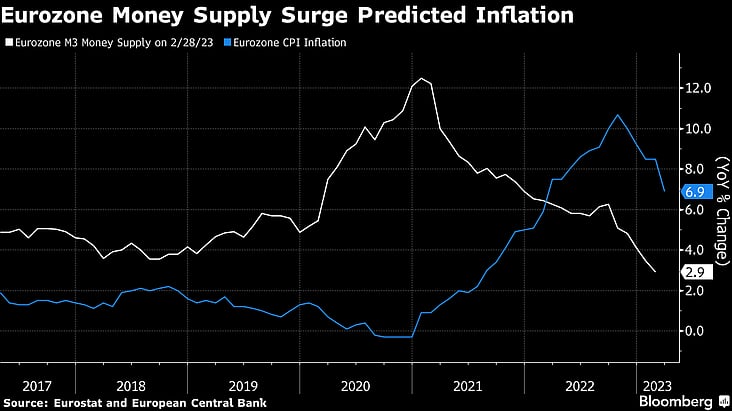

Tumbling Money Supply Alarms Economists Who Foresaw Inflation

Tumbling Money Supply Alarms Economists Who Foresaw Inflation - In the intricate world of economics, the money supply is a crucial indicator of a nation's financial health. Recent developments in the money supply have sent ripples through the economic community, particularly among economists who have been forecasting inflation. In this article, we'll explore the concerns surrounding the tumbling money supply and its implications for the broader economy.

|

| Tumbling Money Supply Alarms Economists Who Foresaw Inflation |

1. Understanding the Money Supply

The money supply, often referred to as M1 and M2, encompasses various forms of currency, including cash, checking deposits, and savings accounts. It is a key metric that economists closely monitor to gauge the overall health and potential inflationary pressures within an economy.

2. The Link Between Money Supply and Inflation

A decrease in the money supply can be an early sign of potential deflation, but it can also have a significant impact on inflation. Let's delve into this connection:

3. Factors Leading to Tumbling Money Supply

Several factors contribute to a decline in the money supply:

- Central Bank Policies: When central banks reduce the money supply by selling government securities or raising interest rates, it can lead to a decrease in money available to the public.

- Reduced Borrowing and Spending: Economic uncertainty or higher interest rates can discourage borrowing and spending, resulting in a decrease in money circulation.

- Bank Lending Practices: If banks tighten lending standards, it can limit the creation of new money through loans.

4. The Concerns of Economists

Economists who have been forecasting inflation are raising alarms due to the tumbling money supply. Here are their primary concerns:

5. Potential for Deflation: A sharp reduction in the money supply can be an indicator of deflation, which can be harmful to an economy as it encourages hoarding of cash and delays spending.

6. Stifled Economic Growth: A shrinking money supply can restrict economic growth by limiting funds available for investments, business expansion, and consumer spending.

7. Increased Debt Burden: Falling money supply can exacerbate debt burdens as borrowers face higher real interest rates, potentially leading to defaults.

8. Central Bank Dilemma

Central banks are now facing a delicate balancing act. They must respond to the tumbling money supply to ensure price stability and economic growth. However, aggressive measures to increase the money supply can also fuel inflationary pressures.

9. Potential Solutions and Responses

Economists and policymakers are considering various strategies to address the concerns related to the money supply:

- Monetary Policy Adjustments: Central banks can adjust their monetary policies to either increase or stabilize the money supply based on economic conditions.

- Fiscal Stimulus: Governments can implement fiscal stimulus packages to boost economic activity and counteract a declining money supply.

- Communication and Transparency: Clear communication from central banks about their intentions can help mitigate uncertainty in financial markets.

10. Conclusion

The tumbling money supply has indeed raised concerns among economists who have been closely monitoring the potential for inflation. While the situation is complex, it highlights the interconnectedness of economic variables and the need for careful policy considerations. Balancing the money supply to promote economic growth while preventing runaway inflation remains a challenging task for central banks and governments alike.

In conclusion, the relationship between the money supply and inflation is a critical aspect of macroeconomic stability. The recent decline in the money supply has prompted economists to rethink their inflation forecasts and has put pressure on central banks and policymakers to respond effectively to the evolving economic landscape. The coming months will undoubtedly be pivotal in determining how these concerns are addressed and the impact they have on the broader economy.