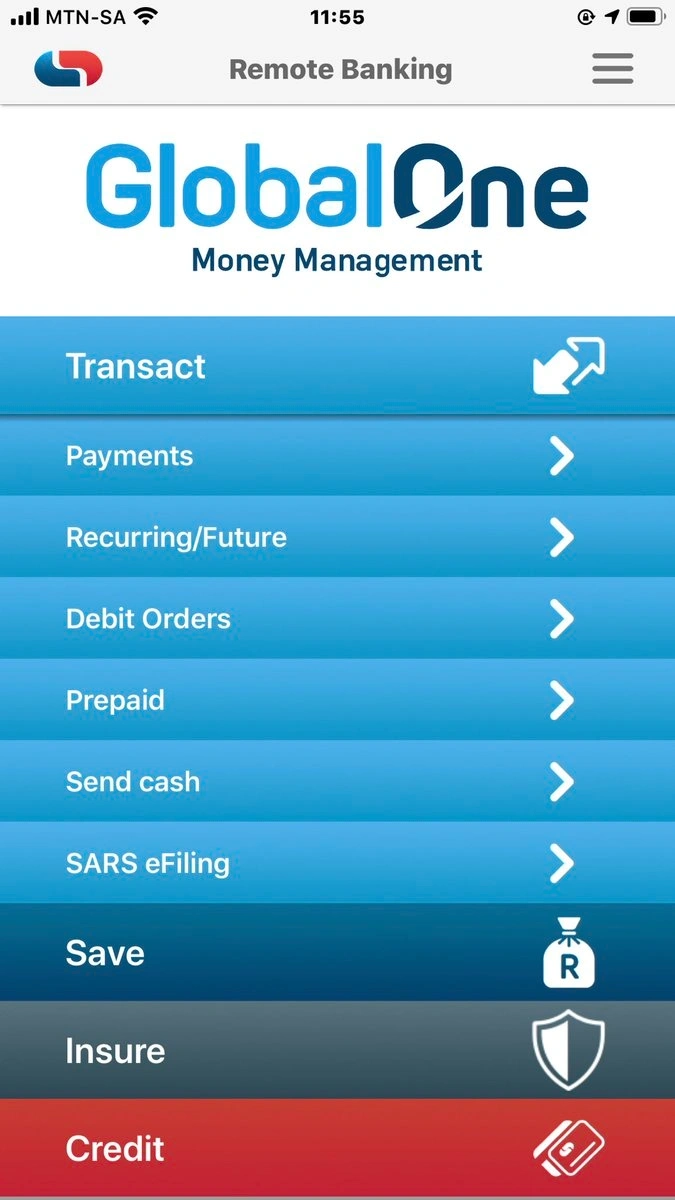

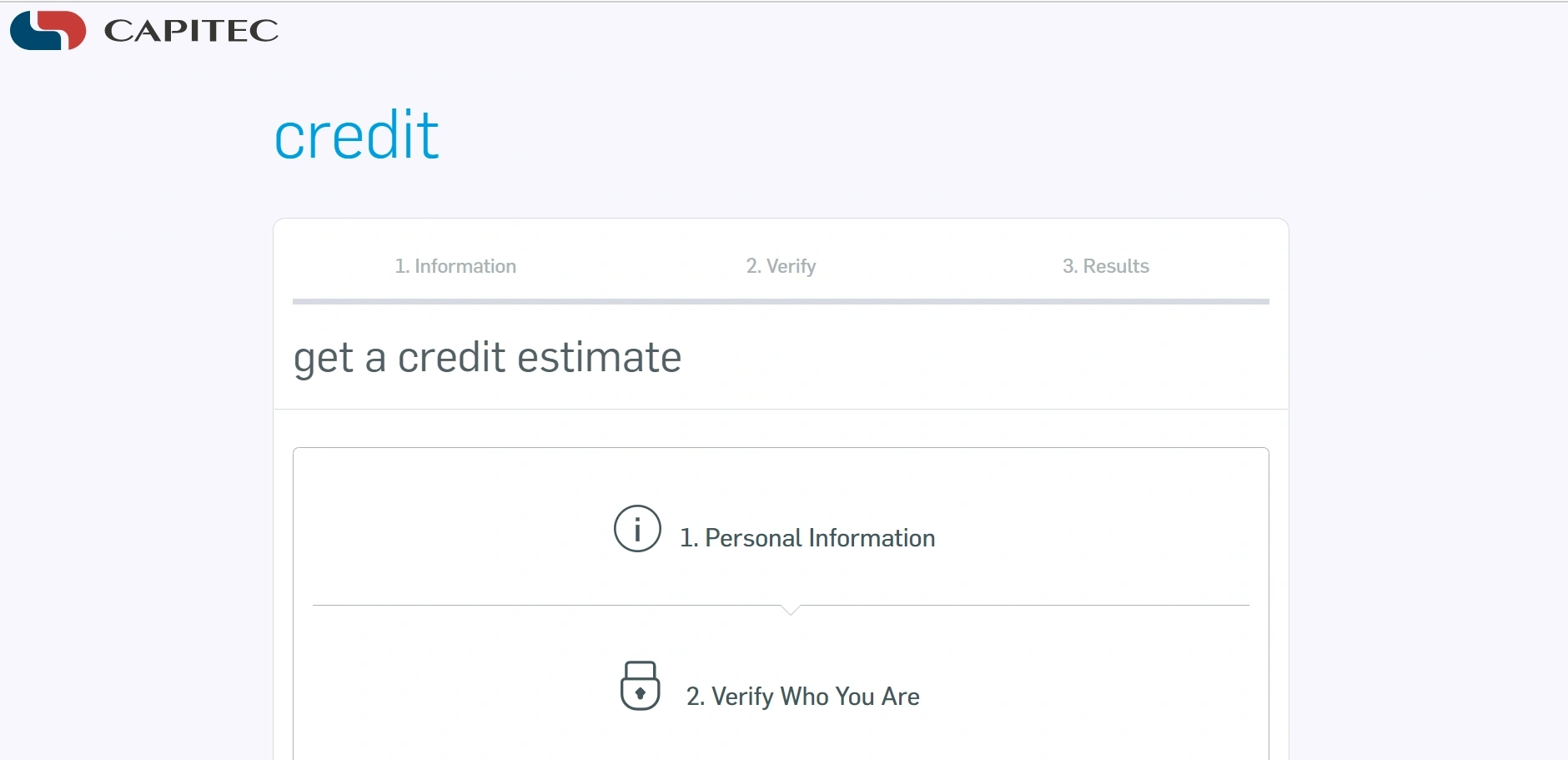

Capitec Bank facilitates loan applications through a multi-channel approach, ensuring broad accessibility for its diverse customer base. The primary and most frequently highlighted application methods include the mobile application and online platform, which are the preferred channels for personal loans, access facilities, and even for initiating home and vehicle loan applications.

The maintenance of multiple access points, despite a clear prioritization of digital channels, reflects a strategic understanding of varied customer segments. Not all potential borrowers possess the same level of technological comfort or access, and some may prefer traditional banking interactions. By offering a hybrid model, Capitec ensures it can serve a broader demographic, effectively bridging any digital divide and maximizing its market reach. This inclusive approach balances the pursuit of operational efficiency with the imperative of catering to diverse client preferences.

To be eligible for any Capitec loan product, applicants must meet fundamental age and income criteria and provide standard identification and proof of income. Generally, applicants must be 18 years or older.

The consistent requirement for detailed financial documentation, such as salary slips and bank statements (especially for non-Capitec accounts), underscores a robust, data-driven framework for assessing affordability and managing risk. This process goes beyond merely confirming an income; it involves analyzing the consistency and source of funds to construct a comprehensive credit profile. This meticulous evaluation enables the bank to offer personalized interest rates and loan offers that are genuinely based on an applicant's financial capacity and credit history, moving beyond a simplistic credit score to a more holistic understanding of financial health and repayment capability. Such an approach aims to minimize default risk for the bank while potentially offering more favorable rates to lower-risk borrowers.

The table below summarizes the general requirements for Capitec loan applications:

| Requirement Category | Specific Details | Notes/Conditions |

|---|---|---|

| Age | 18 years or older | Mandatory for all applicants |

| Employment Status | Permanently employed, self-employed, other income, or pension | Stable income required |

| Minimum Income | Varies by product (e.g., R5,000 for credit card, R10,000 for self-employed credit card) | Specific thresholds apply to different credit facilities |

| Core Documents | Original SA ID document | Essential identification |

| Latest salary slip | Proof of current employment income | |

| Bank statement showing latest 3 consecutive salary deposits | Only if salary not paid into a Capitec account |

III. Detailed Breakdown of Capitec Loan Products and Specifics

Capitec Bank offers a range of credit products, each tailored to distinct financial needs and supported by specific application processes and documentation requirements.

A. Personal Loans and Access Facilities

Personal Loans provide up to R500,000, with repayment terms ranging from 12 to 84 months. Interest rates are personalized, starting from a minimum of 12.75% per annum. These loans are versatile and can be utilized for various personal financial requirements, including debt consolidation, which can simplify monthly repayments.

The Access Facility functions as a revolving credit line, offering up to R500,000 in available credit. A key advantage of this facility is its flexibility: clients only incur charges for the credit they actively use, and any repaid amounts become immediately available for re-use.

Beyond the general application requirements, specific documentation is necessary depending on the applicant's income structure. This detailed breakdown for various income types, from traditional salaried employment to registered businesses, informal sole proprietorships, rental income, spousal maintenance, and even commission-only earners, demonstrates Capitec's sophisticated and inclusive approach to credit assessment.

Interest rates for Capitec's term loans range from 12.75% to 28.25%, while access facilities feature rates from 12.75% to 21.25%. These rates are personalized based on the applicant's affordability and credit profile.

The table below provides a comprehensive list of documents required based on the applicant's income type for Personal Loans and Access Facilities:

Documents Required by Income Type (for Personal/Access Facility Loans)

| Income Type | Definition | Documents Required |

|---|---|---|

| Salary Earners | Income from permanent or contract employment | Latest three salary slips |

| Business Owners (Registered Business) | Income from profits generated by a registered business | 6 months bank statements from business account, Accountant letter, Proof of purchases/trade (invoices, receipts, statements) |

| Business Owners (Informal Business or Sole Proprietor) | Income from profits generated by an informal business (not a legal entity) | Proof of purchases/trade (invoices, receipts, statements) |

| Rental Income | Income from renting out a property or room | Current lease agreement(s) |

| Spousal Maintenance | Monthly income received from a spouse after divorce or separation | Court document showing the amount to be paid (divorce decree or maintenance order) |

| Allowance Income | Regular income from a benefactor | Benefactor will be asked to confirm source of payment |

| Interest Earners | Regular payouts from investment or savings portfolios into the main transactional account | Investment or savings statement |

| Commission Only Earner | Paid solely based on work performed (e.g., Uber or food delivery drivers, Airbnb) | Further documentation to be confirmed (e.g., employment contract, employment letter, invoices, evidence of work performed) |

| Salary from an International Company (SA Citizens) | South African citizens receiving salary from an employer outside South Africa | Latest three salary slips, Employment contract, 6 months bank statements from international bank account (if salary first paid there) |

| General Note | For all income types, if income is not paid into a Capitec account, latest 6-month bank statements showing all income types and amounts are required. The date stamp on bank statements must not be older than 7 days at the application date. |

B. Capitec Home Loans

The application process for a new Capitec Home Loan is primarily initiated online and is estimated to take approximately 5-10 minutes. It comprises four key steps: initial questions, personal information submission, review and confirmation of loan details, and final submission.homeloans@capitecbank.co.za. If there are two applicants, documents for both individuals must be provided.

While the initial home loan application steps are digital, the requirement to email supporting documents signifies a hybrid process. For high-value and inherently complex products like home loans, a fully automated digital verification process may not yet be sufficient or preferred. The submission of sensitive financial and legal documents, even via email, allows for a more thorough human review and due diligence. This approach mitigates risk for both the bank and the borrower, balancing the efficiency offered by digital channels in the initial stages with the stringent regulatory and risk management requirements inherent in mortgage lending.

Applicants for Capitec Home Loans should also be aware of various associated costs beyond the principal loan amount. These typically include transfer duty, which is a government tax levied for transferring property ownership; conveyancing costs, which are attorney fees for registering and transferring the title deed; bond registration fees paid to the Deeds Office; postage and sundries; and home loan initiation fees covering administrative setup.

The table below outlines the comprehensive document checklist for both employed and self-employed applicants for Capitec Home Loans:

Home Loan Documents (Employed vs. Self-Employed)

| Document Type | Required for Employed Applicants | Required for Self-Employed Applicants |

|---|---|---|

| Latest 3 months' salary slips | Yes | No |

| Latest stamped 3 months' personal bank statements | Yes | No |

| Latest stamped 6 months' personal bank statements | No | Yes |

| Copy of ID document | Yes | Yes |

| Copy of marriage certificate or antenuptial contract (ANC) | Yes (if applicable) | Yes (if applicable) |

| Copy of the offer to purchase | Yes | Yes |

| Personal assets & liabilities statement | Yes (for loans > R2.5M) | Yes |

| Letter of drawings from an accountant | No | Yes |

| Latest stamped 6 months' business account bank statements | No | Yes |

| Latest 2 years' annual financial statements | No | Yes |

| Current management accounts (if AFS older than 6 months) | No | Yes (not older than 2 months, signed by applicant & accountant) |

| Copy of registration documents or trust deed | No | Yes |

C. Home Improvement Loans

Capitec offers tailored credit solutions specifically for home renovations and DIY projects. These loans can provide up to R500,000 in credit, with interest rates starting from prime and extended repayment terms of up to 84 months.

Applications for home improvement loans can be made through various channels: directly at any Capitec branch, online via the websites of Capitec's partner retailers, or through the Capitec mobile app.

This integration with specific home improvement partners for loan applications exemplifies embedded finance. Rather than offering a generic personal loan, Capitec has customized a product and integrated the application process directly into the customer's purchase journey at relevant retailers. This strategic partnership approach simplifies the customer experience, potentially increases conversion rates for both the bank and its partners, and fosters a seamless ecosystem where financing is readily available at the point of need. This allows Capitec to effectively capture specific market segments and drive loan origination through specialized channels.

D. Vehicle Loans

Capitec provides unsecured financing for vehicle purchases, offering up to R500,000 for any vehicle. These loans come with extended repayment terms of up to 84 months and interest rates starting from prime.

The application process typically involves applying online directly on partner websites, completing a three-step application to receive a credit offer, after which a Capitec consultant will contact the applicant to finalize the application or direct them to a branch.

The explicit mention that Capitec's vehicle loan is "unsecured, meaning that you own the vehicle from day 1"

For businesses seeking vehicle or asset finance, different qualification criteria apply, including the requirement of a Capitec Business account and a minimum of two years of business operation. Documentation may include signed financial statements, management accounts, personal assets and liabilities statements, and six months of bank statements.

The table below provides a concise overview of Capitec's main lending products:

Capitec Loan Types at a Glance

| Loan Type | Maximum Loan Amount | Repayment Term (Min-Max Months) | Interest Rate Range (Min-Max % p.a.) | Key Feature/Benefit |

|---|---|---|---|---|

| Personal Loan | R500,000 | 12 - 84 | 12.75% - 28.25% | Personalized rates, debt consolidation option |

| Access Facility | R500,000 | Up to 60 | 12.75% - 21.25% | Revolving credit, pay only when used |

| Home Loan | Varies by affordability (calculator available) | 10 - 30 years (as per calculator) | Varies by affordability (calculator available) | Online application, comprehensive document submission |

| Home Improvement Loan | R500,000 | Up to 84 | From prime | Tailored for renovations, partner integrations |

| Vehicle Loan | R500,000 | Up to 84 | From prime | Unsecured loan, immediate vehicle ownership |

IV. Capitec's Credit Assessment and Affordability

Capitec's loan offers are fundamentally determined by an applicant's affordability and comprehensive credit profile.

This capability for customers to actively participate in structuring their loan, by choosing both the credit amount and the repayment terms, signifies a highly dynamic and customer-centric approach to loan structuring. It moves beyond a rigid, bank-dictated offer to a more collaborative process where the borrower's financial comfort and preferences play a direct role. This flexibility, underpinned by sophisticated affordability modeling, can lead to increased customer satisfaction and potentially lower default rates, as borrowers are more inclined to adhere to repayment terms they have actively chosen and can realistically meet.

Credit insurance is a standard component of Capitec's personal loan offerings, designed to provide coverage in unforeseen circumstances such as death, permanent or temporary disability, unemployment, inability to earn an income, or retrenchment.

This unique feature of Capitec's credit insurance, where premiums decline with the shrinking loan balance, represents a clever value proposition. Unlike many traditional insurance policies with fixed premiums, this model offers a tangible financial benefit to the borrower as they repay their loan. This not only makes the mandatory insurance more palatable but also subtly encourages faster repayment by demonstrating a direct cost saving. For the bank, it serves as a robust risk mitigation tool that is simultaneously designed to be more customer-friendly, thereby enhancing client loyalty and fostering a perception of fairness.

V. Clarifying "Application Forms" and Accessing Resources

The user's direct query regarding a "Capitec loan application form" reflects a traditional expectation of loan application processes. However, the available information strongly indicates that Capitec Bank primarily operates a digital-first application process for new personal loans, access facilities, home loans, and vehicle loans, rather than relying on a single, generic downloadable paper form. Applications are predominantly initiated and processed through interactive digital channels (mobile app, online platform), via phone, or through in-branch systems.

This absence of a universal downloadable form for new credit products is not an oversight but a deliberate outcome of Capitec's digital transformation strategy. This operational shift signifies a broader industry trend where manual data entry and paper-based processes are being superseded by real-time digital data capture, automated checks, and dynamic application flows. In this context, the "form" effectively becomes the interactive online or app interface, which is inherently more efficient, less prone to errors, and facilitates instant feedback and personalized offers.

While general loan application forms for new credit facilities are not provided for download, Capitec does maintain a comprehensive "Documents Library" on its website.

VI. Recommendations for a Successful Application

For individuals considering a loan application with Capitec Bank, a strategic approach can significantly streamline the process and enhance the likelihood of a successful outcome.

Practical Tips for Preparing an Application:

- Verify Eligibility: Prior to initiating any application, it is advisable to confirm that all minimum age and income requirements for the desired loan product are met.

- Gather Comprehensive Documents: Meticulous preparation of all necessary documents is crucial. This includes standard identification (original SA ID), the latest salary slips, and bank statements. For self-employed individuals or those with multiple income streams, additional proofs such as business bank statements, accountant letters, lease agreements, or court documents may be required.

- Understand Your Credit Profile: While not explicitly detailed as a preparatory step, gaining an understanding of one's own credit history can help in anticipating the personalized offer from Capitec.

- Account for Credit Insurance: Applicants should be aware that credit insurance is often a mandatory component for personal loans, offering the benefit of decreasing premiums as the loan balance reduces.

- Leverage Digital Channels: For optimal convenience and efficiency, it is highly recommended to utilize the Capitec mobile app or online platform for initiating loan applications.

- Prepare Partner Quotes: For home improvement or vehicle loans facilitated through Capitec's partners, ensure that all relevant quotes or invoices are readily available, especially if the application requires an in-branch visit.

Key Contact Information for Further Assistance:

Capitec Bank provides multiple contact channels to support clients throughout their credit journey, from initial application to managing repayments. This proactive customer support infrastructure is critical for navigating complex financial products, fostering trust, and addressing individual queries that digital self-service might not fully resolve.

- General Loan Enquiries and Applications: For most loan product inquiries and application assistance, individuals can contact Capitec at 0860 66 77 89.

- Credit Repayments Assistance: For support with credit repayments, clients can reach out via WhatsApp at 072 822 1582, send their South African ID number or foreign passport number via SMS to 30679 for a callback, or call directly on 0860 66 77 18.

- Capitec Home Loans Specific Contact: While a direct phone number for home loans was not present in the provided information, it is advisable to visit the dedicated Capitec Home Loans website for their specific contact details and application tracking features.

Capitec Bank Loan Applications Wallpapers

Collection of Capitec Bank Loan Applications wallpapers for your desktop and mobile devices.

Capitec Bank Loan Applications Photo

Gorgeous capitec bank loan applications photo that makes a perfect wallpaper.

Capitec Bank Loan Applications Image

Stunning capitec bank loan applications image with high resolution quality.

Capitec Bank Loan Applications Backdrop

High quality capitec bank loan applications image perfect for desktop or mobile wallpaper.

Capitec Bank Loan Applications Photo

Beautiful capitec bank loan applications wallpaper with stunning details and colors.

Capitec Bank Loan Applications Shot

Gorgeous capitec bank loan applications photo that makes a perfect wallpaper.

Capitec Bank Loan Applications Shot

High quality capitec bank loan applications image perfect for desktop or mobile wallpaper.

Capitec Bank Loan Applications Backdrop

Amazing capitec bank loan applications background image for your devices.

Capitec Bank Loan Applications Photograph

Beautiful capitec bank loan applications wallpaper with stunning details and colors.

Capitec Bank Loan Applications Shot

Stunning capitec bank loan applications image with high resolution quality.

Capitec Bank Loan Applications Shot

Amazing capitec bank loan applications background image for your devices.

Capitec Bank Loan Applications Wallpaper

Gorgeous capitec bank loan applications photo that makes a perfect wallpaper.

Capitec Bank Loan Applications Shot

High quality capitec bank loan applications image perfect for desktop or mobile wallpaper.

Capitec Bank Loan Applications Backdrop

Gorgeous capitec bank loan applications photo that makes a perfect wallpaper.

Capitec Bank Loan Applications Wallpaper

Gorgeous capitec bank loan applications photo that makes a perfect wallpaper.

Capitec Bank Loan Applications Photograph

Gorgeous capitec bank loan applications photo that makes a perfect wallpaper.

Capitec Bank Loan Applications View

Gorgeous capitec bank loan applications photo that makes a perfect wallpaper.

Capitec Bank Loan Applications Background

Beautiful capitec bank loan applications wallpaper with stunning details and colors.

Capitec Bank Loan Applications Photograph

Gorgeous capitec bank loan applications photo that makes a perfect wallpaper.

Capitec Bank Loan Applications Image

Amazing capitec bank loan applications background image for your devices.

Capitec Bank Loan Applications Background

Beautiful capitec bank loan applications wallpaper with stunning details and colors.

Capitec Bank Loan Applications Backdrop

High quality capitec bank loan applications image perfect for desktop or mobile wallpaper.

Capitec Bank Loan Applications Photo

Beautiful capitec bank loan applications wallpaper with stunning details and colors.

Capitec Bank Loan Applications Photograph

Amazing capitec bank loan applications background image for your devices.

Capitec Bank Loan Applications Image

High quality capitec bank loan applications image perfect for desktop or mobile wallpaper.

Capitec Bank Loan Applications Photo

Beautiful capitec bank loan applications wallpaper with stunning details and colors.

Capitec Bank Loan Applications Shot

Beautiful capitec bank loan applications wallpaper with stunning details and colors.

Download these Capitec Bank Loan Applications wallpapers for free and use them on your desktop or mobile devices.